Are you trying to figure out the most realistic money saving tips for you to use today?

Millennials are a unique generation to have grown up with technology nearly every step of the way. Not only that, Millennials were conditioned to go to college and get a degree.

Times have changed and educated Millennials are struggling to find high enough wages to help pay for the high cost of education.

Trust me…

I understand and I’m a Millennial in that same boat.

That being said, having grown up with technology it has allowed for many ways to save money and generate extra revenue.

In this article, I will go into detail several ways Millennials can save money and squeeze every dollar out of their budget.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

8 Simple Money Saving Tips and Advice for Millennials

Let’s first go through the five most important strategies to have when you’re trying to save money on a tight budget.

1. Eliminate Debt

The number one factor that will slow your ability to save is debt. If you are looking to get serious about saving then plan on eliminating your debt first, that way nothing stands in the middle of you and your most important wealth building tool, time.

There are several ways to eliminate debt and a good place to start is by researching.

You can also grab the Debt Free Planning Workbook here to help you get out of debt quickly.

Dave Ramsey is a popular name in the personal finance space and it is a great place to start. From here, you can see the plan he’s proposed for his audience and tweak it to fit your needs.

2. Have an Emergency Fund of $1000 to $3000 Available

An emergency fund is essential for financial stability. Start small with a goal of $500 to cover unexpected expenses like car repairs or medical bills.

Gradually increase this fund to cover three to six months of living expenses. This approach ensures you’re prepared for unforeseen financial challenges without derailing your savings plan.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

3. Create a Budget

An effective way to save money is directing where your income goes in the form of a budget.

This is typically done each paycheck or at least once a month, planning where you can spend your money and when to save you money.

Not only does budgeting lay out your plans for the month, you can also see the places you can curb spending such as eating out or entertainment.

There are several apps and websites on the market to help you start a budget. This is what I use on a daily basis.

For many, simply opening an excel file and creating a custom template is the best way to go. Also, printing out a sheet and hand writing a budget is also an effective way to budget.

Whatever works best for you, find it and utilize it going forward.

4. Implement the 50-30-20 Rule

The 50-30-20 rule is a simple yet effective budgeting strategy.

Allocate 50% of your income to necessities like rent and groceries, 30% to discretionary spending such as dining out, and 20% to savings and debt repayment.

50-30-20 Rule Table

| Amount | Where to Put It |

| 50% | Living Expenses |

| 30% | Fun Money |

| 20% | Savings |

This method helps maintain a balanced budget while ensuring you save consistently.

5. Have a Side Hustle

Growing in popularity is the side hustle, which is when you utilize your free time to generate more income.

For example, you may work a 9 to 5 office job, but when you get home you sell homemade blankets on Etsy, work on starting your blog, or grow your affiliate marketing income.

