Don’t miss out on tax breaks you may need for your vehicle. The mileage tax deduction rate is one of the tools used to help reduce the tax burden when your vehicle is used for business purposes.

This IRS mileage deduction is especially important for tax payers such as independent contractors and entrepreneurs.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

According to the IRS, the standard mileage deduction rate for businesses is based on an annual study of both the fixed and variable costs of using your car.

This includes depreciation, insurance, repairs, tires, maintenance, gas and oil.

Power Tip: Your “tax home” is your regular place of business, regardless of where you maintain your family home.

13 Pro Tips for Mileage Tax Deductions

1 – Know What’s New for Mileage Tax Deduction

There are a few changes that came with the Tax Cuts and Jobs Act of 2017 (TCJA). The new tax act has removed many of the various itemized deductions.

If you are using your car for qualified business, medical, or charitable purposes, you can still deduct your vehicle expenses.

We will go deeper into this topic throughout the guide.

Tax Cuts and Jobs Act Keep Points

- Driving to and from work is still a personal expense

- Business owners can deduct business-related mileage for a vehicle use for work-related things

- Driving to another job-related destination (not the main job site of the same employer) may be deducted if your employer did not reimburse you for the mileage

- Tax Cuts and Jobs Act took away the job-related moving expense deduction (except for military members on active duty moving because of a military order)

- You are still able to claim a deduction for medical-related driven miles for care

2 – Know the IRS Automobile Deprecation Tips to Remember

In order to get the depreciation deduction for your car, you have to use the actual expense method when adding up your annual mileage deduction. Not the standard mileage rate.

- The Modified Accelerated Cost Recovery System (MACRS) is the only depreciation method allowed.

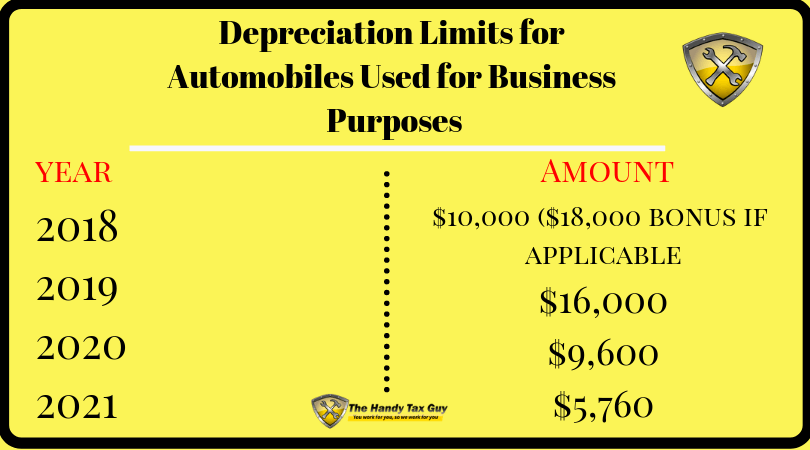

Let’s take a look at the Depreciation Chart for Vehicles below:

As you can see, you can take a maximum of $10,000 in depreciation deduction for 2018. You can even deduct more in 2019 giving you a total of $26,000 in only two years.

Remember: The Depreciation Chart is based only if you use your vehicle for 100% of business activity.

3 – Know Difference Between Standard Mileage Rate Deduction vs. Actual Expenses

You should be sure to note that when deciding on your mileage tax deduction method you can only choose between two:

- Standard Deduction Method

- Actual Expense Method

Each situation will depend based on your current tax situation. The main take away is to know what mileage you can claim on your income tax return.

Power Tip: If you qualify for both the Standard Deduction Method and the Actual Expense Method, then you should choose the one that gives you the largest deduction.

So, what mileage exactly can you deduct?

In general, you can include mileage as an expense if you’re driving between workplaces within your tax home, when visiting customers, when attending business associated meetings out of town, or going to a temporary workplace.

Check out the IRS mileage deduction image below for a quick reference:

If using the standard mileage rates don’t work for you, consider using the actual costs of operating your car instead.

The Actual Expense Method is the actual costs it takes to operate your car for business use.

Actual Expense Method includes:

- Depreciation

- Licenses

- Garage Fees

- Gasoline

- Insurance

- Lease Payments

- Oil

- Parking

- Registration Fees

- Repairs

- Tires

- Tolls

Remember: You must always keep good records of your mileage rates throughout the year.

4 – Know How to Calculate Mileage for Taxes

You can claim mileage on your tax return in 2019 at 58 cents per.

Tax Example: Danielle, a wedding photography business owner, drove her SUV 35,000 miles for her business during 2019.

Her mileage deduction is $20,300

Mileage Deduction = 58 cents × 35,000 = $20,300

Standard Mileage Tax Deduction 2019 Rate Chart

|

Category |

Rate |

|

Business Miles |

58 cents per mile |

|

Charitable Miles |

14 cents per mile |

|

Medical/Moving Travel |

20 cents per mile |

Power Tip: If you have claimed vehicle depreciation, you may not deduct tolls and parking fees.

