You may be eligible to change your business’s tax classification if you file IRS Form 8832. It’s not for everyone – only certain businesses qualify, but it can be financially beneficial.

Find out if your business qualifies for a change in tax classification in this guide.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

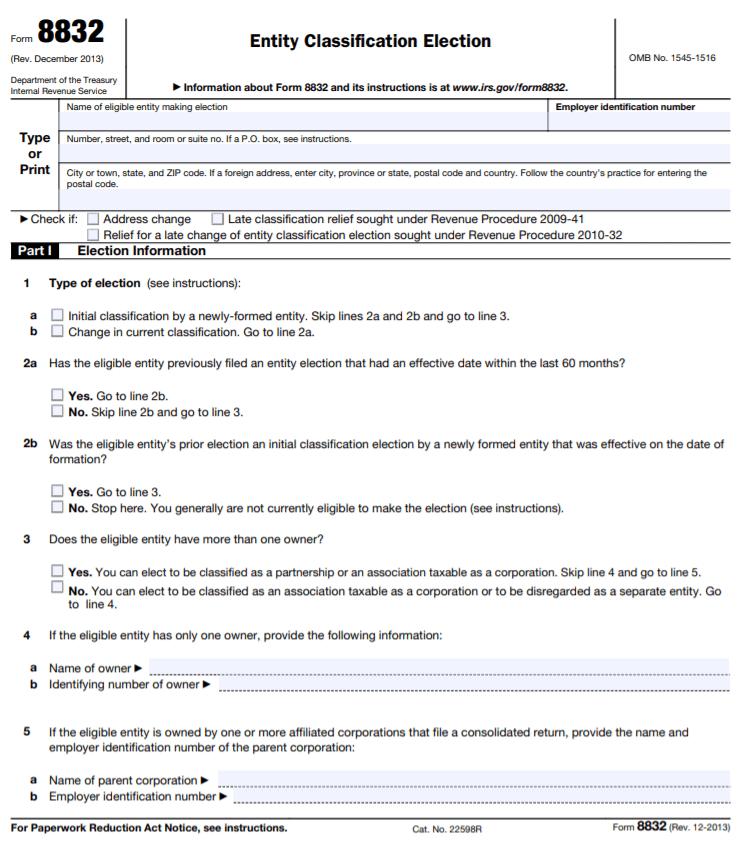

What is IRS Form 8832?

IRS Form 8832 is for LLC companies that wish to change their tax filing status. Normally a one-member LLC is taxed as a sole proprietor, and a multi-member LLC is taxed as a partnership.

LLC owners can change their filing status with IRS Form 8832, though. This form is strictly for tax purposes – it doesn’t change your business’s structure, but it may help you save money on your tax liabilities.

Form 8832 is called the Entity Classification Election. As an LLC, the IRS assigns a default tax classification as we discussed above, but this may leave you paying more taxes than you should.

Using Form 8832 allows you to be taxed as a C-corporation rather than a pass-thru entity. In other words, the income and tax liabilities are separate from your individual income and taxes.

Example Scenario for Form 8832

John started his own company last year. It was a little company that sold digital products to consumers to make their lives easier. John thought it would be a ‘hobby’ business and he would make a little side cash.

He wasn’t worried about the income causing him crazy high tax liabilities. John filed as an LLC just to protect himself since he was selling products to consumers and didn’t want the financial liability of any mishaps.

Fast forward six months and John’s business is booming. His income is triple that of what he makes at his job, and his tax liabilities are sky high.

John’s tax accountant suggested that he file IRS Form 8832 to limit the income that ‘passes through’ to his individual tax return, otherwise John’s tax liability would be much higher than he anticipated.

He filed form 8832 and elected to have his single-member LLC classified as a C-corp for the tax year to limit his liabilities.

File Your Taxes with Ease from Home Today with TurboTax!

Frequently Asked Questions You Must Know

Now that we have the basic done, let’s go through the top questions regarding this IRS form.

Where do you mail IRS Form 8832?

Where your business operates determines where you mail IRS Form 8832. Businesses in Connecticut, Wisconsin, Delaware, West Virginia, District of Columbia, Vermont, Illinois, South Carolina, Indiana, Rhode Island, Kentucky, Pennsylvania, Maine, Ohio, Maryland, North Carolina, Massachusetts, New York, Michigan, New Jersey, or New Hampshire send it to:

Send to: Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999

Businesses in Alabama, Wyoming, Alaska, Washington, Arizona, Utah, Arkansas, Texas, California, Tennessee, Colorado, South Dakota, Florida, Oregon, Georgia, Oklahoma, Hawaii, North Dakota, Idaho, New Mexico, Iowa, Nevada, Kansas, Nebraska, Louisiana, Montana, Minnesota, Missouri, and Mississippi send it to:

Send to: Department of the Treasury Internal Revenue Service Center Ogden, UT 84201

Does a single-member LLC need to file form 8832?

If a single-member LLC wants to change his/her tax classification to a C-corp, then yes, you must file form 8832. If you want to keep your pass-through entity as-is, there’s no reason.

How long do I have to file form 8832?

You can file form 8832 at any time during your business’s lifetime, but it’s only effective up to 75 days before your filing date or up to 12 months after the filing date so time it accordingly.

Do I need to file form 8832 and 2553?

No, you’ll file one form or the other – not both. If you’re an LLC and want to file taxes as a C-corp, file IRS Form 8832, and if you’re an LLC or corporation that wants to file as an S-corp, file Form 2553.

Data: 40% of Small Biz Owners Get Paid by Check

Who must file Form 8832?

No one is obligated to file Form 8832. Only those LLCs that want a different tax classification for a given year must file it. If you’re okay with your default tax classification, you can file your taxes as normal.

Who must sign Form 8832?

Any current business owners or officers who are currently involved in the business should sign it. This gives the IRS a contact person should they have any questions. However, if you’re filing for a retroactive date (up to 75 days), any previous owners or officers at that time must also sign it.

How long does it take to complete IRS Form 8832?

It shouldn’t take much longer than 15 minutes to complete the form. It’s straightforward and the IRS instructions make it simple.

File Your Taxes with Ease from Home Today with TurboTax!

Top 4 Tips to Make Your Process Easier

1. Make sure you choose the right type of election

- If you just started your business and want to change your tax classification, choose ‘initial classification by a newly-formed entity.’

- If you already filed taxes under your current classification, check ‘change in current classification.’

2. You may only change your tax classification once every five years unless you meet one of the following exceptions:

- If your earlier election was for a newly formed entity

- If the business’s ownership changed (at least 50% must change) but this requires a private letter ruling from the IRS

3. Choose your effective date carefully, if you’re choosing anything other than the first date of business, consult with a tax professional to determine the best date

4. You may be eligible for late election relief if you:

- were previously denied form 8832 approval because you missed the filing date

- had a probable cause for the late filing

- are no more than 3 years late

Bottom Line

Choosing your business’s tax classification affects your bottom line. Get professional advice to determine which classification is right for your business.

Don’t assume you can just change your filing status when and if it benefits you.

Without IRS Form 8832, the IRS puts you in a default classification. You need approval to change your classification, but seek advice before doing so to make sure it will have the favorable tax outcome you desire.

For more money-saving tips and guides, subscribe to the weekly newsletter!

I hope this helps your situation.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**