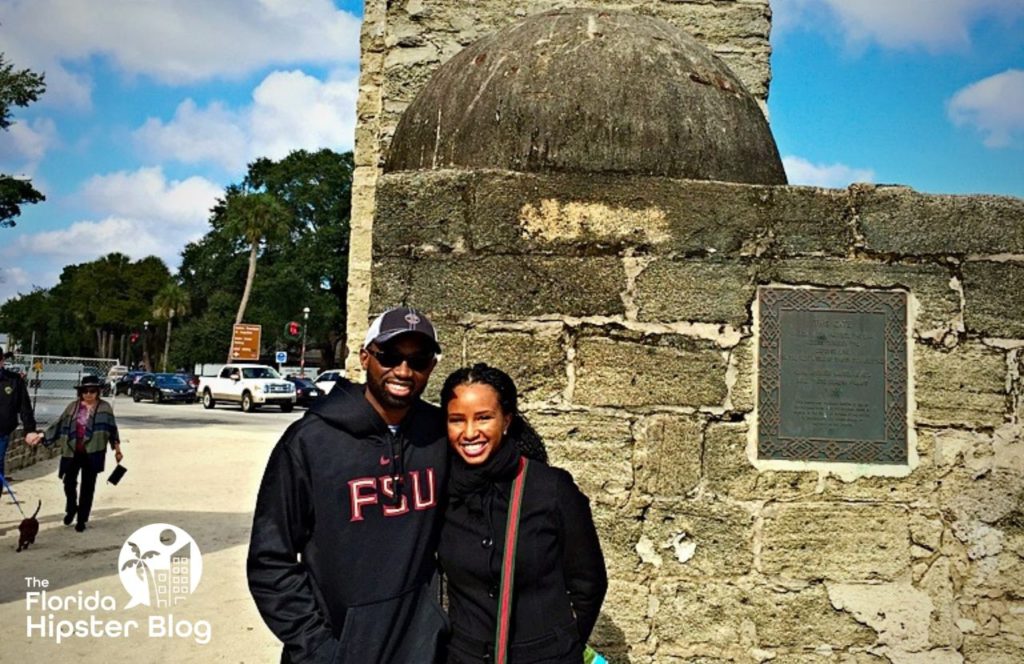

Having a side hustle is an effective way to generate income and help boost your savings potential. I started my own blog around theme parks which allowed me to leave my career as a Pharmacist to blog full-time!

Just mentioned was Etsy, which is a site you can find a variety of homemade crafts or unique items.

Other places to really begin a side hustle include Fiverr.com, Upwork.com, or create your own website and begin your business that way.

While implementing a budget and increasing your income, you can truly boost your savings potential.

Recommended: How Our Co-founder, Nikida, Grew Her Blog From 0 to $10K+ a Month

6. Retirement Accounts

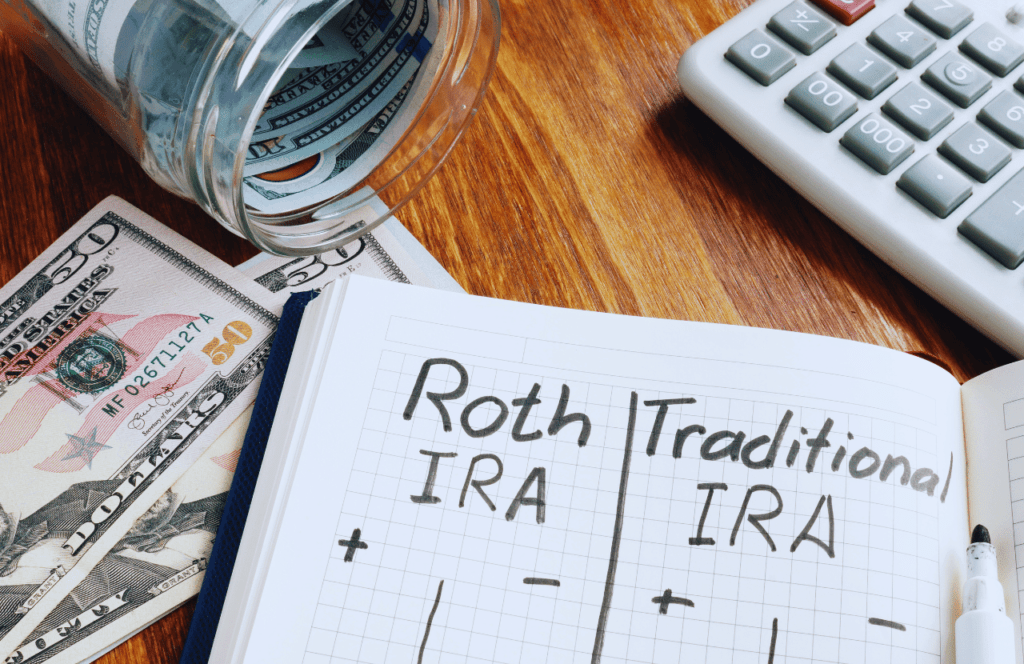

If you’ve already saved up some money but are now looking to save for retirement, it is important to understand the various retirement vehicles out there.

