Calculating Adjusted Gross Income (AGI) is an essential step in determining your taxable income.

One of the key documents needed for this calculation is your W-2 form, which provides information about your earnings and certain deductions.

In this guide, I will go over how to calculate AGI from your W-2 in a detailed manner to help you understand the process clearly.

Ready to get started?

Then keep reading to find out!

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Key Takeaways

- Adjusted Gross Income (AGI) is your total income minus specific deductions, serving as a baseline for calculating taxable income.

- Taxable income: Your taxable income is what you’ll use to determine your tax bracket.

- Self-employment income: Include self-employment income when calculating your total income for AGI.

- A W-2 will give you a statement of your generated income and taxes withheld. This form is only for employers and not for those who are self-employed. Self-employed persons will have to use a different form (Form 1099).

- Tax deductions: Subtract tax deductions from your total income to calculate AGI.

- IRS Form 1040: Use IRS Form 1040 to report your AGI.

- Income tax return: Your AGI is a crucial part of your income tax return.

Keep reading to get everything you need to know about this IRS policy.

What’s AGI (Adjusted Gross Income)?

To understand what Adjustable Gross Income (AGI) is, you first need to comprehend your gross income.

When calculating your AGI, it’s important to remember that income from your W-2 is not the only source.

You’ll also need to factor in other taxable income like self-employment income reported on a 1099-NEC, interest, and dividends reported on a 1099-INT or 1099-DIV, capital gains and losses reported on a 1099-B, and income from sources like prizes, gambling winnings, or jury duty.

Make sure you have records of all your income sources before calculating AGI.

Gross income is the total amount of income that you earn (salaries, rent, retirement distributions, or any other earnings) in a year before your taxes are deducted from it.

Now if you see AGI, then it is the income obtained after subtracting adjustments.

You will need to find your AGI to calculate your tax liability. Plus, you may need it if you want to qualify for credits and deductions.

File Your Taxes with Ease from Home Today with TurboTax!

Common Adjustments

Some of the most common adjustments that can lower your AGI include:

- Deductible IRA contributions

- Student loan interest

- Educator expenses for teachers

- Penalties on early withdrawal of savings

- Self-employed health insurance premiums

- Alimony payments.

Itemizing all allowable adjustments is key to arriving at the lowest possible AGI.

Get your FREE Tax Refund Estimator TODAY!

Understanding AGI vs. MAGI

Adjusted Gross Income (AGI) is your total income minus specific deductions, serving as a baseline for calculating taxable income.

However, for certain tax benefits, the IRS uses Modified Adjusted Gross Income (MAGI), which adds back some deductions to your AGI.

Understanding the difference is crucial, as MAGI determines eligibility for deductions like IRA contributions and credits such as the Child Tax Credit.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

