Do you know how to use the IRS form 8821 to allow you to give tax information to another person or are you confused?

Don’t worry, I understand.

As a taxpayer, have you ever wished that you could just pass the reins over to an accountant or other tax professional to help you navigate tax season?

Or as a Tax Preparer, wouldn’t it just be easier if you were able to request the information you needed from the IRS in order to help your client?

If you’ve ever felt like you were in either of these situations, then you probably have a need for IRS Form 8821.

This form was created to help make the communication process more transparent between taxpayers, tax professionals, and the IRS.

In this article, I’ll take a deeper look at what exactly the IRS Form 8821 is and (more importantly) how you can use it to your advantage.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is the IRS Form 8821?

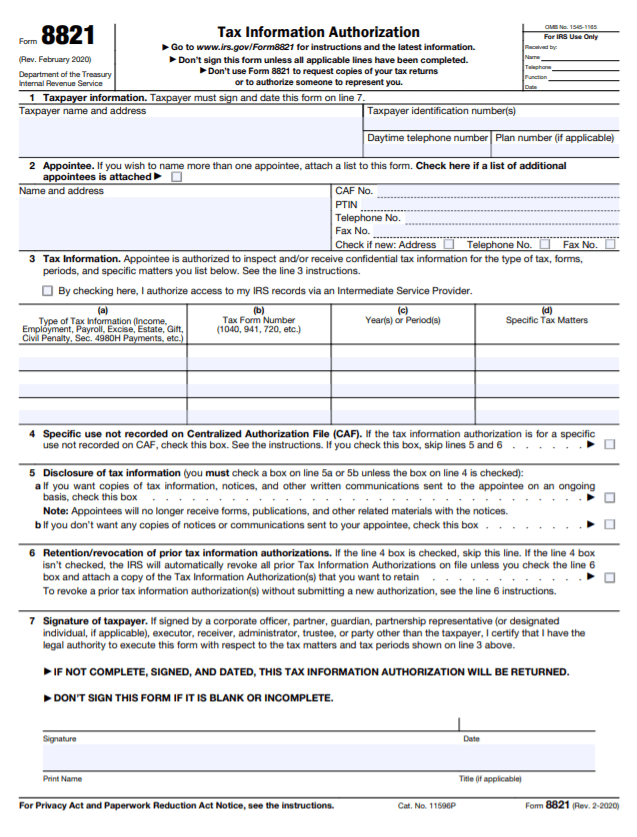

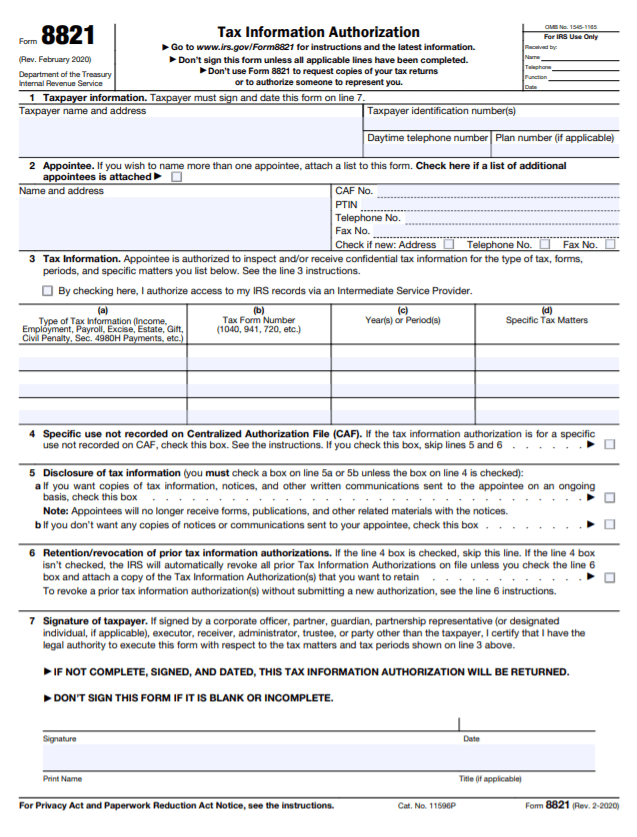

If you’re not familiar, the IRS Form 8821 allows you to choose someone who can receive your tax information for any tax queries needed over a specific time period.

Keep in mind that this person doesn’t necessarily have to be your tax professional. You can assign anyone as your appointee when it’s needed such as a friend or family member.

Another name for the IRS Form 8821 is Tax Information Authorization (TIAs). Once, you’ve appointed a TIA, here are a few of the things that they’ll be able to do:

- Research your IRS account for you.

