As a student receiving financial aid, you may be wondering whether the Pell Grants you receive are taxable.

With tax season approaching, it’s essential to understand the tax implications of your financial aid to ensure you’re in compliance with the IRS regulations.

Let’s dive into the world of Pell Grants and explore whether they are considered taxable income.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission at no additional cost to you.

Understanding Pell Grants

If you’re looking for financial assistance to fund your education, Pell Grants may be an option. Pell Grants are a type of financial aid that are awarded to students who display financial need, as determined by completing the Free Application for Federal Student Aid (FAFSA).

To be eligible for a Pell Grant, you must meet certain criteria, including being an undergraduate student who has not yet earned a bachelor’s, graduate, or professional degree.

Additionally, your expected family contribution (EFC) must fall within a certain range, which is determined by the results of your FAFSA.

If you’re interested in applying for a Pell Grant, start by completing the FAFSA. The FAFSA is available online and must be completed each year to be considered for financial aid.

Pell Grants and Taxable Income

One of the most common questions regarding Pell Grants is whether they are taxable income. The short answer is no, Pell Grants are generally not considered taxable income by the IRS. As stated in Publication 970.

However, it’s important to note that any Pell Grant funds used for expenses outside of qualified tuition and related expenses, such as room and board or books, may be considered taxable income.

If you received a Pell Grant and used the funds for non-qualified expenses, you will need to report that amount as taxable income on your tax return.

It’s also worth considering other factors that may impact the taxability of your Pell Grants.

For example, if you’re also receiving other forms of financial aid, such as scholarships or work-study programs, these funds may affect your overall tax situation and should be taken into account when filing your taxes.

Tax Implications of Pell Grants

If you’ve received a Pell Grant, it’s important to understand the potential tax implications. While Pell Grants themselves are not taxable as income, they may impact your overall tax situation in other ways.

Pell Grant Taxable Status

Under IRS guidelines, Pell Grants are considered financial assistance and are not included in your taxable income. This means that you do not need to report Pell Grants as income on your tax return, and they will not be taxed as such.

However, if you use your Pell Grant funds for non-qualified expenses, such as room and board, those amounts may be taxable.

It’s important to note that while Pell Grants themselves are not taxable, they may affect your eligibility for certain tax credits and deductions, such as the American Opportunity Tax Credit or the Lifetime Learning Credit. We will discuss this further in the next section.

Pell Grant Financial Assistance

While Pell Grants are not considered taxable income, they do count as financial assistance. This means that Pell Grants may reduce your eligibility for other forms of financial assistance, such as scholarships or need-based grants.

It’s important to factor in the impact of a Pell Grant on your overall financial situation when applying for other forms of assistance.

Pell Grant Tax Implications

While Pell Grants themselves are not taxable, they may impact your overall tax situation in other ways. For example, if your Pell Grant funds exceed your qualified education expenses, you may not be eligible for certain tax credits or deductions. This is why it’s crucial to keep accurate records of your Pell Grant usage, including any non-qualified expenses.

If you receive a Pell Grant and also earn income from a job or other sources, your income level may push you into a higher tax bracket. This could result in a higher tax bill overall. It’s important to consult with a tax professional to determine the best tax strategy for your specific situation.

