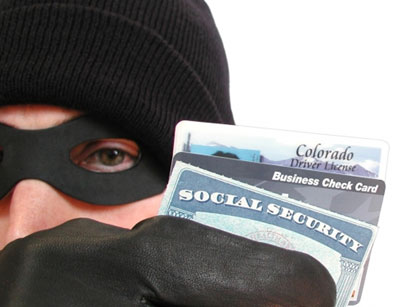

You may be asking yourself, what should I do if I am a victim of tax identity theft?

If this sounds like you, you may have found yourself in a situation where you tried to file your taxes only to find out that a return has already been filed under your Social Security Number (SSN)…

…or even worse, under your child’s SSN?

Someone stole your Social Security Number and used it to file a tax return to claim your refund!

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is Tax Identity Theft?

Tax identity theft happens when someone uses your information to file a tax return without your knowledge. You won’t even realize that this has happened until you go to file your tax return.

Tax Identity Theft Stats You Must Know

I know this may sound bizarre, but this is becoming a very common form of tax identity theft.

Last year, the IRS sent out over 5 million automated audit inquiries. In 2014, 1 out of every 14 Americans had their identity stolen. These are frightening experiences that can happen to any tax payer.

Nearly 60 million Americans have been affected by identity theft, according to a 2018 online survey by The Harris Poll.

There are ways to help prevent it and to protect you from thieves looking to steal your information.

How to GUARD Your Tax Information

- Thoroughly research reputable Tax Preparers before you trust someone with your sensitive documents

- File your tax return as early in the tax season as you can

- Use a secure internet connection (look for “https” instead of simply “http”)

- If you mail your return, send it directly from the post office

- SHRED any tax-related documents if they need to be discarded

More Tax Savings: File at Ease at Home with Turbo Tax

Be Aware of Signs of Identity Theft

Knowing the warning signs of identity theft can help prevent any further damage from occurring.

You might be a victim of tax identity theft if you received a notice from the IRS informing you that:

- More than one tax return was filed for you

- IRS records indicate you received more wages than you actually earned

- You owe additional tax or have had collective actions taken against you for a year you did not file a tax return

- Your state or federal benefits were reduced or cancelled because the agency received information reporting a change in income

How to Deal with Tax Identity Theft

If you think someone has used your Social Security Number for a tax refund you should contact the IRS immediately.

The IRS have specialists available to help you get your tax refund filed properly.

- You will need to first contact the IRS Identity Protection Specialized Unit or call 1-800-908-4490

- You will then need to update your files

- Record the dates and times you made calls or sent letters

- Keep copies of letters on file for personal reference

- Put a fraud alert on your credit reports

- Respond immediately to any IRS notice

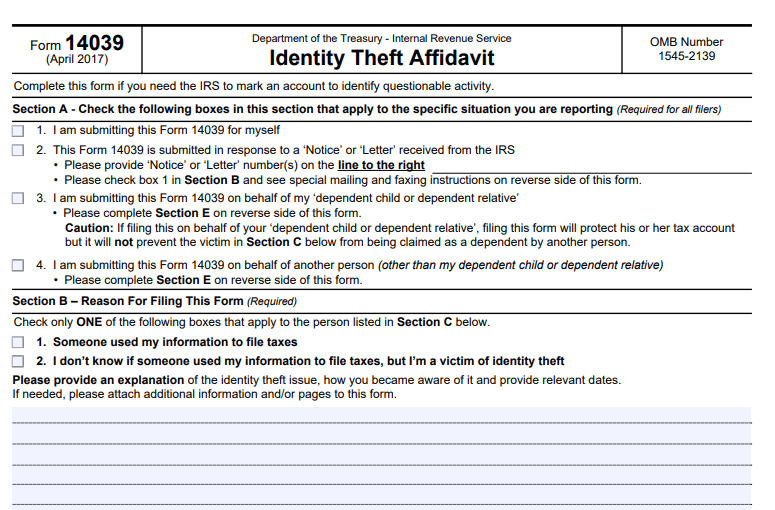

- Complete IRS Form 14039, Identity Theft Affidavit

- Get an IRS Identity Theft Protection PIN

Always remember not to open emails or text messages that claim to be from the IRS. The IRS does not initiate contact with taxpayers electronically to request personal or financial information.

What’s an Identity Protection PIN?

An IP PIN is a six-digit number assigned to qualified victims to help prevent the misuse of their Social Security number on fraudulent federal income tax returns.

How do I get my identity theft pin from the IRS?

Once you have been confirmed by the IRS as being a victim of identity theft, an IP PIN will be mailed to you if your case is resolved prior to the start of the next filing season.

If you already get an annual IP PIN via mail but lose it, you may use the Get an IP PIN tool to retrieve your number.

How Do I Use an IP PIN?

Whenever you have to file your taxes, you will be required to enter your six-digit IP PIN. If you do not do this or if you use an incorrect number, you return will be rejected or delayed.

PRO TIP: The IRS will never ask for your IP PIN. So, if anyone calls or emails you asking for it, you will know that it’s a scam.

Can I Use the Same IP Pin from Last Year?

At this time you cannot, but a new IP PIN is generated each year for you.

You can read the most common questions here if you have any questions about getting your IP PIN.

Finding Help

I recommend talking to your Tax Advisor to provide you with access to an experienced professional to aid you directly and thoroughly through this process if it happens to you.

There are also services out there like an audit assistance program that will provide coverage on your current federal tax return and help prevent and restore any issues that may have occurred due to this unfortunate event.

File Your Taxes with Ease from Home Today with TurboTax!

Your Identity Theft Restoration Services should provide assistance in the event of:

- stolen credit cards

- compromised bank accounts

- fraudulent tax returns

- other identity theft incidents

Many people choose this benefit for their own peace of mind and I recommend you do the same.

How Long Will it Take to Get My Refund After Tax Identity Theft?

Most situations can be taken care of within 120 days. This can also depend on the complexity of your issue and the workload of the IRS.

Final Thoughts

I hope this article has helped eased your mind regarding any Tax Identity Theft situations. Remember to always guard your information and trust your instincts.

Be sure to contact the IRS immediately if you ever have any questionable situations occur.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

- Divorce and Taxes: Everything You Need to Know

For more money-saving tips and guides, subscribe to the weekly newsletter!

Until the next money adventure, take care from The Handy Tax Guy Team!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Written in 2016/ Updated July 12, 2021)