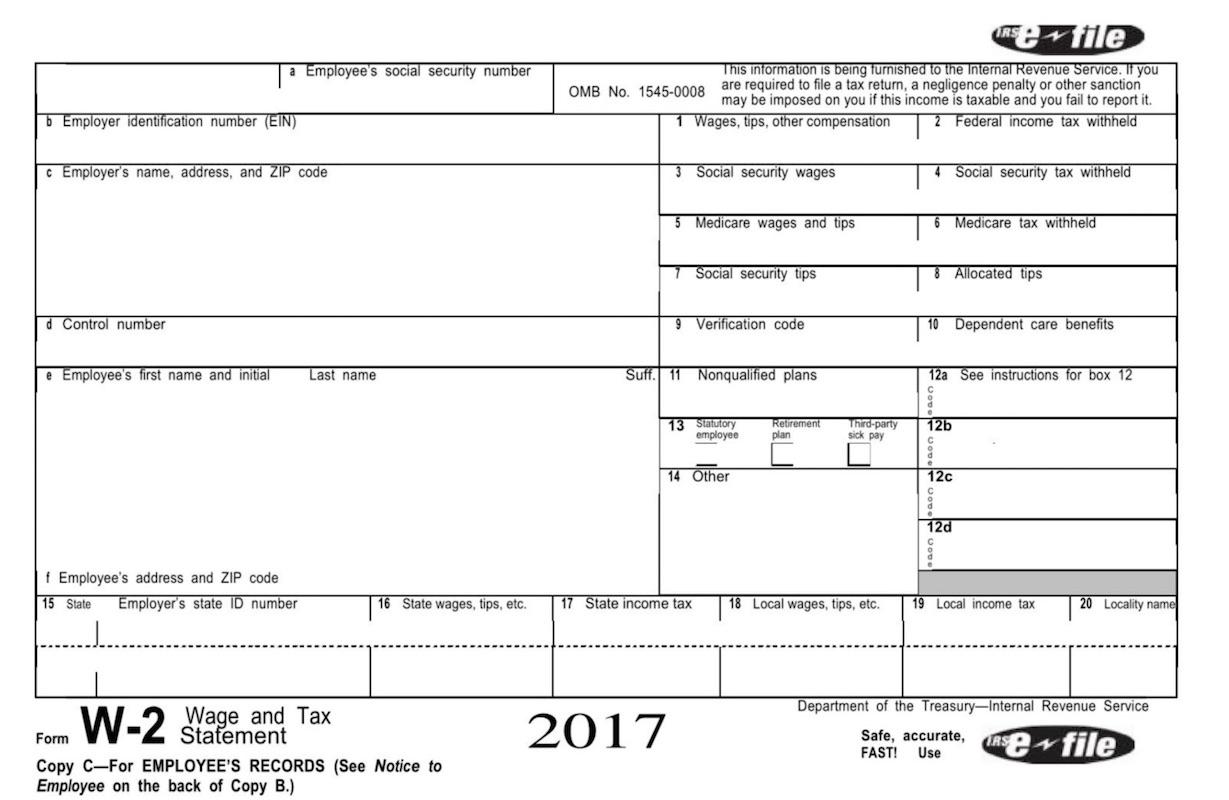

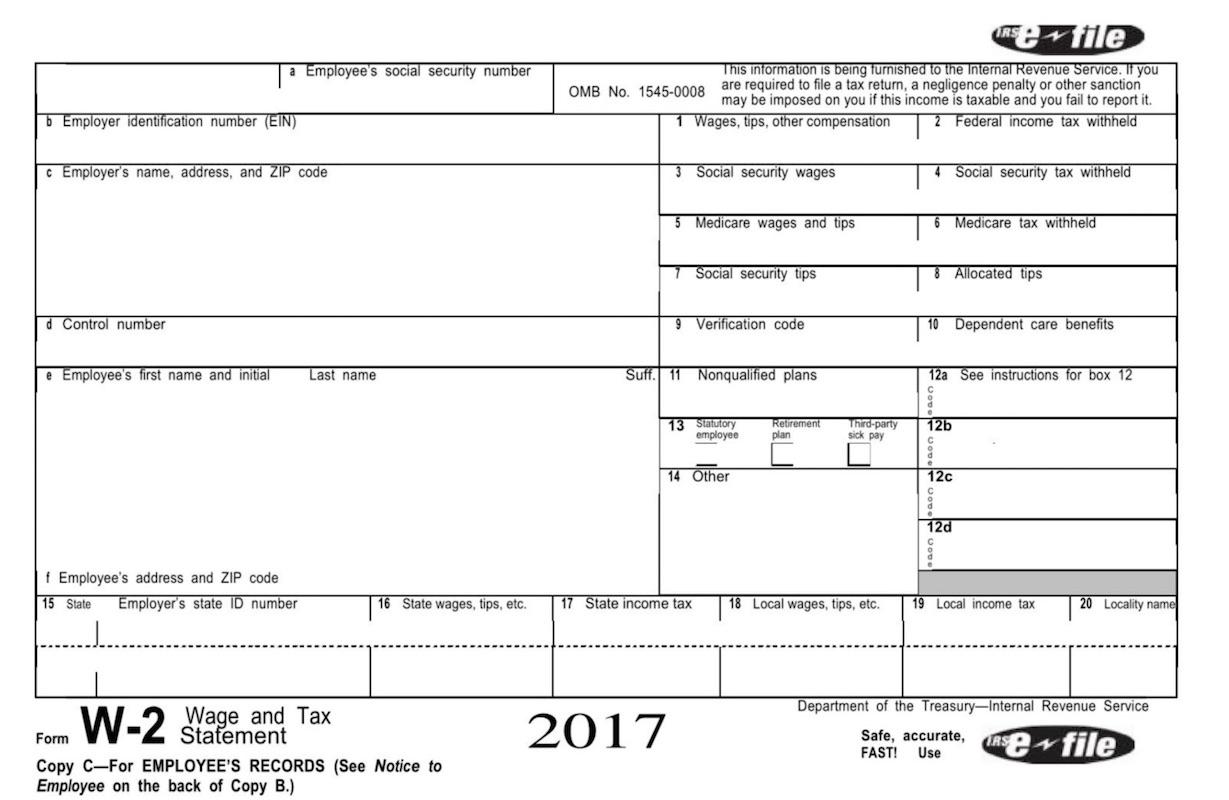

What is a W-2 Form?

A W-2 form tells the amount of annual income you will receive along with the value of taxes deducted from the annual income. Your employer will send you as well as the Internal Revenue Service (IRS) a W-2 after the end of the tax year (December 31).

A W-2 will give you a statement of your generated income and taxes withheld. This form is only for employers and not for those who are self-employed. Self-employed persons will have to use a different form (Form 1099).

You will receive your income-related information from the W-2 while the IRS will receive your wage and tax statement.

That is why the information on a W-2 form must be accurate. Having a W-2 will help you get your tax returns back efficiently.

Where Do I Find My AGI on a W-2?

Your AGI is not found on the W-2; it requires additional income and deductions not reported on the W-2.

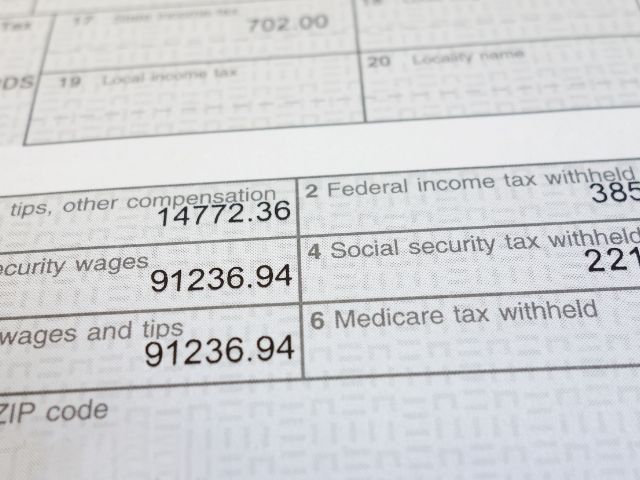

There are numerous boxes on the W-2 form itself. Each box identifies a particular value related to your wages and taxes.

- Box 1 will tell you your annual salary.

- Box 2 will tell you how much your employer has withheld for taxes.

- Box 3 will show you social security wages. (if applicable)

- Box 4 will tell you the withheld tax from social security wages. (if applicable)

Other boxes have related information that you can use to calculate your adjusted gross income (AGI) on Form 1040.

How Do I Calculate AGI?

There is no rocket science involved in the AGI calculation. The simple steps involved in calculating your AGI from the information given on W-2 are:

- First, you will have to gather your income and tax statements. Your income will include your salary, prizes, lottery, rent, jury duty fees, unemployment benefits, etc.

- Add up all of these sources of income to find out the final annual income.

- Now add certain payments known as above-the-line deductions or adjustments to income that you made in the last year.

- Subtract above-the-line deductions from your final annual income.

- The amount that you get is your adjusted gross income (AGI).

Above the line deductions that you will have to subtract include:

- Alimony

- Student loan interest

- Educator expenses

- Contributions to a Health Savings Account

- Contributions to retirement accounts

- Specific job-related expenses

- Moving expenses

- Half of the self-employment taxes that you paid

The greater the value of your deductions, the lower the taxes you will have. So, make sure you write in the correct value of deductions while calculating your adjusted gross income.

Using IRS Tools for AGI Calculation

The IRS provides several tools to assist you in calculating your AGI. This IRS Interactive Tax Assistant is also valuable resource that helps determine filing requirements and potential eligibility for refunds or credits.

Using these tools can simplify the tax filing process and ensure accuracy for you this year.

Get your FREE Tax Refund Estimator TODAY!

