Do you owe the IRS money, but are confused about how to fill out the Form 9465 and how to set up a payment plan?

No worries, you’ve come to the right place!

Income Tax Returns can often be daunting especially if you find out that you owe more tax that then you can immediately pay.

If you are one of the Americans who find themselves in similar situations, you are in for a surprise!

The Internal Revenue Service (IRS) has a program specifically designed to help you by allowing you to make your payments on monthly installments as opposed to a one-time payment.

You can now file the IRS Form 9465 in order to ease your tax paying concerns, so that it does not excessively strain your pocket.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

IRS Installment Agreement Request (Form 9465) at a Glance:

- Allows you to have a payment plan if you can’t pay your taxes at once.

- It’s designed to simplify the approval for taxpayers with liabilities of $50,000 or less.

- Taxpayer owes an amount within $10,000 will be automatically approved.

- If you owe an amount greater than $ 50,000, you cannot file electronically.

- By meeting the streamlined criteria, you can benefit from a more straightforward and faster approval process, making it easier to manage you tax liabilities.

Keep reading to get everything you MUST know BEFORE you fill out this form!

What’s the IRS Form 9465?

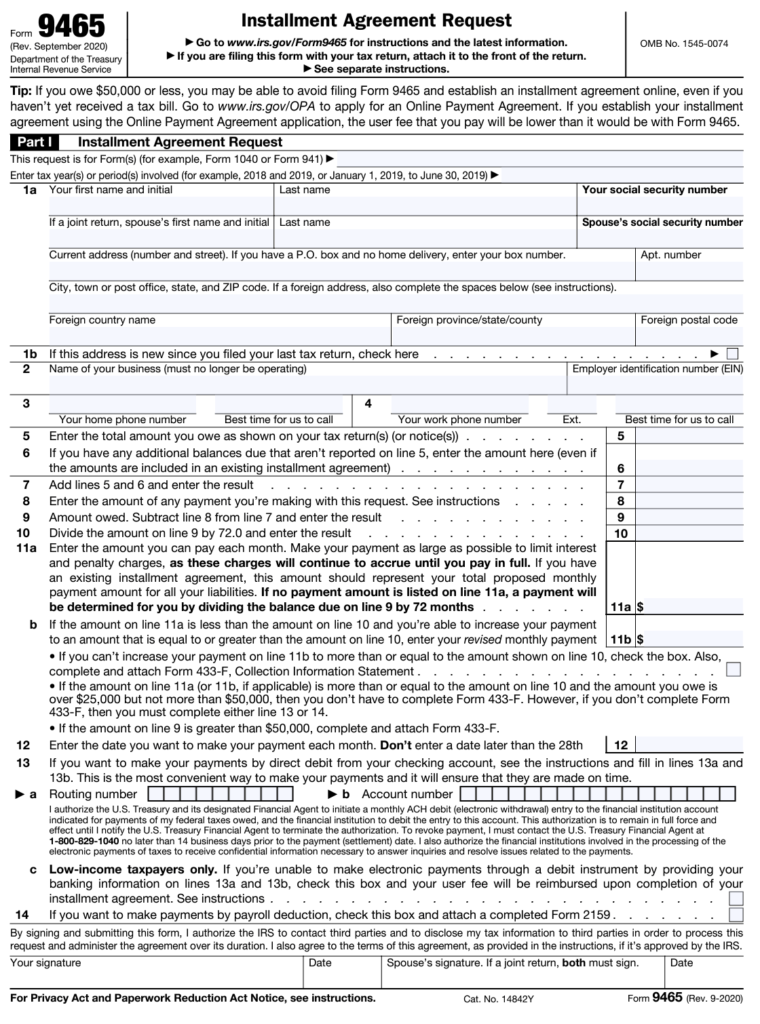

IRS form 9465 is a document that has been designed for all taxpayers who cannot pay the taxes that they owe in one go. This form allows you to set up a payment plan with IRS if you meet a certain criteria.

In case you plan on submitting this form, you should be aware that the installment plans are supposed to be completed within a maximum time frame of 72 months or 3 years.

There is also another condition, regarding the overall amount you owe. If you owe $ 50,000 or less, you may be able to skip out on using the IRS Form 9465 and instead use the online payment application instead.

However, regardless of the amount owed, it must be taken into account that all late penalties, and overdue surcharges continue to be accrued unless the amount is paid off.

File Your Taxes with Ease from Home Today with TurboTax!

