Are you so confused with trying to understand taxes with your Etsy business?

If so, did you know that as an Etsy Shop Owner, you can write-off some of the common items you use to make your web empire awesome?

Thanks to the evolution and growth of technology, you are able to turn your passions into a revenue generating business.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission at no additional cost to you.

Key Takeaways:

- Self-employment tax: As an Etsy seller, you must pay self-employment tax if your net income is $400 or more.

- Business expenses: Deducting business expenses like materials and shipping can significantly reduce your taxable income.

- Sales tax collection: Etsy automatically handles sales tax collection for certain states, but it’s essential to verify your obligations.

- Tax deductions: Maximize your tax deductions by keeping detailed records of all business-related expenses.

- VAT obligations: Understanding VAT obligations is crucial for Etsy sellers shipping internationally.

Keep reading to get the full list of items you can deduct this year!

Selling on Etsy

Whether it’s building your own website or using an established marketplace, the possibilities are endless.

One of the more popular platforms out there is Etsy.

This platform allows people who are gifted in making DIY products, arts and crafts, and one of a kind items to showcase their talents and make an income from it.

When it comes to selling on Etsy, it is important to understand that you are running an online business that generates income.

In this article I will show you how to get the most business deductions and lower your Etsy shop taxes.

When preparing for the tax season, please keep in mind that you can write-off expenses that are common for your profession and ones that are necessary to help you run your business.

If you need to claim expenses, then be sure to fill out the itemized deduction Schedule A Form.

Self-Employed Tax Deduction Checklist

I’ve put together a quick, generalized tax preparation checklist for you to download. Now, let’s chat about paying taxes on your Etsy income.

Understanding the Basic Business Essentials for Your Esty Shop

Before I get into all the of the tax deductions you can write-off, I want to go over a few things for you to know about your new business.

1. Know How to Have Your Esty Shop Registered

This makes a difference later on when starting your tax filing process. For many, it is a simple sole proprietorship which means you are using your own social security number for your shop.

If you are higher volume and find sales to be larger, you may have filed as a business through an LLC, S-Corp, or C-Corp. and that means you will have an EIN or an Employer Identification Number.

From there, you’ll know what path to take when identifying tax implications.

2. Keep Good Tax Records

Make sure you are keeping detailed records of all of your transactions and expenses. These will potentially be used when your tax filings.

Similar to a traditional business, you will need to pay the appropriate Federal taxes, state taxes, and sales tax on items you have sold.

Most businesses will pay taxes quarterly, but if you are a hobby and processing lower numbers, you may be able to file annually.

Always check with your Tax Advisor to see if you need to pay quarterly taxes. That being said, this should be a contributing factor on how you operate your store.

If you are selling products as a business, you will want to ensure you have enough profit to cover the appropriate taxes.

If not, you will be stuck paying the tax bill out of your own pockets, as the profit margin is very low.

PRO TIP: Check with you state tax levels and ensure you are earning enough to cover state sales tax.

3. Keep Track of Sales

When you are operating your Etsy store, you’ll want to ensure you are keeping track of sales and all transactions.

You can do this through your own Excel spreadsheet or a software like FreshBooks.