- Obtain information from the IRS for you.

- Receive copies of your IRS transcripts and any other forms your receive.

- For faster processing of certain authorizations, use the all-digital Tax Pro Account at IRS.gov/TaxProAccount.

Essentially, they can act as an extension of you and get access to some of your personal tax information. Then they can use this information to help you make the proper decisions when it comes time to file taxes.

Power Tip: It’s important to note that the one thing that your Tax Information Authorization appointee cannot do is take action on your behalf. Giving your TIA the ability to take action would be what’s called granting them power of attorney and is done by filling out Form 2848.

Confidentiality Protections

IRS Form 8821 is governed by Section 6103(c), which ensures that any information disclosed under the taxpayer’s consent is protected.

This section limits the use and redisclosure of return information, holding the recipient accountable for any unauthorized access or use.

This legal framework provides you with peace of mind, knowing that your confidential information is safeguarded against misuse.

How do you use the IRS Tax Form 8821?

Filling out the IRS Form 8821 can be especially useful for a few reasons.

- If you’re a tax professional – You may need to access private tax information on behalf of your client. By filling out Form 8821 , you’ll be able to request the information you need form the IRS on their behalf. This can drastically reduce the amount of back-and-forth and create a much more streamlined process.

- If you’re a taxpayer – You probably don’t necessarily want to be relaying information constantly to your accountant. Also, since this probably isn’t your area of expertise, you might not really know what is needed from you in the first place. Filling out IRS Form 8821 will essentially cut out the middleman (you, in this case) and allow your tax advisor to speak directly with the IRS on your behalf.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

I want to reiterate that this should not be confused with IRS Form 2848, which grants the power of attorney.

IRS Form 2848 is actually a much more common type of document that grants your appointee of choosing the ability to represent you to the IRS.

You would fill this out if you’re comfortable with your appointee making tax decisions on your behalf. If you still want to be in the decision-making process, then IRS For 8821 is going to be your best bet.

Example Scenario for IRS Form 8821

There are a number of situations where a taxpayer would need help from a professional and want that professional to be able to access information. For example, say that you have a complex tax situation that spans several years and the IRS is running an audit.

As the taxpayer, you want to make sure that you’re accurately reporting all of your income. However, you’re not sure how to navigate the situation since it occurred over several years and probably requires searching back through archives to find and report the information properly.

In this situation, you might file an IRS Form 8821 so that your accountant can access all of your documents to review the entire situation. Then they can help you make the best decision possible.

In this case, you might not want to file Form 2848 (Power of Attorney) because you may not necessarily want your accountant to make any decisions for you. You just want them to review the situation and let you know the proper course of action.

Since this tax situation spanned several years, it will probably require a lot of time and know-how to find the proper information.

It’s probably just easier if you allow your accountant or tax preparer to speak directly with the IRS on your behalf so they can get the information you need.

File Your Taxes with Ease from Home Today with TurboTax!

Things to Remember About this Tax Form

Now that we have the basics dones, let’s go through a few frequently asked questions.

Revocation of Prior Authorizations

When you submit a new IRS Form 8821, it automatically revokes any prior authorizations unless you attach copies of the previous forms.

This feature helps manage and update your authorizations efficiently, ensuring that only the most current permissions are in effect. It’s important to keep track of your submissions to avoid any unintended revocations.

What is the difference between IRS Form 8821 and 2848?

IRS Form 8821 gives your tax professional or chosen appointee the ability to inspect or receive financial information on your behalf but no ability to make decisions. Form 2848 is the Power Of Attorney.

This means that your chosen person can fully represent the client and make decisions on their behalf.

How long does it take IRS to process Form 8821?

The number of days is unknown, but it usually takes the IRS a few weeks to process most tax forms.

Can form 8821 be electronically signed?

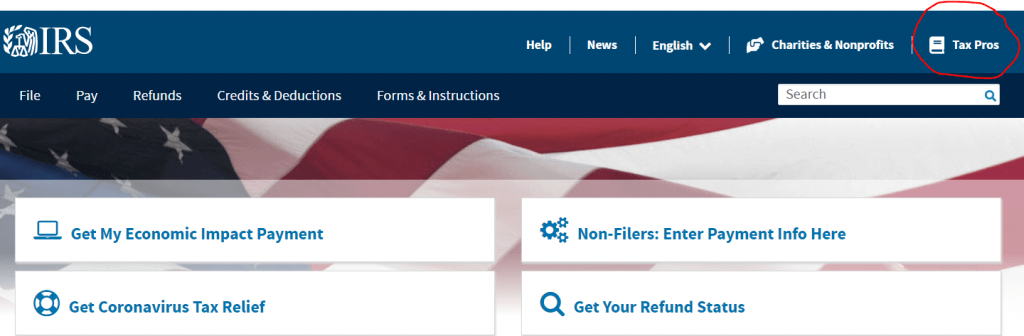

Yes. According to the IRS, your designated person can file Form 8821 electronically with the IRS from the IRS website. All the have to do is:

