As the new tax season approaches, you may have already started receiving multiple documents to hand over to your tax preparer or accountant. Among all of those docs you may notice a tax form called a 1098-T. Don’t be afraid by this document at all.

Form 1098-T is a Tuition Statement used to help you understand which education credits you may qualify for relating to tuition and other school-related expenses paid during the tax year.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

IRS 1098-T Form at a Glance:

- It’s information about college expenses that may qualify you for certain credits

- For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN)

- Qualified expenses include tuition, any fees needed for enrollment, and course materials required for you to be enrolled

- Schools must send the form to you by January 31 and file a copy with the IRS by February 28

Keep reading to get the full guide on this college student IRS form.

Two Education Tax Credits You Need to Know About

Before I breakdown the 1098-T Form, I want to first explain what the Education Tax Credits are if you’re a qualifying student or parent of a qualifying student.

The Lifetime Learning Credit

This credit gives up to $2,000 for qualified education expenses paid for with eligible students per return.

Lifetime Learning Credit = 20% of the first $10,000 of qualified education (max of $2000)

American Opportunity Credit

This credit allows you to claim the $2,500 American Opportunity Credit for each qualifying student on your federal income tax return.

What Is a 1098-T Form Used For?

Basically, the 1098-T Form is information about educational expenses that may qualify you as the student or the student’s parents or guardian, if the student is still a dependent. This is for the education-related tax credits mentioned earlier only that you may receive.

File Your Taxes with Ease from Home Today with TurboTax!

Eligible institutions for 1098-T:

- Colleges

- Universities

- Vocational schools

The mentioned schools and institutions are participants in the Department of Education’s student aid programs.

Your institution must include its name, address, and information contact telephone number on this statement. It may also include contact information for a service provider.

Remember: For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer (your school) will have reported your complete TIN to the IRS.

What is a qualified expense for 1098-T form:

Qualified expenses include tuition, any fees needed for enrollment, and course materials required for you to be enrolled.

However, if someone else pays such as a parent, you will still get the credit and the parent will get to use the 1098-T form on their taxes.

Schools can report a student’s qualified expenses one of two ways:

- Based on how much the student actually paid during the year

- Or based on how much the school billed the student during the year

Who qualifies for the 1098-T form?

You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040.

Schools must send Form 1098-T to any student who paid “qualified educational expenses” in the preceding tax year.

What’s New for the IRS 1098-T form?

In recent years, the IRS has made significant updates to Form 1098-T to streamline the reporting process.

As of 2018, schools are required to report only the amounts actually paid for qualified tuition and related expenses in Box 1. Box 2, which was previously used to report amounts billed, is no longer in use.

Additionally, Box 3, which indicated a change in reporting methods, has been removed since there is now only one method for reporting.

These changes aim to provide clearer and more accurate information for taxpayers claiming education-related tax credits.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

When Should You Received 1098-T form?

Schools must send the form to you by January 31 and file a copy with the IRS by February 28.