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

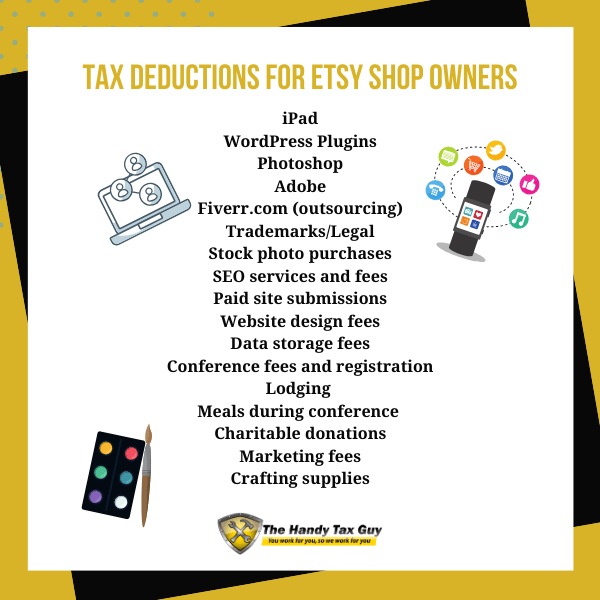

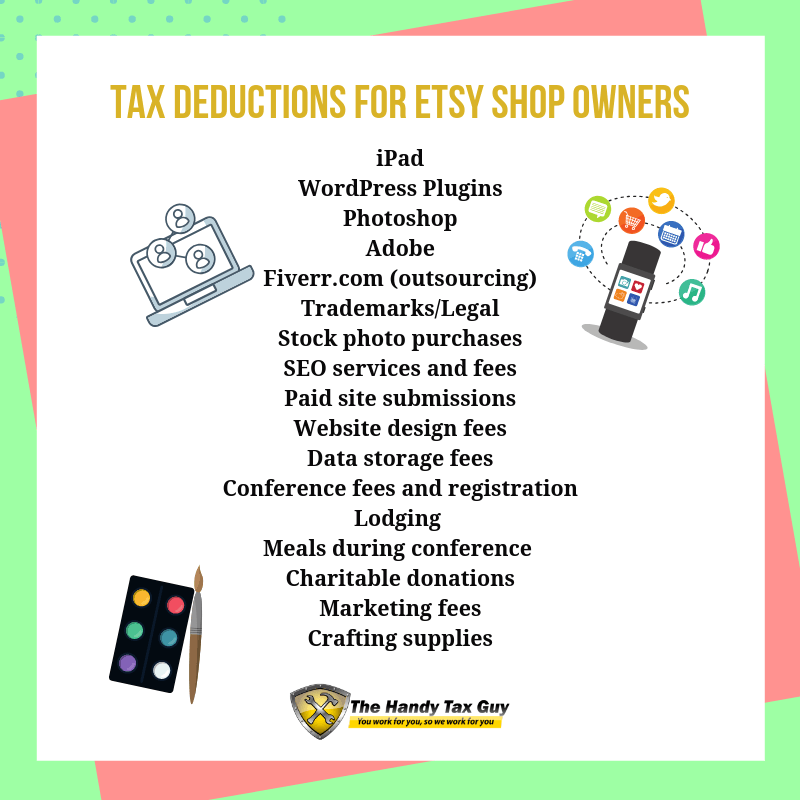

6 Commonly Missed Tax Deductions for Etsy Shop Owners

Let’s go through some deductions that you may need to know about, in order to maximize your tax savings.

1. Supplies and Subscriptions

Any amount you spend on materials you purchase as an Etsy Shop Owner for your business.

Listed below are some deductions you may be missing each tax year and not even know that you’re eligible to claim.

These items include:

- iPad

- WordPress Plugins

- Blog Post Creation and AI Marketing Tools

- Photoshop

- Adobe

- Fiverr.com (outsourcing)

- Stock Images

- Shared Workspace

- Trademarks/Legal

- Canva.com (for design)

- Tailwind (for marketing)

2. Education

When it comes to your education, which is highly important to stay competitive, these fees can also be written off.

Along with any travel associated with obtaining your continued education, such as online business conferences.

Get your FREE Tax Refund Estimator TODAY!

3. Start-up and Operating Expenses

Start-up expenses are everything you spent to get your Etsy shop running such as, equipment, online services, rental space (if needed), marketing, etc.

The IRS treats these differently, in the fact that you can write off up to $5,000 of your taxes, with the rest being depreciate over 15 years.

Your CPA (Certified Public Accountant or trusted Tax Advisor can go into more detail on depreciation with you).

Depreciation means you can claim some of the equipment costs for a smaller tax break over a few years (read more about the process called depreciation here).

Operating costs are the expenses need to maintain your business such as, monthly subscriptions and website hosting fees.

4. Any Services

Services such as advertising or business coaching are examples of services needed to maintain the integrity of your business.

