Are you trying to figure out how to use the IRS Form 4506-T?

I know dealing with the IRS can be confusing at times that’s why I’m here to help you.

As you may know, the Internal Revenue Service (IRS) is an agency of the United States federal government that controls tax laws.

It manages the tax return process, different tax services, and the implementation of tax laws.

The IRS also saves information of taxpayers such as yourself and provides the info whenever you need it. You may need your tax-related details due to numerous reasons.

Mostly, it is needed when you are interested in taking a loan/mortgage and the mortgage provider has to verify your income source.

The IRS provides different forms that taxpayers can use to retrieve different information regarding their tax. One of them is the IRS Form 4506-T in which the letter ‘T’ stands for transcript.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Getting a Copy of Your Tax Information at a Glance:

- You’ll need to use the IRS Form 4506-T to request your tax return transcripts.

- The form can request transcripts for the current year and up to three prior years, making it a total of four years.

- Since there are different kinds of transcripts, you will have to mention only one in the form.

Keep reading to get everything you need to know about this IRS policy.

What is the IRS Form 4506-T?

IRS Form 4506-T is a document that is used to request your tax return transcripts. It can also request tax account, wage and income, record of account, and verification of non-filing transcripts.

Plus, it can be used to retrieve and then provide various tax-related information of any taxpayer to a third party that could be a loan or mortgage provider agency etc.

All you have to do is put in your correct and completed information on the form along with your signature and any other tax payer signature who is on the return. That’s it!

The IRS will then send your transcript directly to the third party.

Since there are different kinds of transcripts, you will have to mention only one in the form. You will also have to write down the specific year of the transcript you want.

This can be done by filling out this form online, print it, and then mail it to the address provided by the IRS.

File Your Taxes with Ease from Home Today with TurboTax!

When Do You Need the IRS Form 4506-T?

As previously mentioned, you will need IRS Form 4506-T when you have to provide proof of your income to a lender.

Through the financial information written on the transcript, the lender will verify that the income that you have told them is the same income filed in the IRS.

If you have a regular job (W-2) then you will not need this form because the lender can directly get the required information from your employer.

A lender can also send a verification of employment (VOE) form to your company to retrieve your financial information.

On the contrary, if you are self-employed then your lender may ask you to provide a transcript of your tax return.

Providing financial information could be risky, so make sure that you are dealing with a trusted lender.

Pro Tip: To stay on the safer side, mention the name of the lender in the form before submitting it.

Protect Your Information

Some lenders can request that you provide a copy of the tax return (Form 4506).

Though this is rare, if it happens you must be aware of the security risks associated with it. Again, mention your lender’s name in line 5 of IRS Form 4506.

Remember that IRS Form 4506-T can provide you tax-related information of only four years. If you want to get information from previous years, you must submit Form 4506 instead of submitting Form 4506-T.

Data Protection Features

One of the key features of IRS Form 4506-T is its focus on protecting taxpayer data. The form partially masks personally identifiable information, such as your Social Security Number, while keeping financial data fully visible.

This ensures that sensitive information is safeguarded during the transcript request process.

Additionally, the form includes a field for a customer file number, which can be used to help track and identify your request without exposing personal details.

These measures are designed to enhance privacy and security for taxpayers.

