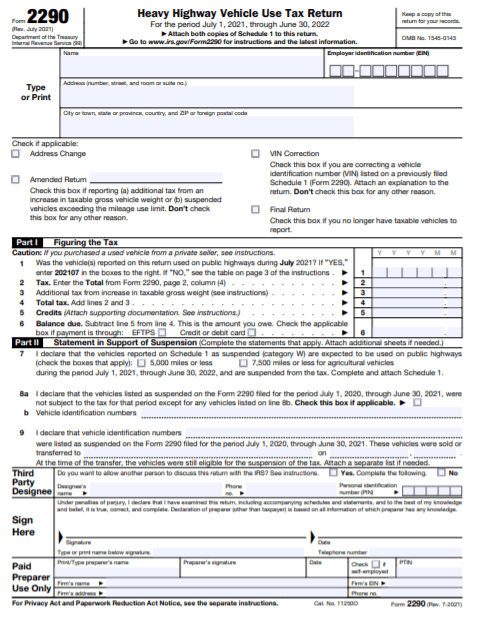

If you drive a large truck, then you will have to learn about IRS tax form 2290. But what is IRS tax form 2290 exactly? This is a tax levied on all vehicles with a gross weight of over 55,000 pounds.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is IRS form 2290?

Known as the, “Heavy Highway Vehicle Use Tax Return,” IRS form 2290 is used to provide improvements to highway construction and maintenance.

Example Scenario for Form 2290

James is an owner-operator of a 60,000 pound semi-truck and drives an average of 120,000 miles per year for two different shipping companies. As the owner of the 60,000 pound semi-truck, James must file IRS tax form 2290.

What You Must Know About the IRS Form 2290

Here are some of the most commonly asked questions about IRS Tax Form 2290.

How do I get Form 2290?

You can get Form 2290 two ways by:

- E-filing IRS tax form 2290 through the IRS website.

- Manually filing IRS form 2290. The IRS form 2290 can be downloaded via the IRS website.

Who must file 2290?

Anyone who owns a vehicle with a gross ton weight of over 55,000 pounds must file IRS tax form 2290.

Example of taxable vehicles include the following:

- Trucks

- Truck tractors

- Buses used for carrying loads on the highway

How much does it cost to file a 2290?

If you file the 2290 form yourself, then there is no fee. If you use a filing service, you can expect to pay anywhere from $40 to over $160 per vehicle.

How do I pay my 2290 tax?

There are currently four ways that you can pay your 2290 tax:

- Electronic Federal Tax Payment System (EFTPS) – This is a free service provided by the IRS. Taxpayers should have a valid account with EFTPS.

- Electronic Funds Withdrawal (EFW) If you email, then you can use the EFW service. Simply provide the routing and account number along with the total tax to be paid. The tax will be automatically debited from your account.

- Credit or Debit Card Payment – You can pay with a credit card or a debit card if you e-file or paper-file Form 2290.

- Check or Money Order – You can pay your 2290 tax using a check or a money order. Be sure to write the check or money order payable to “United States Treasury” and add a voucher form 2290-V.

File Your Taxes with Ease from Home Today with TurboTax!

What is Schedule 1?

Schedule 1 is proof that you have paid your heavy vehicle use tax to the IRS. If you file electronically, your Schedule 1 (with an IRS watermark) will be sent to you.

When is IRS form 2290 due?

Form 2290 is due on the last day of the month following the month of first use during the current tax period.

How do I calculate interest and penalties for late payment?

You will likely be charged a late penalty if you don’t file form 2290 on time. The total penalty is 4.5% of the total tax due. This penalty is added up for 5 months.

For example, if the tax due is $300. Then the penalty will be $300 x .045 or $313.50.

Apart from the penalty fee, the IRS may also add interest fees. The interest fee will be 0.05% for every month that the tax is past due.

In what cases can the tax be suspended?

You do not have to pay the Heavy Highway Use Tax if you have driven your vehicle less than 5,000 miles or 7,500 if the vehicle is used for agricultural purposes.

In this case, you do not have to pay the tax until the vehicle exceeds the mileage threshold.

What is the EIN?

In order to file form 2290, you will have to provide an EIN. The EIN is known as the Employer Identification Number. The EIN is used to identify a business.

What if I don’t have an EIN?

You can register and get an EIN, for free, from the IRS.

In what situations where the IRS may reject my return?

Here are the most popular reasons why the IRS may reject your 2290 return:

- The EIN does not match the name of your business

- You sent a duplicate return or there is a return with a duplicate EIN

- The EIN is not on file with the IRS

- The form was sent with the incorrect routing number

3 Easy Tips to Help You With Your Taxes

Here are some tips that can help you better understand and manage your IRS 2290 tax forms.

1. Hire an tax accountant who specializes in the trucking industry

It is a good idea to hire a tax accountant who works with those who own large vehicles for highway use. They should have lots of experience dealing with IRS tax form 2290.

2. Enroll in the Electronic Federal Tax Payment System (EFTPS)

If you enroll in the Electronic Federal Tax Payment System or EFTPS, you will make it easier on yourself to pay your tax without having to deal with checks, money orders or credit cards.

3. Take advantage of available tax credits

Make sure that you take advantage of any tax credits that will allow you to offset the tax due from IRS form 2290. As an owner-operator, there are many expenses that you can potentially deduct.

Beyond expense credits, there are other credits that you may also be able to claim:

- You can claim a credit if your vehicle was stolen, destroyed or damaged.

- You can claim a credit if your vehicle was used less than 5,000 miles in a year (7,500 miles in the case of agricultural vehicles).

Get started on your taxes early TODAY!

Let’s Wrap This Up

While no one likes to pay taxes, the Heavy Highway Use Tax will allow the government to maintain and construct highways across the nation. Be sure to learn the latest information on IRS tax form 2290 to help you stay on top of your tax obligations.

I hope this article helped you gain some control of your tax plan this year. Remember not to stress out. Don’t forget to check out Tax Forms page for any additional online tax checklists and forms you may need this year.

If you like this article, then you’ll love these:

- How to Save Money for Vacation in 3 Months (23+ Money Saving Tips)

- Do I Need to File a Tax Return?

- Pay Off Debt Quickly with These 4 Simple Tips

- How to Save $3,000 in 6 Months (Save Money Fast)

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**