5. Home Office Deduction

The home office deduction can provide substantial tax savings but requires meeting strict IRS requirements. Plus, your space must be used regularly and exclusively for business.

Homeowners calculate the deduction based on the percentage of homes used for business, while renters deduct a portion of rent.

Ensure your home office meets the rules to claim this valuable deduction.

6. Health Insurance Deductions

As a self-employed Etsy professional, you can deduct your health insurance premiums, including medical, dental, and vision insurance, from their taxable income.

PRO TIP: This deduction is available as long as the insurance is not provided through a spouse’s employer. It’s a significant tax break that can help reduce your overall tax liability.

Other Tax Deductions for Etsy Shop Owners

Online Tools

- Internet (partial amount)

- Domain fees

- Hosting fees (use BlueHost if you run a blog)

- Public internet access fees

- Stock photo purchases

- SEO services and fees

- Paid site submissions

- Website design fees

- Data storage fees

- Business related software and licensing fees

Home Office

- Portion of landline/cell phone dedicated to business

- Computer equipment used to conduct business

- Home Office (room exclusive use only, contact us for more details)

- Business Cards

- Office Supplies

- Cameras

- Digital memory cards/Cloud Subscription

- Craft Supplies

- Business furniture

- Zip drives

- Photo printouts and processing

- Printer ink and copier toner

- Phone fees/Long distance charges related to business

- Business equipment rental

- Computer upgrades and depreciation costs of computer equipment

Travel

- Conference fees and registration

- Lodging (do not combine with meals)

- Meals during conference/travel (50% of cost- do not combine with lodging)

- Entertainment (50% of cost)

- Vehicle Expenses/Mileage

- Transportation (flight, shuttles, taxi, car rental, tolls, etc.)

Education and Professional Tools

- Industry books & periodicals, including audio books

- Magazine subscriptions

- Research sites that require a subscription

- Educational webinars

- Business podcasts

- Professional memberships

- Online courses

Miscellaneous

- Charitable donations

- Marketing fees

- Business incorporation costs

- Costs for Trademarks or Copyrights

- Business logos and graphic design fees

- Advertising costs

- Photocopying/faxing fees

- Legal fees

- PayPal, Bank Fees and Western Union fees

- Post Office Box and Safe Deposit Box fees

- Coaching advice that pertains to your business

- Prizes and giveaways

- Gatherings you organize for your business

Tax Related Items

- Real estate taxes paid (% for your home office)

- Qualified mortgage insurance premiums (% for your home office)

- Deductible mortgage interest (% for your home office)

Forms Needed to Claim Deductions as an Etsy Shop Owner

Etsy Shop Owners are generally independent contractors, meaning self-employed. Whatever way you are paid, you’ll want to keep track of every amount of money you receive.