- Go under the Tax Professionals tab

- Click the on e-services–Online Tools for Tax Professionals

Please Note: If you do decide process your tax Form 8821 for electronic signature authorization, then don’t file a Form 8821 with the IRS.

How do I submit form 8821?

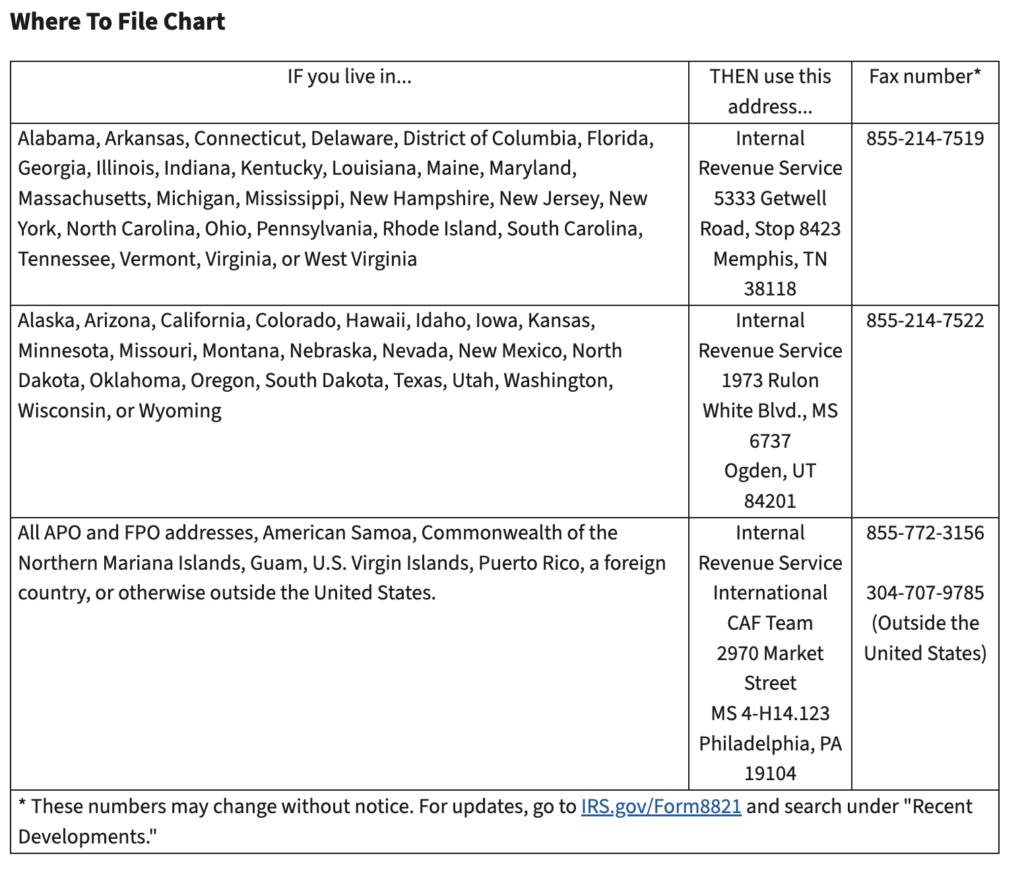

The best way to submit Form 8821 to the IRS is to mail it to the office handling the specific matter. Otherwise, mail or fax Form 8821 directly to the IRS address. A TIN (Taxpayer Identification Number) is used to confirm the identity of a taxpayer and identify the taxpayer’s return and return information.

File Your Taxes with Ease from Home Today with TurboTax!

Things You May Need

- Tax Payer information (social security number, individual taxpayer identification number (ITIN), and/or employer identification number (EIN)

- The Appointee’s name and information

- Signature of Tax Payer

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

Final Thoughts

I hope that you’ve found this article valuable when it comes to understanding what the IRS Form 8821 is and how you can use it to your advantage.

For more tax and money-saving tips, subscribe here to get alerted of new articles as we write them.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: September 10, 2020/Updated on December 18, 2024)