Are you trying to figure out if the Dave Ramsey Investment Calculator can help you truly plan out your retirement?

Saving for retirement can be intimidating. From investment selection to financial goals, many data points influence the outcome. When you started and how much you have contributed to name a few.

Luckily, thanks to the Internet, there are various tools to help you understand what you need to properly save for retirement.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is the Dave Ramsey Investment Calculator?

Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. This calculator is designed to provide you with data points to help formulate a plan.

Also, if you are already saving, you can estimate how much you will have at retirement.

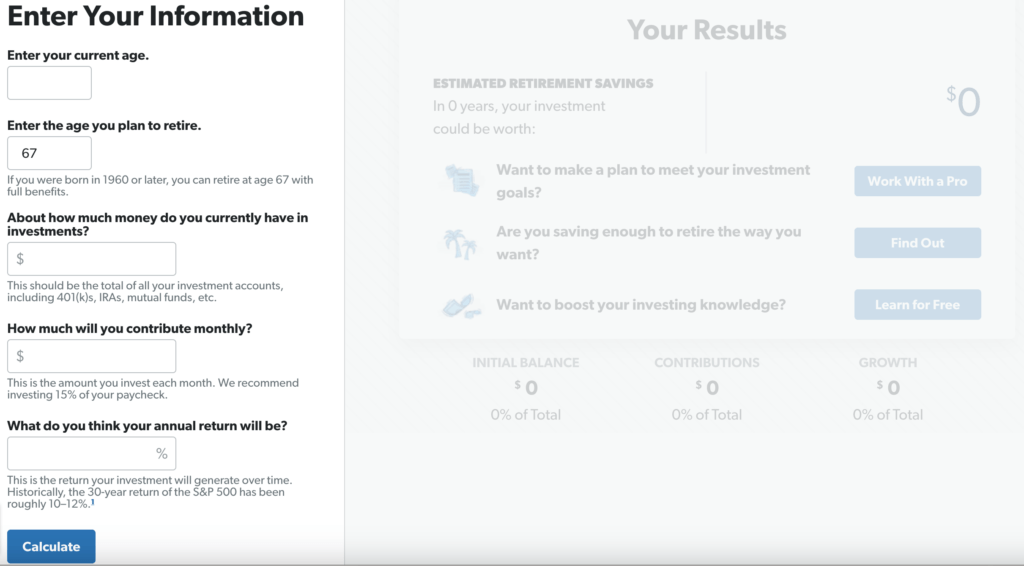

To start, you need a few data points.

- Current age

- Retirement age

- How much do you currently have saved?

- How much will you contribute monthly?

- Estimated annualized return

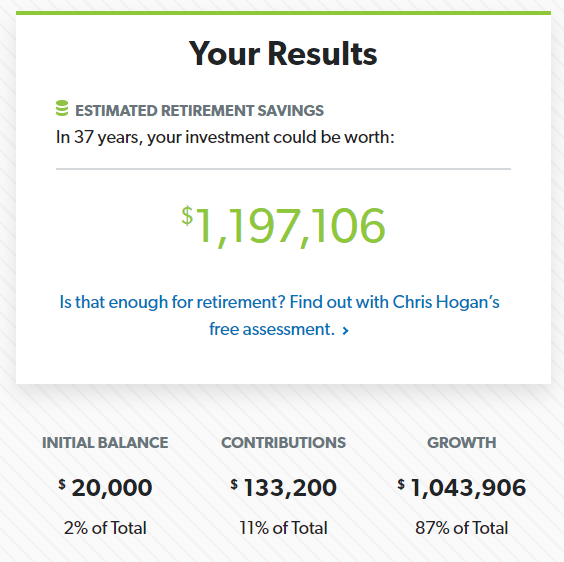

From there, you click calculate and it will generate some numbers as pictured below.

While this certainly is not an exact science, it will help you establish a baseline to begin saving.

Factors not included are tax returns, unexpected bonuses or increases in contributions. These will positively increase your estimated savings at retirement.

File Your Taxes with Ease from Home Today with TurboTax!