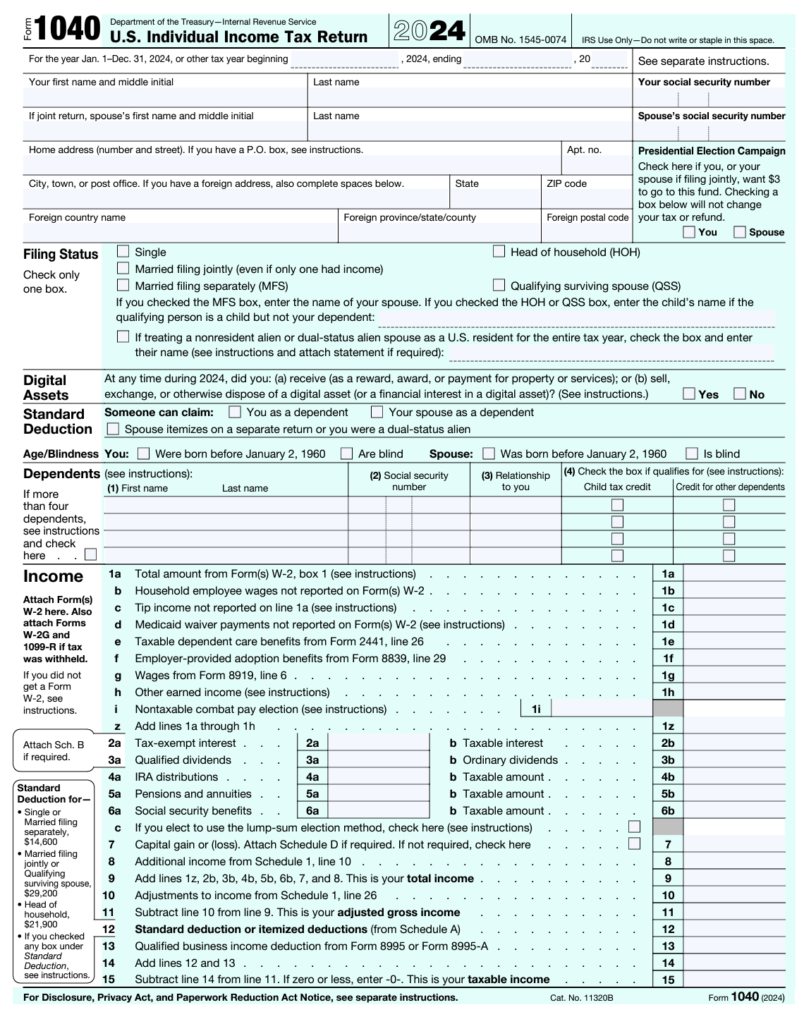

Form 1040

IRS Form 1040 is needed to write off your expenses as an Etsy Shop Owner. The expenses of your business will be placed inside the deductions area of Form 1040.

Power Tip: Use the standard deduction only if your total expenses do not exceed the dollar amount set by the IRS.

For tax year 2025, the standard deduction amounts are as follows:

| 2025 Standard Deduction and Personal Exemption (Estimate) | |

| Filing Status | Deduction Amount |

| Single | $15,000.00 |

| Married Filing Jointly | $30,000.00 |

| Head of Household | $22,500.00 |

| Married Filing Separately | $15,000.00 |

| Personal Exemption | Eliminated |

An itemized deduction is only needed if your expenses are more than the set standard deduction dollar amount.

You can use the IRS Form 1040 Schedule C if you need to itemize your deductions.

Receiving Your 1099-K Form from Etsy

If you operate a shop on Etsy, it is important to understand that you may be required to pay income tax on your earnings, which generally refers to the total revenue generated from selling your products, minus any business-related expenses.

Etsy usually submits your gross income figures to the IRS using Form 1099-K.

However, it is crucial to note that even in the absence of a 1099-K, you are still obligated to report your income from Etsy sales on your tax return.

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

NEW 1099-K Reporting Thresholds

The IRS has updated the 1099-K reporting thresholds, which are essential for Etsy sellers to track.

For 2024, the threshold is $5,000, dropping to $2,500 in 2025, and further to $600 in 2026.

These changes mean more sellers will receive a 1099-K form, making it crucial to report all income accurately.

How to File Etsy Taxes

- If you meet the above conditions, then you’ll receive a 1099-K from Etsy.

- Once you have this information, gather the rest of your tax filing information

- File your taxes with a trusted advisor

You can read the full guidelines here.

How Do You Know if Your Etsy Shop is a Business for Tax Purpose?

The IRS will categorize your Etsy shop as either a business or hobby. If your shop is a hobby, then you cannot claim any tax deductions.

In order to be seen as a business you must have a profit in at least three of the most recent five tax years.

Read: Is Your Side-Hustle a Hobby or Business for Taxes?

How to Keep Your Files Tax Information Organized

- Hold on to your 1099-K form from Etsy

- Save receipts of items you bought for your business.

- Keep track of expenses in an excel spreadsheet or through a bookkeeping software such as FreshBooks.

