Are you trying to figure out if you need to fill out the IRS form 12277?

When you have a tax lien filed against you, it means you owe the federal government money and they’re staking a claim in your property to get it.

Once you pay the debt back, the IRS reports the lien paid in full, but it may still negatively affect your ability to get new credit for many months or even years in the future.

Is there a way to get rid of the lien and ensure an easier time getting financing moving forward?

For your situation, the IRS Form 12277 may help. Let’s see why…

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is IRS Form 12277?

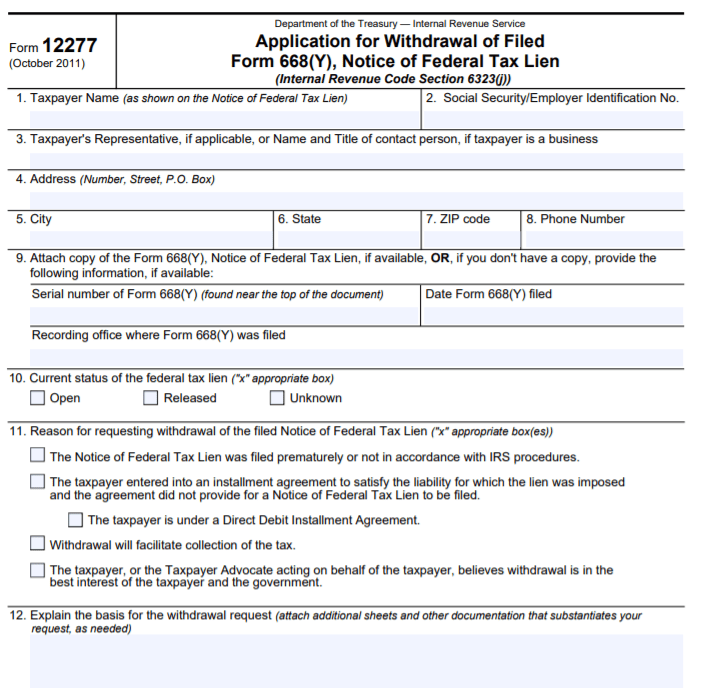

IRS Form 12277 is the option to resolve from a resolved tax lien. If the IRS approves your request, this form allows them to remove the lien from from public record.

You should also not see it listed on your credit report at all, but if you do, form 1277 can be filled out to report a withdrawal rather than reporting it paid-in-full. It sounds like the same thing, but there’s a major difference.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

What is a Tax Lien ?

According to the IRS, a federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt.

Before the requirement to remove a tax lien from you credit report, if creditors saw a tax lien on it, they would’ve look upon it negatively (almost like a bankruptcy).

It was an indication to them you didn’t make good on your tax debt and it got so far that the IRS had to file a lien against you.

The IRS doesn’t file liens automatically – they give you time to clear the debt, typically 6 months or so.

Once enough time has passed and you still haven’t made good on your tax debt, the IRS issues Intent to Levy.

This letter gives you 30 days to come clean on your debt. If you can’t pay it in full, you may ask for a payment arrangement, which the IRS must approve.

Conditions for Lien Withdrawal

The IRS considers withdrawing a federal tax lien under specific conditions. These include if the:

- Lien was filed prematurely

- Taxpayer has entered into a qualifying installment agreement

- Withdrawal will facilitate tax collection

- It’s in the best interest of both the taxpayer and the government

Just know that each condition requires substantial documentation and justification to support the withdrawal request.

Understanding these criteria can significantly enhance the chances of a successful lien withdrawal.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

What is a Tax Levy?

According to the IRS, a tax levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.

If the IRS doesn’t approve the payment arrangement or you ignore the tax lien all together, they’ll issue an Intent to Levy within 30 days of the letter. Meaning, the government can levy or seize your property as a means of collection.

If you complete Form 12277, though, the IRS may consider withdrawing your tax lien rather than reporting it paid in full on your record. The good news is that future creditors won’t see the lien anymore as it is no longer required to be reported on your credit report as mentioned earlier.

What’s the difference between a Tax Lien and Tax Levy?

A tax lien is a way for the government to make a claim against your assets (first dibs on your stuff) while a levy is a way for them to take your assets.

Example Scenario

John owed the IRS $5,000 in taxes. He knew he owed the taxes when he filed on April 15th, but he didn’t have the money then. The IRS sent him a follow-up reminder that gave him an additional month to pay his debt or set up a payment arrangement.