Who is Automatically Placed into a Payment Plan to the IRS

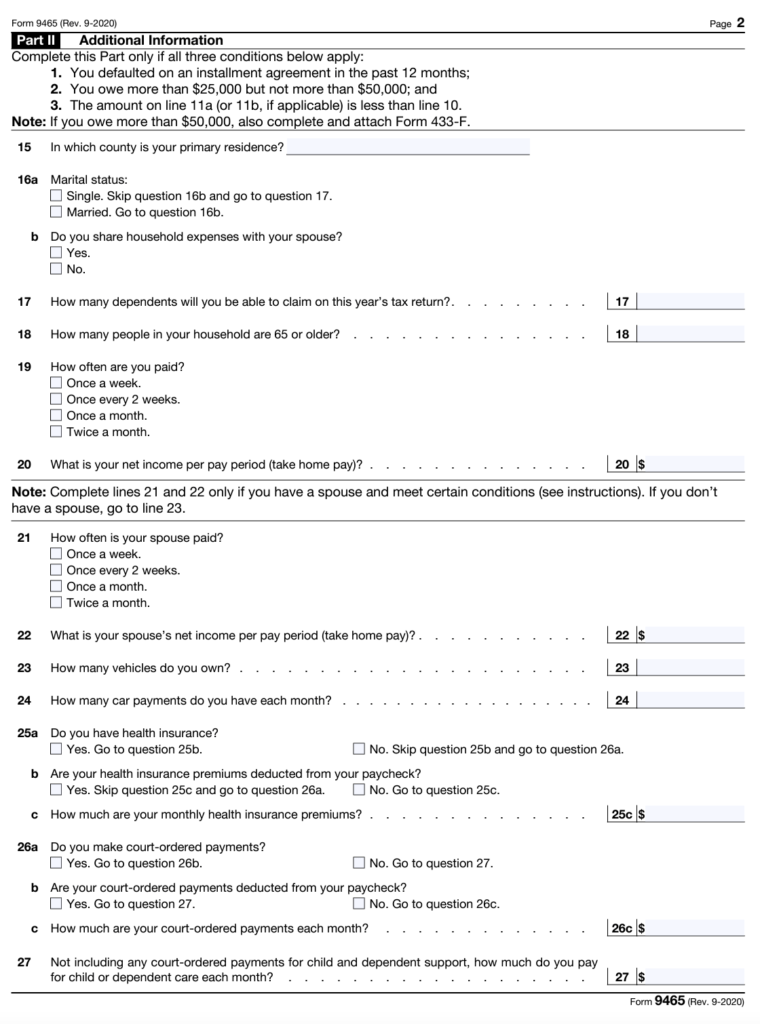

In the case where taxpayer owes an amount within $10,000, the installment plan application is going to be automatically approved if the following conditions are duly met:

- Over the past 5 years you filed and paid your taxes on time without getting an installment plan

- You agree to pay your tax bill within 3 years

- You’re just not able to pay your bill in full

Who Should Use the IRS Form 9465

If you are accrue tax obligations, you can then file Form 9465 in order to set up monthly installment plans if you’re eligible. The eligibility criteria in this regard is quite simple to comprehend.

- A taxpayer who is not able to pay taxes in full, when they are due (whether it’s income tax, employment taxes related to a sole proprietor)

- Anyone who owes an individual shared responsibility payment under the Affordable Care Act

You can get the full details on the IRS website here.

Who Should NOT Use the IRS Form 9465

- If you want to pay online

- You plan on paying the bill in full within 180 days

- If you own a business that still owes employment or unemployment taxes

Pro Tip: According to the IRS, if you only need a little bit of time to pay your fee, you can apply for a short-term payment plan only if you pay within 180 days. You can pay online at IRS.gov/OPA or call the IRS at 800-829-1040.

Frequently Asked Questions

Now that we have the basics out of the way, let’s go through some of the most common questions asked when getting ready to use this IRS form.

Can I file IRS Form 9465 electronically?

