Do you think it’s hard to save $3000 in 6 months on a low income?

Saving money can be a difficult task and that isn’t completely our faults.

Large corporations and their marketing departments are attempting to make spending money as easy and painless as possible, ultimately giving us a sort of high.

Also, using plastic (credit or debit cards) to purchase items is painless because with paper money, you hand over one amount and get less in return.

With plastic, you hand over your card and get your card back, eliminating the immediate trigger of pain relating to loss.

Now certainly there are some of our own habits that contribute to a savings shortfall, such as fast food eating and vending machine buying.

These need to be curbed or eliminated to boost saving potential.

Also, there are several other ways to help you save and as you continue on with this article, I will uncover effective ways for you to save $3,000 in a six-month period, or sooner.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

1. Eliminate Unnecessary Spending

First, before we pinpoint ways to save money, we first have to discuss spending.

By focusing on spending alone, you will likely see a dramatic difference in the amount of money you retain at the end of the month.

Begin by eliminating fast food trips and eating out, as this can quickly become expensive.

The alternative to this is to begin eating at home and cooking meals, using left overs for lunch the next day or even dinner again.

From there, limit what you are spending on items such as clothes and entertainment.

It can be easy to purchase a movie off of Amazon Prime when you’re sitting on the couch, but those quickly add up and put a dent in your savings.

You can think of it as a $20 movie equates to a half-a-tank of gas, or a $50 meal out could have been put towards groceries instead.

Once you’ve eliminated unnecessary spending you can begin focusing on increasing incoming cash flow.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

2. Use the 50/30/20 Budgeting Rule

The 50/30/20 budgeting rule is a simple yet effective way to manage your finances.

It suggests allocating 50% of your income to necessities, 30% to discretionary expenses, and 20% to savings and debt repayment.

50-30-20 Rule Table

| Amount | Where to Put It |

| 50% | Living Expenses |

| 30% | Fun Money |

| 20% | Savings |

This method helps ensure that you are living within your means while also prioritizing savings.

By following this rule, you can create a balanced budget that supports both your current lifestyle and future financial goals.

3. Take a Second Job

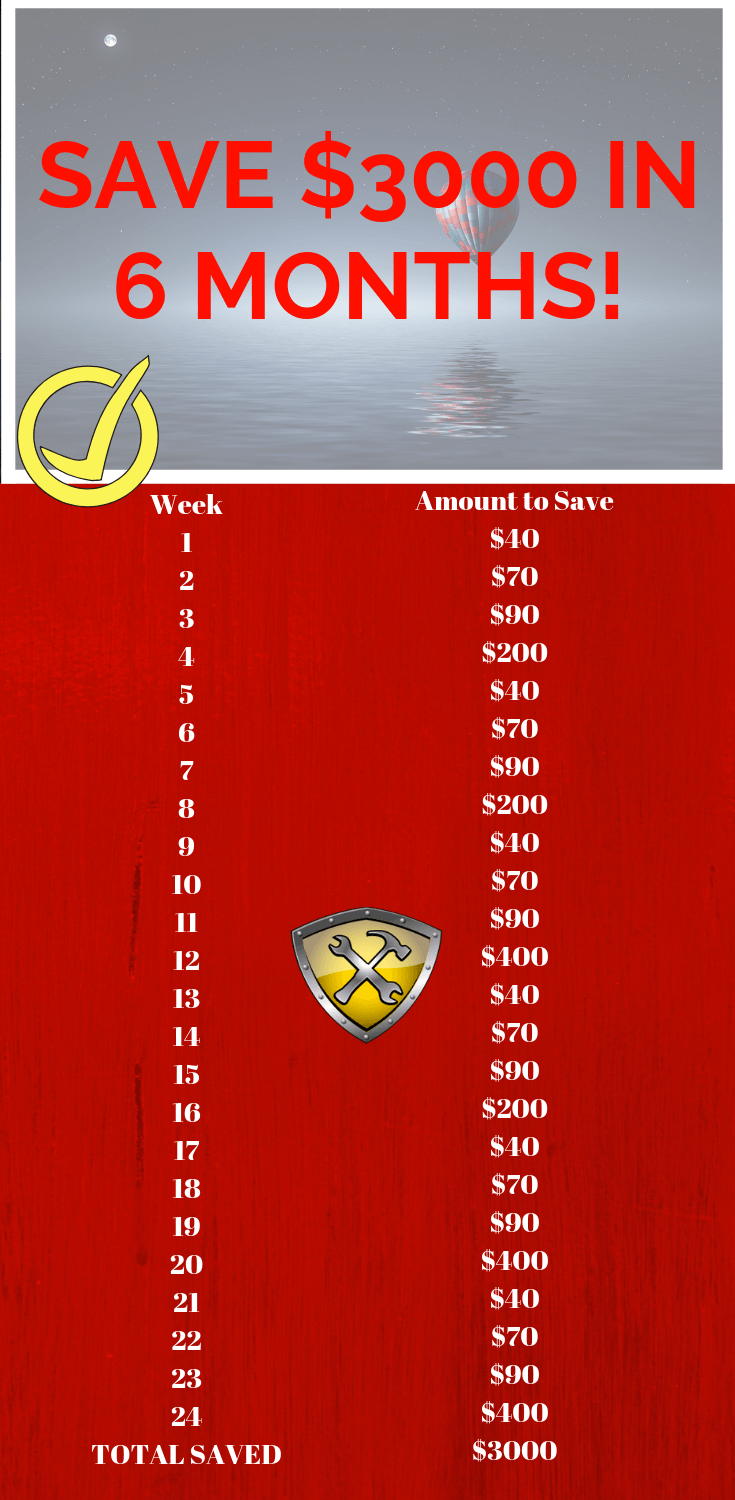

In order to save $3,000 in six months you’ll have to be mindful of spending and potentially increase cash flow.