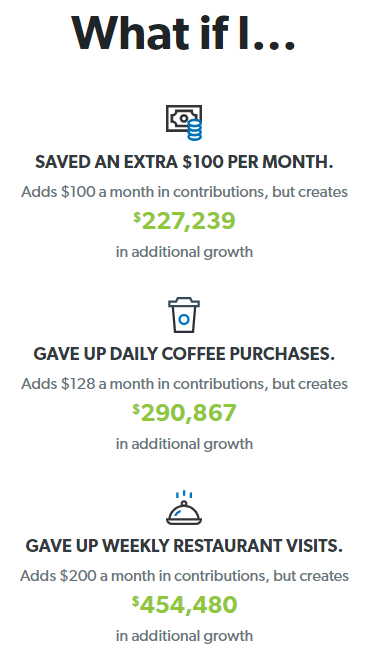

The calculator will also provide these “what if” scenarios.

It can be effective in getting you thinking of ways to cut expenditures to increase your contribution levels. Also, it puts into perspective how small changes can have large impacts on your retirement savings.

Now, it is important to understand the results and know what they mean. Without action, these numbers are simply that, numbers.

Initial Balance

The initial balance is just that. What you currently have. Do not think about the size of that number, it is there to help calculate the grand total.

While it certainly helps to have that number as large as possible, it is perfectly fine if it’s lower than you anticipated.

Contributions

These are the total amounts you have contributed over your working life. The larger the contributions and the earlier, the longer they can compound, working in your favor.

Using compound growth to your advantage gives you an extra edge that not everyone has.

Remember, even increasing your contributions by $20 a month can pay dividends later. This number should change frequently (increasing) so keep that in mind when analyzing your results.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

Growth

Lastly, you have the growth total. This is the driving factor behind your portfolio’s performance and offer the greatest volatility.

In the past, Dave Ramsey’s investment calculator stated the S&P 500 averages returns near 12%. Personally, that’s a bit high. Now it’s more accurate to state that historical returns are closer to 7-10% when adjusted for inflation.

When estimating growth, play it conservative. Better to expect the best but plan for the worst. Many investment articles will be around 6% up to 8%. Even one percent can greatly impact the long-term performance of your portfolio.

If in doubt, you use a lower growth rate. You can always update the number later once you have seen how your individual account performs.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

Understanding the SmartVestor Program

The SmartVestor program is an advertising and referral service operated by Ramsey Solutions, designed to connect individuals with investment professionals.

You can be introduced to up to five investment professionals based on your geographic location.

Each professional pays a fee to participate in the program, ensuring they are committed to providing quality service.

However, it’s important to note that Ramsey Solutions does not provide investment advice or recommendations through this program.

You are encouraged to interview each professional to determine the best fit for your investment needs.

How much to invest according to Dave Ramsey?

Yes, the great debate of how much you need to invest. Truthfully, it all goes back to the numbers and your overall goals. However, let us see what Dave Ramsey has to say.

According to Dave’s investment calculator, you would ideally save 15% towards retirement.