John did nothing about it. The IRS filed a lien. John read the letter but did nothing about it. The letter gave him 30 days to pay up on his debt or the IRS would file a lien.

John couldn’t pay and he didn’t file for a payment arrangement, so the IRS sent him a final notice with the Intent to Levy. John was extremely worried at this, but a couple of months later, he received a bonus from work and paid his tax lien.

Within 30 days after paying, the IRS reported John’s debt paid in full, but he still sees the lien on his credit report and it’s affecting his credit score negatively. After research, he knows that it shouldn’t be there.

John completed IRS Form 12277 and asked for a withdrawal of the lien. He explained how it was hurting his credit score and how he couldn’t get a mortgage to buy a house. After 30 days, the IRS approved John’s IRS Form 12277 and the credit bureaus removed the lien from John’s credit report.

Get your FREE Tax Refund Estimator TODAY!

How to fill out form 12277?

- Download the IRS form 12277

- Fill in all of the boxes based on your information

- Mail your application to the IRS office assigned your account

- Wait for the IRS approval

- Make sure the report has been removed from your credit report

- That’s it!

The Former Fresh Start Initiative (Now the Tax Debt Help)

The Fresh Start Initiative, introduced by the IRS in 2011, aimed to make it easier for taxpayers to manage their tax debts and avoid liens. Now it’s just under the guise of helping you with your tax debt.

Under this initiative, taxpayers who enter into a direct debit installment agreement may qualify for a lien withdrawal.

This initiative is particularly beneficial for those who owe $25,000 or less and can pay off their debt within 60 months.

By facilitating easier withdrawal of liens, this initiative helps taxpayers improve their financial standing and creditworthiness.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

Key Questions You May Have About the Federal Tax Lien

Now that we have the basic understanding of this tax form, let’s go through the most common questions.

How can you avoid a tax lien?

The best way to avoid a tax lien is to pay your tax debt on April 15th. If you can’t, consult with the IRS about a payment arrangement. They have several options that may fit your budget.

What is the difference between a tax lien release and withdrawal?

A tax lien release shows you paid your debt in full. You made good on your debt. A withdrawal removes the lien/debt from your credit report altogether so no one knows it existed.

How long does it take to hear back from the IRS?

After you complete and send Form 12277 to the IRS, it takes 30 to 45 days to hear back whether they approved or denied your request.

How bad is it to have a federal tax lien on your credit report?

Each person’s credit report will be affected differently, but prior to 2018 it was not unusual to lose between 50 and 100 points on your credit score from a federal tax lien.

Overall, tax liens do not appear on your credit report anymore, but you still have to pay the tax debt and creditors might still access this information through public records.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

5 Easy Tips of Filling out IRS Form 12277

- Have your Form 668(Y) handy when you complete IRS Form 12277. This is the form the IRS sent you when they filed the lien. You need it to file.

- Make sure you have a good reason for the withdrawal of the tax lien. Line 12 on Form 12277 asks for your reason. The IRS uses this to make their decision.

- You must send your Form 12277 via certified mail.

- If you need information about your tax lien debt, call the IRS Lien Desk at 1-800-913-6050.

- Check your credit report with all three bureaus – Experian, Trans Union, and Equifax 30 days after withdrawal approval. If the lien still exists, you may need to file a credit dispute with each bureau. Provide your letter from the IRS approving the withdrawal. It may take the credit bureaus up to 30 days to respond and/or fix your credit report.

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

My Final Thoughts

If you get to the point that you can’t pay your taxes and end up with a tax lien, you have options.

While a tax lien isn’t the best thing to happen, if you pay it and deal with the IRS paperwork as suggested, you can get the lien removed from your credit report.

It’s best to avoid the tax lien at all, though. If you can work out a payment arrangement with the IRS, do it.

The process is simple – all you have to do is request the payment arrangement online and they’ll respond to you via mail.

If you are accepted, make your payments on time and you can avoid a tax lien.

Just know that if you are in a payment arrangement, you must make all of your future tax payments on time or you risk losing your payment arrangement and putting yourself at risk for a tax lien all over again.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Tax Software vs. Accountant or Tax Pro (Which Should You Use?)

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Last Minute Tax Tips for Beginners

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: July 23, 2020/Updated on December 31, 2024)