5 – Know the Tax Year Standard Deductible Mileage Rates

Below are the rates you can use for the 2019 tax season. These rates are from Jan. 1, 2018- Dec. 31, 2018

The optional standard tax-deductible IRS mileage rates can be used for your car, van, pickup truck, or panel truck:

- 54.5 cents per mile driven for business

- 18 cents per mile driven for medical or moving

- 14 cents per mile driven for service with a charitable organization

Previous Years Standard Mileage Rates

|

Year |

Rate per Mile |

|

2019 |

58 cents |

|

2018 |

54.5 cents |

|

2017 |

53.5 cents |

|

2016 |

54 cents |

|

2015 |

57.5 cents |

6 – Know the Mileage Deduction Rules

Before you get excited about claiming all of the mileage tax deduction money you may be owed, you should know a few IRS mileage deduction rules for 2019.

Although the Standard Mileage Deduction is pretty straightforward, there are a few restrictions you should remember.

Standard Mileage Rate Restrictions and Rules:

- May not be used for a vehicle used as equipment

- Cannot be used for more than four* vehicles at once

- May not be used if you claim vehicle depreciation

- You must choose to use the Standard Mileage Rate for the first year the car is used in your business

- If you lease a car, you have to use the standard mileage rate method for the entire life of the lease (only if you choose the standard mileage rate initially)

7 – Keep Good Records

You don’t have a limit on the amount of mileage tax deduction you can claim on your taxes. However, you’ll want to keep good tax records and make sure you’re following the IRS mileage rules correctly with an up-to-date mileage log.

8 – Remember the Type of Vehicle Does Matter

Whether your car is leased or if you own it, it’s good to know what IRS mileage deductions apply to you.

As mentioned earlier, if your car has been leased and you choose to use the standard mileage rates, the you will always have to use the standard rates for the entire life of the car lease.

Going the itemize deductions route will allow you to deduct this from your taxable income.

9 – Understand Self-employed and Business Mileage Deduction Rules

Self-employed people have the highest deduction rate with the lowest restrictions. This is a great tax-saving opportunity as those miles can rack up quickly.

As mentioned above, the IRS has specific rules on what governs use of using the business mileage deduction.

You will not qualify if your car is not used for normal commuting to your usual place of work or “tax home.”

10 – Know What qualifies as a deductible business mileage expense?

- Driving to a business meeting away from your usual workplace

- Meeting clients or customers

- Going from your home to a temporary workplace

- Getting from your regular workplace to a second workplace

Power Tip: If you use your car ONLY for your business, you can deduct all of the vehicle related expenses or miles driven.

If you’re self-employed, you can begin calculating your mileage and costs from the moment you leave that place as long as you’re traveling for business purposes.

You can also claim your IRS tax mileage deduction on your Schedule C tax form instead of the Schedule A form.

11 – Know What Traveling for Your Current Job and Deducting Mileage for Work Means

So, can you deduct mileage to and from work?

I know I may be sounding like a broken record, but you cannot deduct mileage to and from work. Even if your drive is extremely long.

This is mainly due to the fact that the IRS feels that the location of your residence is your own choice.

12 – Know What Qualifies for Medical Mileage Deduction or Medical Transportation Expenses

As previously mentioned, you can still deduct mileage for medical care.

Here are a few examples:

- Fees for ride-sharing, taxis, buses, trains, or ambulance rides

- Out-of-pocket expenses with your own car

- Tolls and parking fees

13 – Know the Common Questions to Remember

How many miles can you claim on your taxes?

There is no limit to the miles you can claim on your taxes; you can claim as many miles as you can prove.

Triggers for a Possible IRS Audit:

- Having super high mileage numbers on your tax return

- Round number such as 40,000 miles

- Stating that 100 percent of your miles have been for business

Can I claim tolls to work on my taxes?

Yes, you can deduct business-related parking and toll costs on your taxes. Just make sure you keep accurate records for possible auditing.

Final Thoughts

I know that understanding the IRS tax mileage rules can be a pain, but hopefully I was able to break it all down for you.

These are a few key takeaways to remember from this article:

- Commuter miles are not deductible

- You can deduct any mileage from your main place of employment (“tax home”) to another workplace or to visit clients or customers

- If your employer reimburses you, you can’t deduct the mileage

- You can use one of the mileage deduction methods (Standard Mileage Rate or Actual Vehicle Expenses)

- Use the standard mileage rate for the first year of your business

- If you choose the standard mileage rate method, you cannot deduct actual car operating expenses

- Keep good records

- If you qualify for both the Standard Deduction Method and the Actual Expense Method, then you should choose the one that gives you the largest deduction

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

- Divorce and Taxes: Everything You Need to Know

For more money-saving tips and guides, subscribe to the weekly newsletter!

I’m super grateful when you share my posts on Twitter, Instagram, Facebook, or Pinterest.

It helps spread the word about The Handy Tax Guy and allows me to keep bringing you great content.

Until the next money adventure, take care!

Handy

Disclosure Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation to the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site.