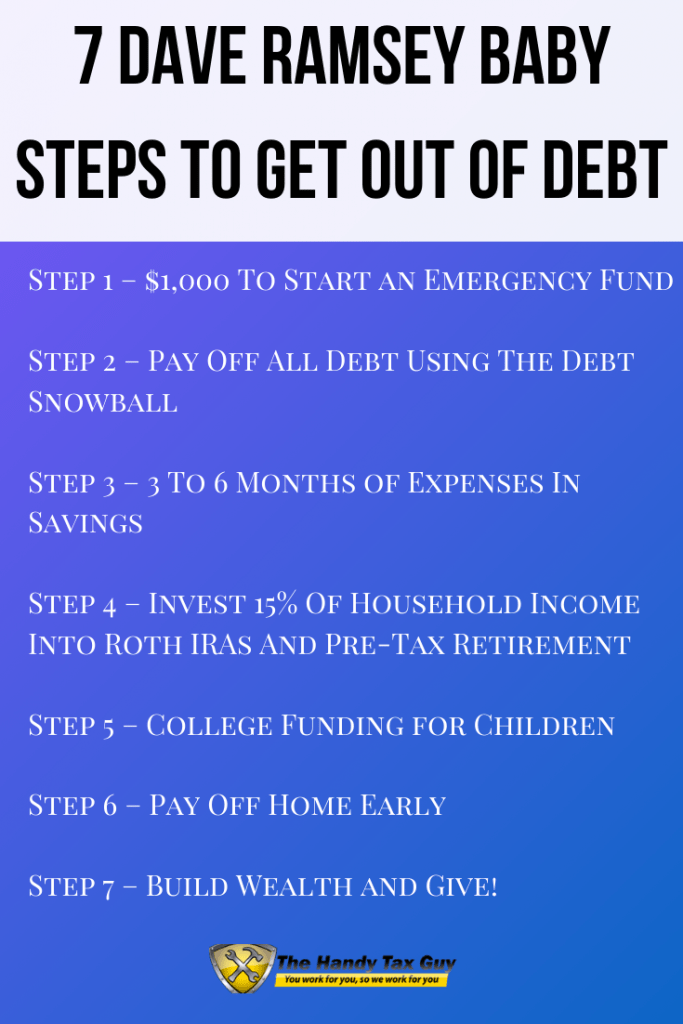

Now, if you know the Ramsey program, this is dependent on where you are in your Baby Steps. For example, if you are on Baby Step 2, you should not be saving for retirement at all.

15% is right on par with other recommendations. If you need a bit more cash at the end of the month you can look more towards 10%.

Keep in mind it might take longer to reach your retirement goal lowering your retirement contributions.

Comparing Financial Tools

In addition to the Dave Ramsey Investment Calculator, Ramsey Solutions offers a variety of financial tools to assist with different aspects of financial planning.

The 401(k) Save the Max Calculator helps you determine if you are maximizing your retirement contributions, while the Mortgage Calculator assists in evaluating loan options.

These tools, alongside the Investment Calculator, provide a comprehensive suite of resources for managing personal finances effectively.

Get your FREE Tax Refund Estimator TODAY!

3 Easy Tips For Your Retirement Planning

Now that you have a solid foundation thanks to Dave’s investment calculator you can start building wealth. This is not going to happen overnight.

Saving for retirement is a marathon that happens over decades.

1. Eliminate Debt

First you should aim to eliminate debt as quickly as possible. Debt can quickly eat into any returns you are making in the market.

For example, you may earn 9% in a year, but you have debts costing you 15%. Eliminating those debts let you build wealth faster.

2. Passive Investing Over Trading

Remember that old informercial, “set it and forget it!”. Investing works similarly.

What you want to do is automate the investing process as much as possible. This can be in the form of automated deductions from your paycheck. Ideally, you don’t want to think about it and contribute no matter how the market is doing.

3. Find an Advisor

If you are not privy to market happenings or what to invest in, no worries. Many people are unfamiliar with the market and still build wealth. Finding an advisor can take a lot of that stress of your shoulders.

Before putting your money with anyone, you need to do your own due diligence. This is a long-term relationship.

When looking for an advisor, consider items such as:

- Consulting fees

- Trading fees

- Conflict of interests

- Independent advisor

With many of the larger institutions, they are aligned with the investment bank, not you.

When you find your advisor, they will be able to help formulate a proper plan of attack. You can bring your results from the Dave Ramsey investment calculator for starters.

Remember, if you become unhappy with your advisor, you can always move your money.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

Final Thoughts on the Dave Ramsey Investment Calculator

While the Dave Ramsey investment calculator leaves out other important factors, it can provide you with an excellent number to begin with.

One thing to keep in mind is retirement isn’t an age, it is a financial number.

Surprisingly, you may only need to save until you are 50 years old for a comfortable retirement.

Some other philosophies Dave Ramsey has that we’ve hinted at are the Baby Steps. These are effective yet simple to begin steps that can put you on the path to a wealthy retirement.

Keep in mind that your situation is different than your neighbors. This plan and numbers are for you and only you. Lastly, saving for retirement is a marathon, not a sprint. Keep consistent and you’ll reap the benefits.

Until the next money adventure!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: October 8, 2020/Updated on December 27, 2024)