- Have a tax preparation checklist completed

- Keep a detailed Etsy Shop Owner tax deduction checklist handy

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

12 Tax Tips for Etsy Shop Owners

- Remember deductions have to be items related to your business

- Keep track of receipts

- Create a separate bank account for business only

- Use excel spreadsheet for bookkeeping or a software which will make your life easier once tax season comes

- Take a percentage out of each sale/payment to save for taxes

- Remember that if you make money from your blog, then you have to report it (Profit vs Loss)

- Talk to a professional tax advisor or you can chat with me if you have a question

- Print your tax checklist: the list will help keep you organized and help you not miss any possible deductions

- Save finalized tax reports from (e.g. Form 1040) previous years in a file area easy to locate

- Start early and prepare throughout the previous year (trust us it will save you a lot of pain)

- Stay current on new tax laws and breaks especially if they affect you directly

- Remember that overlooked deductions mean you put less money into your wallet, and you may end up paying too much in taxes

Frequently Asked Questions

Now that you’re empowered to conquer your taxes, let’s go through a few of the most common questions.

How do I file taxes as an Etsy shop owner?

Etsy Shop Owners are generally independent contractors, meaning self-employed. If you’re selling on Etsy without expecting a profit, your shop may qualify as a hobby.

IRS Form 1040 is needed to write off your expenses as an Etsy Shop Owner. The expenses of your business will be placed inside the deductions area of Form 1040.

This is usually handle by your tax advisor. Throughout the year, you keep up with your expenses needed to keep your shop going and your tax advisor fills out the Form 1040 for you.

Etsy will also send you a tax form (or upload it to your account) that shows how much you made that year. You will then give that form to your tax advisor and that’s all you will need for your shop.

File Your Taxes with Ease from Home Today with TurboTax!

How do I get an early start on my taxes as an Etsy shop owner?

Here are a few things you can start doing to prepare for tax season early

- Keep a good record of all your paper work and transactions

- Track every expense you use that is needed for your Etsy shop

- Look out for the tax form that Etsy will send you at the end of the year if you make over a certain amount

- Read this guide on Side-hustle vs. Hobby to understand how the IRS views your Etsy shop

Does Etsy send me a tax form (How does the 1099-K work from Etsy)?

According to Etsy,

“If you earn $5,000 or more in gross sales during a calendar year, Etsy is required by the IRS to provide you a 1099-K form with your Etsy sales and transactions the following January. If you meet this threshold, Etsy is also legally obligated to report your sales and taxpayer information to the US government.”

Even if you don’t receive a 1099-K, you will still need to report your total year earnings to the IRS which is easily done by just letting your Tax Advisor know how much you’ve made.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

Does Etsy handle Nexus Taxes for me?

According to Etsy, if you sell items to customers in another state, but do not have nexus in that state, you do not have to collect sales tax on the items you sell to them. However, your customers are responsible for paying the tax in their state on the items when they receive them. So in essence, yes.

How Does Etsy calculate the Nexus taxes for you?

Etsy calculates the state sales tax rate for your buyer’s shipping address. Etsy then charges the buyer, and sends the tax owed to the state.

According to Etsy, if your buyer places an order through PayPal, the sales tax collected will be sent to you as a part of the payment. Etsy will then add the sales tax amount to your Etsy bill so that they can remit the tax to the state.

If you are required to file a sales tax return in the Nexus states, you do not need to report sales tax on Etsy sales. You will only need to state that the sales were made through Etsy.

Remember to always consult with your tax advisor for the best guidance for your situation.

Final Thoughts on Taxes for Your Etsy Shop

The main factor here is to determine if you are using your Etsy shop as a side-hustle or full-time income.

This will help you determine the best path to take because you will likely need an EIN if you are running a business.

From there, make sure you are keeping accurate records of all transactions and sales because this will be used in your tax filings.

Lastly, ensure your profit margins are enough to cover items such a Federal and state taxes, otherwise you’ll be stuck paying those out of pack.

Don’t worry, you got this!

Plus, Etsy has the tools to make sure you are applying the right tax information to your account. However, it is ALWAYS up to you to ensure the data is accurate.

I know that Esty shops are popular, but you don’t want to be caught off guard when it comes time to reporting your earnings.

Now go out there and conquer the world with your awesome online business!

Will you be filing taxes this year for your Etsy shop? Let me know in the comment section below.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclosure Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation to the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site.

(Original Article Date: February 11, 2019/Updated on February 13, 2025)