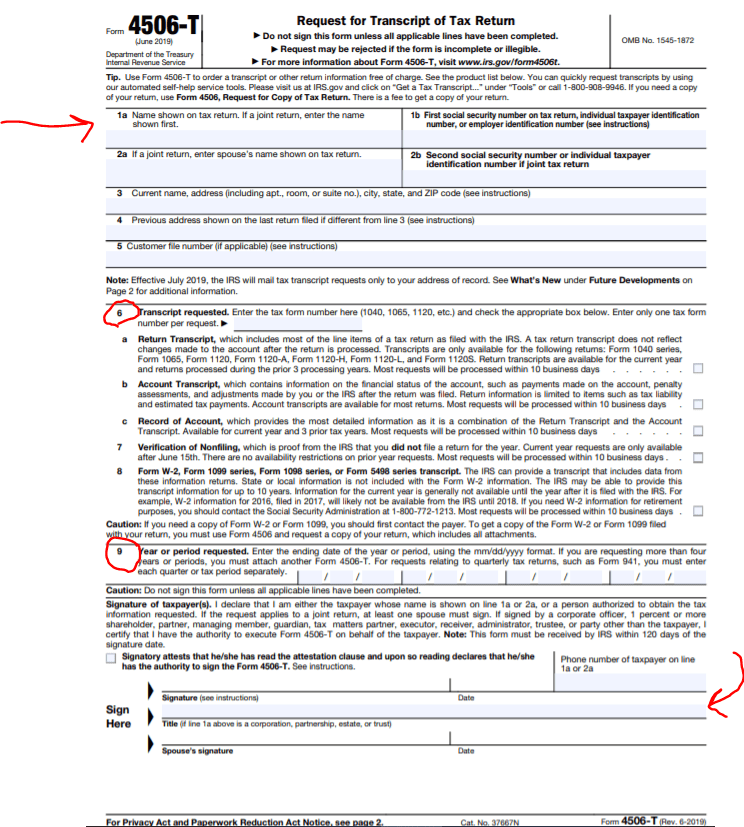

How to File IRS Form 4506-T?

Read the following steps in order to file your IRS Form 4506-T correctly.

- To get access to the form visit the official site of the IRS and start filling in the form provided on their site online.

- First, enter your personal details which may include your name, your spouse’s name, your SSN (social security number), your current residence address along with the old address if you have added any on previous tax return documents.

- Basic information of the third party to whom you want to mail your tax return transcript.

- Based on your needs, fill in the tax form number (1040, 1099, 1065, 1120, etc.) in order to specify the transcript type that you want to request.

- Write in the year whose tax return information you want to request. Also, write down the date of the IRS Form 4506-T submission.

- Your signature along with the signature of your spouse.

Once you have completed the form, make sure that information is correct according to other documents.

Get a printed copy of this form and send it to the office of the IRS. IRS has different locations to send different forms, so choose the address listed on the form itself.

Visit the official site of the IRS to get information regarding their mailing addresses if not found on the IRS form 4506-T.

File Your Taxes with Ease from Home Today with TurboTax!

Things to Know About IRS Form 4506-T

Now that we have the basics explained, let’s go through the most common questions that are asked about this tax form request.

How to Request Transcript from the IRS via Form 4506-T?

To request an IRS Form 4506-T, you can visit their site irs.gov. From there you can choose ‘Get a Tax Transcript’ that is under the category of ‘Tools’.

You can also contact IRS officials via phone at 1-800-908-9946.

What can Cause Rejection of Form 4506-T?

Different reasons can cause rejection of your form. For instance, if your form is incomplete or your writing is unreadable then it will be rejected instantly.

If you have written a different address than the address written on the tax return that you are requesting, your form will be rejected.

Before submitting 4506-T, make sure that every section is filled with the correct information.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

Which Transcripts can be Ordered through IRS Form 4506-T?

Transcripts of different kinds are available. Based on your needs, you can order any of the five different transcripts all via IRS Form 4506-T:

- 1099

- W-2

- 1098

- 5498

- 1040

- 1120

- 1065

You can order only one form of transcript through a single Form 4506-T.

What is the Difference between IRS Form 4506-T and 4506?

The key difference between these forms is that Form 4506 is used to get a copy of your tax information or previously filed tax returns by IRS. On the other hand, Form 4506-T is used to order a tax return transcript that the IRS has on file.

How many years of tax return information can one have via Form 4506-T?

By requesting Form 4506-T, you can get tax return information up to 4 years (current year and previous 3 years). If you want to get more information of previous years, go for the IRS Form 4506.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

Key Takeaway …

Overall, the IRS Form 4506-T provides all the necessary information that a lender may need to verify your income.

So do not fear to send your lender a transcript if you have already provided them the right information.

I hope this helps your situation. For more money-saving tips and guides, subscribe to the weekly newsletter!

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: August 13, 2020/Updated on December 17, 2024)