Breaking it down, to save $3,000 in six months is to simply earn $500 a month, which is very manageable.

An easy way to expedite the saving is to take on a second job.

The second job doesn’t have to be anything extravagant, but something simple like delivering for Door Dash or working for a ride sharing service can drastically increase you monthly revenue.

When you earn money from your second job, ensure you keep that separate and use it for saving only. It can be easy to have that money put into your normal checking account and spend it.

4. Freelance/Have a Side Hustle

Similar to a second job is to take on freelancing, which is simply allocating your free time to something you are good at.

Whether it be writing, accounting, starting a blog, building websites, doing YouTube, or being a virtual assistant, you can make extra money with a few hours of work while staying at home.

A few websites you can use include Fiverr.com and Upwork.com. Both give freelancers a place to find work and promote their natural talents. This is a great way to save $3000 in 6 months.

The only drawback is it takes 2 weeks for the funds to clear so keep that in mind if you choose to go this route.

My side hustle as a theme park blogger eventually became my full-time job so you never know what can happen!

Recommended: How Our Co-founder, Nikida, Grew Her Blog From 0 to $10K+ a Month

5. Selling Unwanted Items

Another way to generate extra income is to sell the unwanted items in your home. This could be the box of randomness in your attic or that couch that is no longer used.

You can accomplish this by having a garage sale (weather permitting), or simply post your items on the Internet for others to purchase.

Places like, eBay and Facebook Marketplace work extremely well for those looking to sell items. Many times, your items will sell within 24 hours and you’ll have cash in hand for your unwanted items.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

5. Open a Separate Savings Account

A common mistake many people run into is using their checking account as a savings account as well.

Thinking they have enough will power to not spend a certain amount of money, next thing you see is a new television in their living room. But I know that’s not you…

Six Months Savings Chart

There are many local banks and credit unions that have free savings accounts for individuals, usually with minimal initial deposits.

Keep in mind that a savings account limits the amount of withdraws per month, incentivizing you to save your money.

The alternative would to open a second checking account but ensure you either keep the debit card in a place you won’t have easy access to it or request that no debit card is issued.

6. Build an Emergency Fund

An emergency fund is a financial safety net that covers unexpected expenses, such as medical emergencies or car repairs. Ideally, it should cover three to six months of living expenses.

Starting with a smaller goal, like saving $500, can make the task less daunting.

Once you reach this initial target, you can start saving for something you really want and you can also continue to build your emergency fund to ensure you are prepared for any financial surprises.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

15 More Ways for to Save $3000 in 6 Months

- Set your budget up the right away

- Open up a bank account that’s only dedicated to saving for your vacation

- Set up an automatic transfer to your savings bank account (do weekly or bi-weekly transfers)

- Start using cash to pay for your daily expenses (think of the envelope system that Dave Ramsey speaks about and only budget a certain amount of money for day-to-day items…once it’s gone you have to wait for the next month to take more cash out)

- Take a break from buying coffee (instead make your own coffee at home)

- Keep your monthly food budget in check

- Become a meal planning pro

- Find gym alternatives to save money (work out from home using YouTube or ask for deals at your current gym)

- Eat out less

- Remove big expenses from your budget like your outrageous rent/mortgage car (I know I’m being blasphemous right now, but could you sell your car and buy a cheaper car?)

- Get a part-time job

- Car pool to work with your co-workers (you guys can alternate the weeks of who will drive into the office or location)

- Download a savings app

- Rent out a room in your home

- Stay motivated while saving!

File Your Taxes with Ease from Home Today with TurboTax!

My Final Thoughts on How to Save $3000 in 6 Months

Other ways to save money quickly are to temporarily stop your contributions to a 401k or an IRA until you’ve reached $3,000 saved.

Also, if you take a toll road to work you can take the side roads, saving you a few extra dollars on travel expenses.

Put simply, saving $3,000 is easily done if you take inventory of your spending and find where you can cut out unnecessary spending.

In the mean time, you can find ways to increase your incoming cash flow such as picking up a second job or selling items in your house you no longer use.

$500 a month can be easily done and for some that is a sizeable chunk of change.

You can even use this way to save $3000 in 6 months for an epic travel trip to a place for your family such as Walt Disney World.

I hope this breakdown helps you discover some additional money to save quickly.

Let me know which savings idea is your favorite in the comment section below. If you want more handy tax tips, then feel free to check out my latest articles here.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: January 14, 2019/Updated On: December 11, 2024)