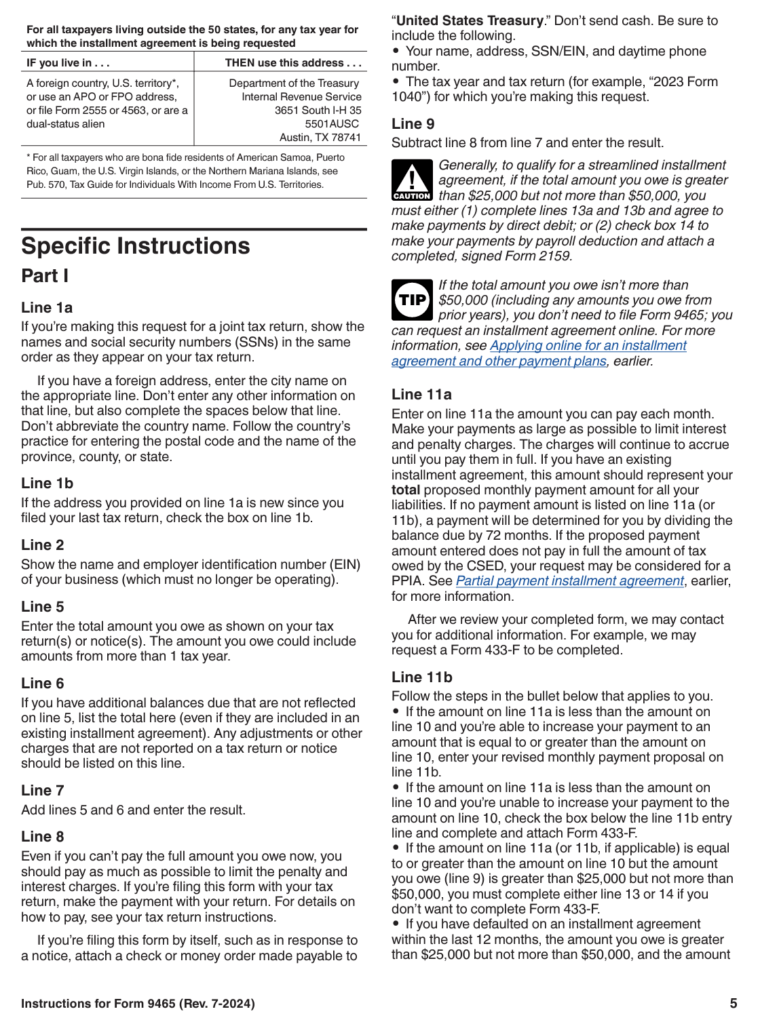

Yes, you can file IRS Form 9465 electronically if you owe an amount equal to or less than $50,000.

Can I file IRS Form 9465 electronically if the outstanding amount is greater than $50,000?

If you owe an amount greater than $ 50,000, you cannot file electronically. In this case, you are supposed to manually file IRS Form 9465 along with original signatures (the people who signed the tax return).

This is done by attaching the signed form on top of the tax return when filing.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

What else do I need to submit if I owe an amount greater than $50,000?

If you owe an amount greater than $50,000, you must also submit Form 433-F: Collection Information Statement, in addition to IRS Form 9465.

Do I necessarily need to file IRS Form 9465 if I owe an amount lesser than $50,000?

If the total amount outstanding is less than $50,000, you have the option to avoid filing Form 9465 and instead complete the online payment agreement (OPA) application as mentioned earlier.

What is the maximum time allowed to pay back the amount?

Generally, the maximum time allowed to settle the amount is within 72 months or less. However, it is contingent on the amount owed.

File Your Taxes with Ease from Home Today with TurboTax!

How long does it take for the IRS to approve the installment agreement?

The IRS takes 30 days after they receive your request to let you know if you have been approved or denied. It may take longer than 30 days if you send your application in regarding a returned filed after March 31st.

What are the Installment Agreement user fees?

If you plan on using the IRS payment installments, then you will have to pay the fees as listed below.

- Direct Debit: $22 (using online payment application) or $107 (NOT using online payment application)

- Check, money order, credit card, or debit card: $69 (using online payment) or $178 (not using online payment)

Pro Tip: You may qualify for a lower fee of $43 if you are a low-income taxpayer. Learn more here.

Waiver and reimbursement of user fees for low-income taxpayers.

According to the IRS, for installment agreements entered into by taxpayers with adjusted gross income, for the most recent tax year available, at or below 250% of the federal poverty guidelines, the IRS will waive or reimburse user fees if certain conditions are met.