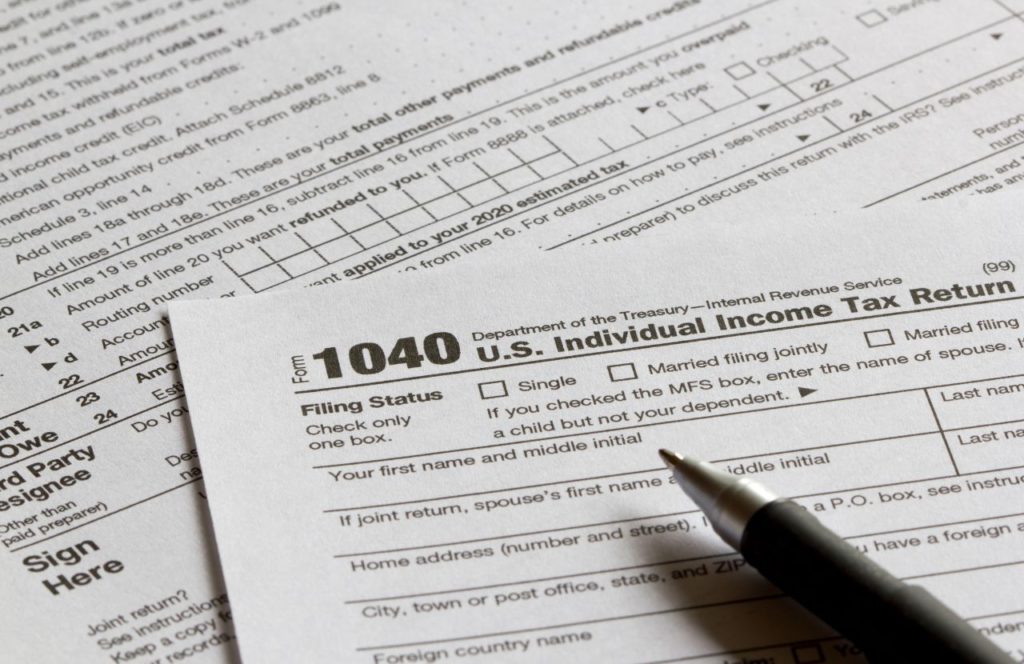

Reporting Pell Grants on Your Tax Return

Once you’ve determined whether your Pell Grants are taxable income, it’s important to know how to accurately report them on your tax return. This will ensure that you’re complying with IRS regulations and avoiding any potential penalties or fines.

You will need to report your Pell Grants on your Form 1040 or 1040A tax return. You should receive a Form 1098-T from your college or university that reports the amount of Pell Grants you received during the tax year. You’ll use this form to help you accurately report your grants.

On your tax return, you’ll report your Pell Grants on line 1 or line 7 of your Form 1040 or Form 1040A (depending on which form you’re using). This is the line where you report your total income. You’ll need to enter the amount of your Pell Grants on this line, along with any other taxable income you received.

It’s important to note that Pell Grants are considered taxable income only to the extent that they exceed the amount of qualified education expenses you incurred during the tax year.

If you received a Form 1098-T, you’ll need to use this form to determine your qualified education expenses. You’ll subtract your qualified education expenses from the amount of your Pell Grants to determine the taxable amount.

If you did not receive a Form 1098-T, you’ll need to determine your qualified education expenses on your own. These expenses may include tuition, fees, books, and supplies required for your coursework. You’ll need to keep receipts and other documentation to support your expenses.

Reporting Pell Grants on your tax return can be a complex process, but it’s essential to get it right to avoid any potential issues with the IRS. If you’re unsure about how to properly report your grants, consider consulting a tax professional or using tax preparation software.

Pell Grants and Financial Aid

If you’re considering applying for financial aid to help pay for college, the Pell Grant program is a great place to start. Pell Grants are need-based awards that provide eligible students with financial assistance to pursue their educational goals.

To be eligible for a Pell Grant, you must demonstrate financial need based on the expected family contribution (EFC) calculation from the Free Application for Federal Student Aid (FAFSA). Additionally, you must be a U.S. citizen, have a high school diploma or GED, and be enrolled or accepted into an eligible degree program.

If you are awarded a Pell Grant, it will be disbursed directly to your school to cover your educational expenses. The amount of the grant varies based on your financial need and the cost of attendance. For the 2023-2024 academic year, the maximum Pell Grant award is $7,395.

It’s important to note that receiving a Pell Grant may impact your eligibility for other forms of financial aid. For example, some scholarships and grants may be reduced if you receive a Pell Grant. However, loans and work-study programs are not impacted by Pell Grants.

If you have questions about how Pell Grants may impact your overall financial aid package, it’s a good idea to speak with a financial aid advisor at your school.

Tips for Managing Your Taxes with Pell Grants

Managing your taxes can be challenging, especially if you’re receiving financial aid like Pell Grants. Here are some tips to help you navigate the tax process smoothly:

Keep Accurate Records

It’s crucial to keep track of all your financial aid, including Pell Grants. Make sure you retain all relevant documentation, such as award letters and receipts for educational expenses. These records will come in handy when you prepare your tax return and if the IRS audits you.

Understand the Tax Implications

As we discussed earlier, Pell Grants are typically tax-free. However, you may need to report them on your tax return in some cases. Understanding the IRS guidelines and regulations is essential in determining whether and how to report your Pell Grants, so research the relevant tax laws carefully.

Consider Tax Planning

If you’re receiving Pell Grants, you may be eligible for certain tax credits, such as the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit. These credits can reduce your tax liability, so make sure to explore all available options to maximize your tax savings.

Seek Professional Advice

If you’re unsure about how to manage your taxes with Pell Grants, don’t hesitate to consult a tax professional. They can provide expert advice and guidance on your tax situation, ensuring compliance with IRS regulations and minimizing your tax liability.

Be Diligent and Proactive

Managing your taxes when you receive Pell Grants requires diligence and proactive action. Make sure to keep up with all deadlines and requirements, timely file your tax return, and seek help when you need it.

By following these tips, you can effectively manage your taxes and maximize your financial assistance with Pell Grants.

Final Thoughts on Understanding the Taxability of Pell Grants

Pell Grants can be a valuable form of financial assistance for students pursuing higher education.

As long as you use them for educational expenses and report them correctly on your tax return, you can take advantage of the benefits they offer without worrying about any additional tax burdens.

If you still have questions about the taxability of Pell Grants or their potential impact on your taxes, don’t hesitate to seek professional advice or consult with the IRS directly. With a little bit of knowledge and planning, you can manage your taxes with Pell Grants with ease.

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**