Did you know that Uncle Sam can help you pay for your post-secondary education? That’s right. With IRS Form 8863, you can save up to $2,500 in tax liability for education expenses for you or your dependent student.

Known as the American Opportunity Credit, this credit is applicable for those who make up to $90,000 in filing individually or up to $180,000 if married filing jointly.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is IRS Form 8863?

IRS Form 8863 is a two page form that entitles eligible tax payers for the American Opportunity Tax Credit.

The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. Do keep in mind that the American Opportunity Tax Credit is eligible for post-secondary education only.

File Your Taxes with Ease from Home Today with TurboTax!

Example Scenario for IRS Form 8863

Here are two example scenarios for IRS Form 8863. The first example illustrates the student as the taxpayer:

Janice is attending the University of Arizona. Her current post-secondary educational expenses include $12,670 for in-state tuition, a $495 one-time enrollment fee, $1,300 in textbooks, and $470 in supplies.

Each one of these expenses qualifies for the American Opportunity Tax Credit. Therefore, Janice will be able to receive the full $2,500 education credit.

This second example illustrated the taxpayer with a dependent student:

Amanda’s son Greg is attending the University of Maryland. Greg’s current post-secondary educational expenses include $13,670 for in-state tuition, a $515 one-time enrollment fee, $1,450 in textbooks, and $425 in supplies.

Each one of these expenses qualifies for the American Opportunity Tax Credit. Therefore, Amanda will be able to receive the full $2,500 education credit.

Frequently Asked Questions About IRS Form 8863

While the American Opportunity Tax credit is pretty straight forward, there are some common questions that you may have.

What are qualified expenses for IRS Form 8863?

Here are some examples of qualifying expenses that can be applied towards the American Opportunity Tax credit:

- Tuition (in-state and out of state tuition)

- Student activity fees (intramural sports, visiting academics etc.)

- Required books (textbooks, workbooks and reference books).

- Education related equipment (lab equipment, calculators, measuring equipment etc.)

- Supplies (pens, pencils, notebooks, sketchbooks, book bags, etc.)

Who fills out form IRS Form 8863?

IRS Form 8863 can be filled up either by the student or the taxpayer who can claim the student as a dependent.

How do I know if I received American Opportunity Credit?

If you are using a tax preparer software, you can perform the following steps:

- Sign into your online account

- Select the year that you wish to review and download the PDF

- Scan the document and see if IRS form 8863 appears anywhere. If the is there, then you have claimed the credit for that tax year. If the form is not there, then you did not claim the credit for that year.

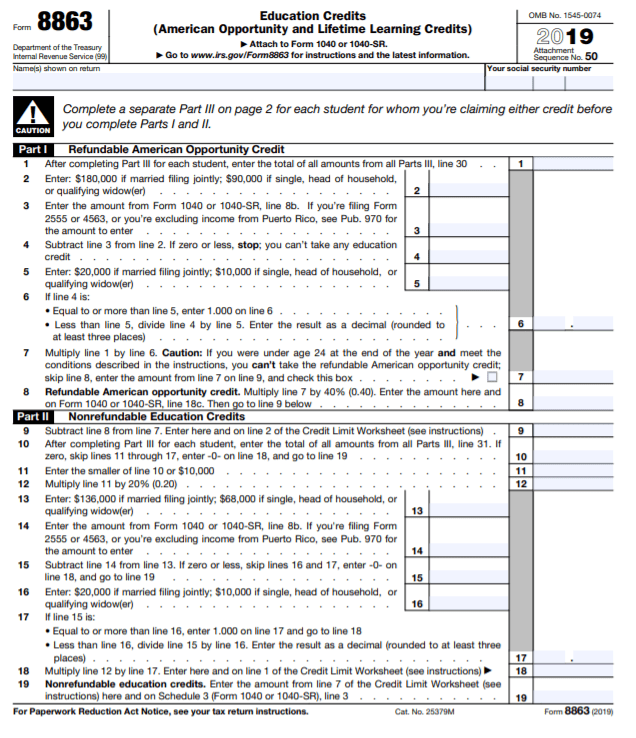

How to fill out IRS form 8863?

To receive specific instruction on filling out IRS form 8863, you can find the IRS instruction guide through this link.

Here is an overview of the information needed for IRS form 8863:

- You need to enter your MAGI (Modified Adjusted Gross Income)

- Enter the amount from the Credit Limit Worksheet

- Put int the student’s name

- Enter the student’s social security number

- Put in the name of the educational institution(s)

- Indicate if the student has been convicted of any felony for possession or distribution of a controlled substance

What is defined as a post-secondary school?

A post-secondary school is an accredited University, college or trade school.

How long do I have to attend school during a tax year to qualify for the tax credit?

You or your dependent student has to attend at least half the time of one or more academic semesters during the tax year. Also, the student must be pursuing a degree of another type of recognized credential.

What is the difference between the American Opportunity Credit and the Lifetime Learning Credit?

Many people seem to confuse the American Opportunity Credit and the Lifetime Learning Credit. While both educational credits seem similar, each educational credit has some important differences.

The American Opportunity Credit is intended for a student in a post-secondary institution pursuing a degree or an accreditation. The Lifetime Learning Credit is intended for those taking classes to improve or gain extra job skills.

Here are some more specific differences between the American Opportunity Credit and the Lifetime Learning Credit.

The American Opportunity Credit:

- Up to $2,500 credit per eligible student

- $180,000 income limit if filing jointly or $90,000 is filing as a single individual

- 40% of the credit may be refundable. The rest is non-refundable

- Available only if the student(s) has not completed the first four years of postsecondary education before 2019

- Available for only 4 tax years

- Student(s) must be pursuing a program that leads to a degree or some other form of accredited certification

Lifetime Learning Credit:

- Up to $2,000 credit per return

- $136,000 income limit if filing jointly or $68,000 is filing as a single individual

- Nonrefundable

- Available for all years of postsecondary education needed to improve job skills

- Available for an unlimited amount of tax years

- Student(s) does not need to pursue a degree or an accredited certification

Read: What Is A 1098-T Form Used For? (Full Guide for College Students)

4 Easy Tips to Remember for Tax Form 8863

While the completion of IRS Form 8863 is rather simple, here are some tips to ensure that you successfully get your American Opportunity Credit.

- Be sure to ask your tax preparer if you qualify for the American Opportunity Credit.

- If you are using tax preparation software, be sure to look for the American Opportunity Credit tax credit or form 8863. You will be able to fill out the form electronically.

- Ensure that you are attending your school for the necessary amount of time to qualify for the tax credit.

- Keep track of all of your post-secondary expenses by keeping records and receipts.

File Your Taxes with Ease from Home Today with TurboTax!

Final Thoughts on Getting Your American Opportunity Credit

The American Opportunity Credit is a simple way to save you or your dependent’s post-secondary education. Be sure to check if you qualify.

For more money-saving tips and guides, subscribe to the weekly newsletter!

If you enjoyed this article, then you’ll love these:

- What Is A 1098-T Form Used For? (Full Guide for College Students)

- Tax Software vs. Accountant or Tax Pro (Which Should You Use?)

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Last Minute Tax Tips for Beginners

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**