For this, we’ll go over two of the most popular and widely used, and those are a 401k and a traditional IRA.

Traditional IRA vs. 401K Plan

Both are similar in nature but have a few differences. Let’s take a closer look.

What is the 401K Plan and how does it work?

First off, a 401k is offered through your employer and utilizes pre-tax dollar to fund the account. Within the 401k, there are funds you can invest your money into that are pre-determined by the plan sponsor.

Once the funds are deposited into the account, they sit there until you retire.

You are able to withdraw funds early but you will incur a 10% penalty for early withdraw, along with having to pay taxes on the money.

What is a Traditional IRA and how does it work?

An IRA is similar in that it uses pre-tax dollars, but the main difference is that an IRA is not offered through an employer and anyone can open it.

Also, within an IRA you have the ability to select from a wider range of equities or mutual funds, giving you more flexibility in how your money grows.

Keep in mind the annual contribution limits and should you want to invest more, you will likely have to open a traditional brokerage account.

7. Setup an Automation System

Lastly, a way to help you save is to automate the process as much as possible. With the growth of financial technology, we can nearly automate anything we choose.

That being said, automating deposits into a retirement account or automatic bill pay will allow you to say on top of the game.

This creates a habit of saving, but also doesn’t give you a chance to spend the money.

Similar to the old phrase out of sight out of mind, if you never see your money then you have a tendency to feel less pain. This is one of the top money saving tips for millennials!

8. Leverage Money Saving Apps

In today’s digital age, money-saving apps can be a game-changer. Apps like Mint, YNAB, Every Dollar and Acorns help track spending, offer cash back, and automate savings.

By integrating these tools into your financial routine, you can effortlessly manage your budget and boost your savings.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

15 Easy Ways for to Save Money for Millennials

- Set your budget up the right away

- Open up a bank account that’s only dedicated to saving for your vacation

- Set up an automatic transfer to your savings bank account (do weekly or bi-weekly transfers)

- Start using cash to pay for your daily expenses (think of the envelope system that Dave Ramsey speaks about and only budget a certain amount of money for day-to-day items…once it’s gone you have to wait for the next month to take more cash out)

- Take a break from buying coffee (instead make your own coffee at home)

- Keep your monthly food budget in check

- Become a meal planning pro

- Find gym alternatives to save money (work out from home or ask for deals at your current gym)

- Eat out less

- Remove big expenses from your budget like your outrageous rent/mortgage car (I know I’m being blasphemous right now, but could you sell your car and buy a cheaper car?)

- Get a part-time job

- Car pool to work with your co-workers (you guys can alternate the weeks of who will drive into the office or location)

- Download a savings app

- Rent out a room in your home

- Stay motivated while saving

File Your Taxes with Ease from Home Today with TurboTax!

My Final Thoughts on Money Saving Tips for Millennials

Millennials have many advantages within reach to help grow and put in place the proper habits to save efficiently. Saving is necessary but understanding how to save is important as well.

If you are saving for an emergency that’s one thing, but saving for retirement is completely different. Regardless, begin saving and I’m sure you’ll begin seeing a noticeable change in your financial health.

I hope this breakdown of the five easy money-saving tips help you discover some additional ways to grow your finances this year.

Let me know what’s your favorite money-saving tip in the comment section below. If you want more handy money and tax tips, then feel free to check out my latest articles here.

Stay savvy, and may the tax odds be ever in your favor!

If you enjoyed this article, then you’ll love these:

- How to Save Money for Vacation in 3 Months (23+ Money Saving Tips)

- Do I Need to File a Tax Return?

- Where Do Nurses Make the Most Money by State and City?

- Tax Deductions (You’re Missing) and Tips for Bloggers and Online Influencers

Get started on your taxes early TODAY!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: December 10, 2018/Updated On: December 6, 2024)