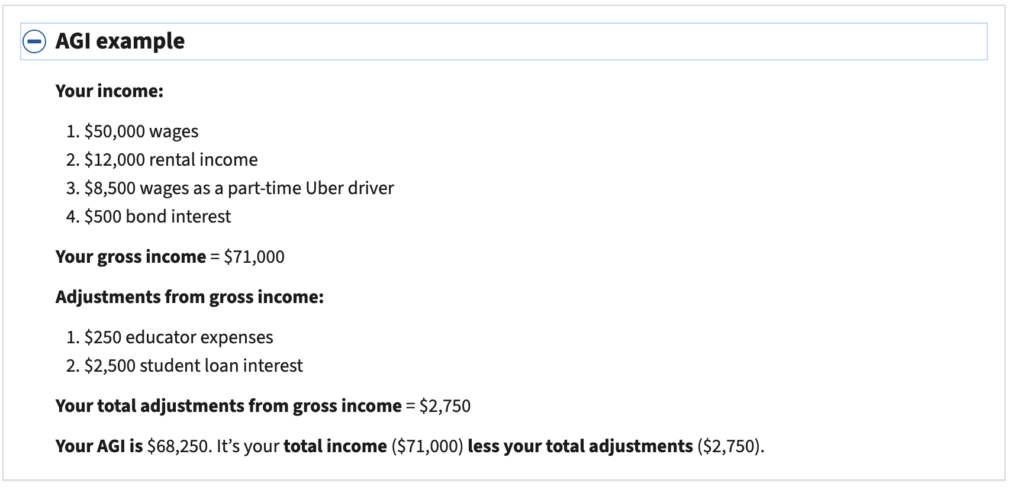

Let’s Understand It Better with an Example

Suppose your final income is $100,000. Now calculate your specific expenses from the last year. Let’s suppose those expenses are:

- Your student loan interest is $300

- Educator expenses are $700

- Your contributions to the retirement accounts are $10,000

- And your contributions to the health savings account are $5,000

Your total deductions will be (300+700+10,000+5,000) $16,000. Now subtract deductions from your annual income (100,000 – 16,000), the value $84,000 will be your adjusted gross income. If they qualify.*

How do I find my adjusted gross income without a W-2?

If you want to find out your adjusted gross income but you have not received the W-2 form, do not worry. You can use other means such as your last paystub to calculate your adjusted gross income as well.

It is not much different from calculating AGI with the help of a W-2 form.

- You can find your annual income from the pay stub. Add your other sources of income (rent, lottery, etc.) into it.

- Now add up all of your deductions like you did in the above steps.

- Subtract deductions from the annual income. This value will be your adjusted gross income.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

Where is the AGI on my tax return?

To find the value of adjusted gross income by using your tax return, you will have to look in the upper left-hand corner of your income tax return. There you will see the name of your tax form which could be any form including: 1040, 1040-SR.

In the United States, Form 1040 is used for federal income tax returns. This form has various versions. You can determine the value of your adjusted gross income from different lines on various forms.

- For the tax year 2024, check the line 8b on the form 1040.

- For the tax year 2024, check the line 8b on form 1040-SR.

3 Simple Tips to Remember When Calculating Your Adjusted Gross Income (AGI)

If you want to calculate your adjusted gross income then these handy tips may be useful to you.

- Add up all of your deductions. The more deductions you have the more credits you will be able to receive. A lower AGI will benefit you in this regard.

- Use a W-2 form to determine your final income. If you have received this form from your employer, do not panic. Instead, use your last pay stub to find your final income.

- When calculating AGI, it’s easy to make mistakes, such as confusing it with taxable income or omitting income sources like dividends or rental income. Make sure that you include all income and eligible deductions to avoid errors that could affect your tax liability.

File Your Taxes with Ease from Home Today with TurboTax!

My Final Thoughts

Your adjusted gross income holds great importance in the world of taxes. If you have a lower adjusted gross income, you can increase your tax refunds and decrease the amount of tax that you owe.

Be sure to use all of this information wisely to help you when calculating your AGI. For more money-saving tips and guides, subscribe to the weekly newsletter!

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Tax Software vs. Accountant or Tax Pro (Which Should You Use?)

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Last Minute Tax Tips for Beginners

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: October 22, 2020/Updated On January 10, 2025)