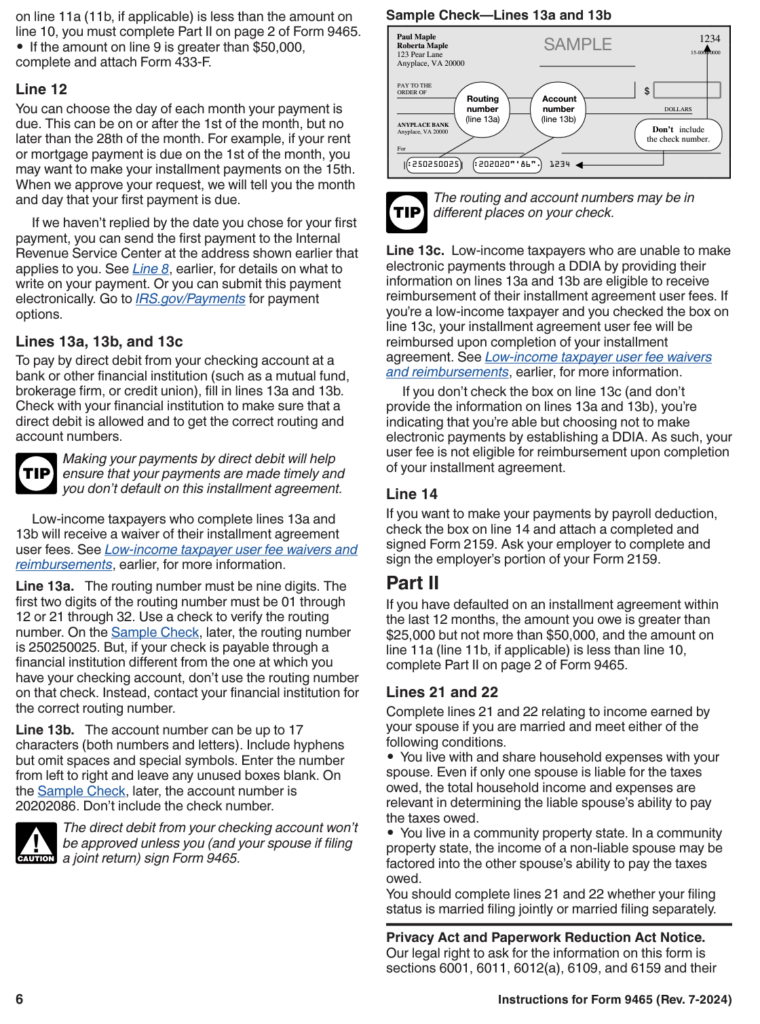

What payment methods do I use to pay back the IRS?

- Cashier’s checks/money orders

- Credit card

- Debit money from your bank account

- Electronic Federal Tax Payment System

- Personal checks

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

3 Simple Tips to Remember When Setting Up Your Installment Agreement with the IRS

When filing IRS Form 9465, there are a number of things that you need to be sure of, in order to make sure that the transition is smooth.

Here’s something that can come in handy if you find yourself in a similar situation:

- If you own a business, it is not a good idea to use IRS Form 9465. This is because there are potential complications (other obligations, for example) which are outside the scope of Form IRS 9465.

- Avoid manually filling out the forms. This is because writing might often make it harder for IRS officers to understand what you’ve written, and therefore, it might not render the desired objectives, if the form is illegible. An alternate is to fill out the form electronically, and then turn it over manually.

- As far as IRS Form 9465 is concerned, the entire form is quite self-explanatory. The main confusion offer arrives in part 11 (a), where you have to mention the amount that you can afford to pay as an installment. It is favorable to put in the amount that is the bare minimum and covers the period of 72 months.

File Your Taxes with Ease from Home Today with TurboTax!

How to Set Up Your Payment Plan

Now that you’re feeling a little bit better about this stressful situation, let’s go through the steps that you will go through for Installment Agreement Request to the IRS:

- You receive your tax bill

- Decide if you need to apply online or if you need to use IRS Form 9465 based on your amount owed

- Turn in your application

- Receive your approval from the IRS

- The IRS will tell you the amount of fees that will be added to your bill based on your income

- Start making your payments

- Send your last payment

- That’s it!

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

My Final Thoughts

The IRS Form 9465 can be a savior for you if you are looking to pay your taxes via installments.

In case you find yourself in the same boat, where paying exorbitant taxes lump sum is daunting for you, this option is probably the best alternate you have.

It can be exercised with relative ease, and can help you pay your dues without being overwhelmed.

Having said that, it should further be reinstated that in case you own a business, this might not be the best alternate for you because of existing tax obligations. I sure hope this helps your situation.

BOTTOM LINE: If your balance due isn’t more than $50,000, just apply online for a payment plan instead of filing Form 9465.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: July 5, 2020/Updated on December 10, 2024)