Read: Your Ultimate Guide to Etsy Taxes and Tips for Shop Owners

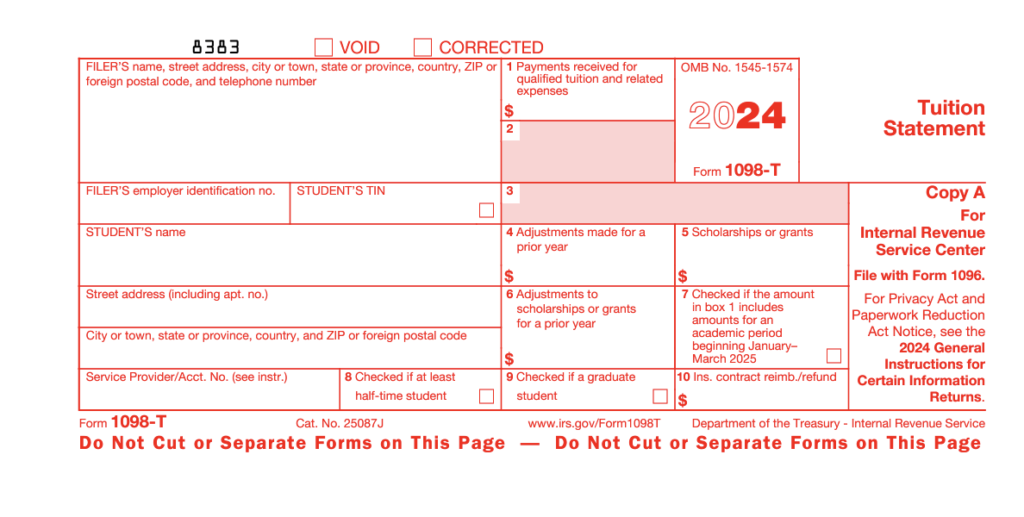

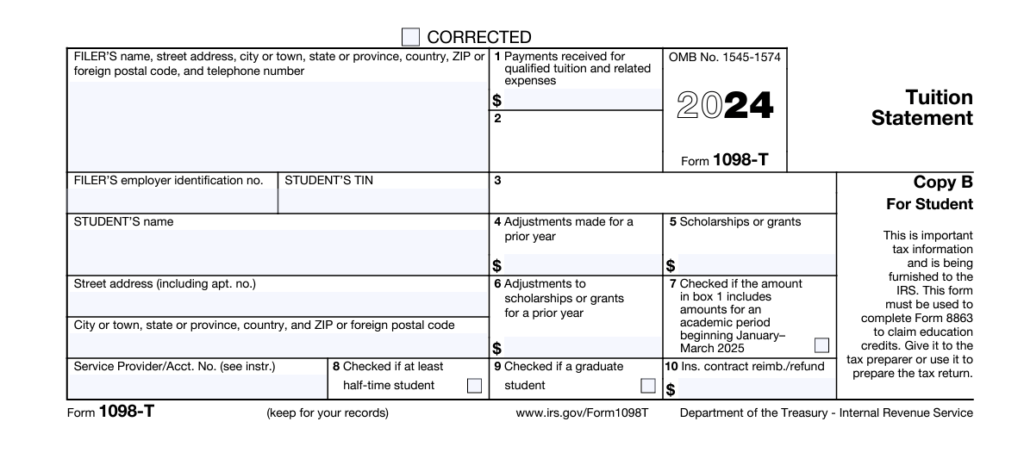

1098-T Form Explained

When you receive your 1098-T, you will see multiple boxes on the form. I am going to breakdown what each box represents in order to you understand.

Box 1. Payments Received for Qualified Tuition and Related Expenses

This is the whole amount of payments and expenses received by your school in current tax year.

Box 2.

According to the IRS, this box is reserved for future use.

Box 3.

This box is also reserved for future use.

Box 4. Adjustments Made for a Prior Year

Shows any adjustment made by your school for a previous year of eligible tuition and expenses reported on a prior year Form 1098-T.

The amount reported may decrease any of the education credits you claimed for the prior, which may make your tax bill higher.

Box 5. Scholarships or Grants

Shows the total of all scholarships or grants administered and processed by your school for the year. It may also includes those not reported and may reduce the amount of the education credit you can claim.

File Your Taxes with Ease from Home Today with TurboTax!

Box 6. Adjustments to Scholarships or Grants for a Prior Year

This box shows the adjustments of any scholarships or grants for a prior year which may affect the amount of any allowable tuition and fees, deductions or education credits.

Box 7. Checked if the Amount in Box 1 Includes Amounts for an Academic Period Beginning January–March of The Next Year

This displays if the amount in box 1 includes amounts for an academic period beginning January–March of the FOLLOWING YEAR.

Box 8. Check if at Least Half-time Student

This box states whether you are considered to be carrying at least one-half the normal full-time workload at your school.

Box 9. Enrolled in A Program Leading to A Graduate Degree

This is completed when you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or another recognized graduate-level educational credential.

Box 10. Amount of Reimbursements or Refunds of Qualified Tuition and Related Expenses Made by An Insurer

Box 10 on the Form 1098-T is used to report any reimbursements or refunds of qualified tuition and related expenses made by an insurer.

This is particularly relevant for students who have tuition insurance policies.

These policies provide reimbursements when students are forced to withdraw from school due to unforeseen circumstances, such as medical emergencies.

It’s important to note that any reimbursements reported in Box 10 will reduce the amount of expenses eligible for education tax credits, potentially affecting the student’s tax liability.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

My Final Thoughts

I hope this breakdown of the 1098-T tax form help you discover some additional credits to claim.

Let me know if you’ve ever seen great tax breaks using the 1098-T form in the comment section below. If you want more handy tax tips, then feel free to check out my latest articles here.

Get started on your taxes early TODAY!

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Last Minute Tax Tips for Beginners

- Why a Tax Preparation Checklist Will Make Your Season Easier

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: December 23, 2018/Updated On: December 7, 2024)