Are you worried about whether or not you need to fill out the IRS form 8949?

Buying and selling stocks is a great way to increase your net worth for short and long-term goals. When you sell stocks (or any asset for that matter), you affect your tax liability. Just like money you make working, you must pay taxes on any money you earn.

Not every sale earns money, though. Many investors sell stocks at a loss whether to offset their capital gains or because they have no choice but to sell at a loss – as we all know, life is unpredictable.

When you buy and sell stocks for a profit or loss, the IRS wants to know about it on Form 8949. Every investor must complete one. Here’s how it works.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

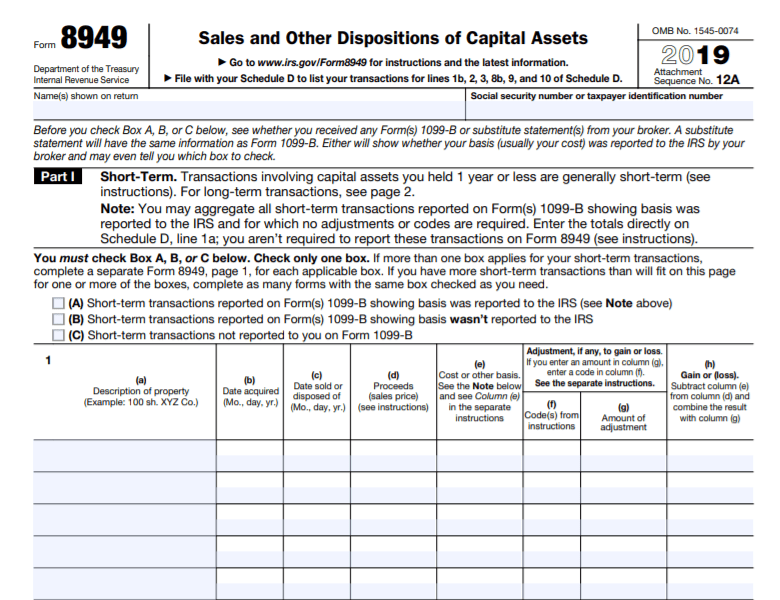

What is IRS Form 8949?

When you, your partnership, or business sells an asset, you have a capital gain or loss. The IRS wants to know about the income or loss, which you report on IRS Form 8949.

Why report both income and losses?

If you have an income, you owe taxes on it. But, if you have losses, the IRS allows you to take a tax deduction (on certain losses). The loss offsets capital gains earned that year. If you don’t have capital gains, it offsets your taxable income.

IRS Form 8949 summarizes the information provided to you from your brokerage firms on Form 1099-B. You’ll receive Form 1099-B from each asset you sell throughout the year. It reports your cost basis for the assets you bought and sold.

Even if you don’t receive Form 1099-B, you must complete Form 8949 for each transaction. You carry over any subtotals create on Form 8949 onto Schedule D of your 1040.

File Your Taxes with Ease from Home Today with TurboTax!

Let’s Take a Look at John’s Example Scenario

John bought XYZ stock for $20 per share on August 1st, and he bought 50 shares. John spent $1,000 on his initial investment.

On November 1, John sells his XYZ stock because the market kept falling and he wants to cut his losses. John sells all 50 shares for $10 per share or $500. John has a $500 loss.

If John doesn’t sell any other stocks that year, he can claim the $500 loss on his taxes, decreasing his taxable income by $500.

Now consider Jan’s Situation

Jan bought XYZ stock on June 1st for $100 per share. She also bought 50 shares. Jan spent $5,000 on her initial investment.

On August 15th, Jan sells XYZ stock because the stock market has done well. She wanted to take advantage of her profits while she could.

Jan sells all 50 shares for $150 per share. Jan has a $2,500 gain. If Jan doesn’t buy or sell any other stocks that year, she would have to claim the $2,500 capital gain on her taxes.

If she has other transactions, she’ll add the $2,500 capital gain to any other capital gains she earns.

Also, if Jan has any losses, she’ll reconcile the differences between the gains and losses. The bottom line is what she’ll either pay taxes on or use to offset her taxable income.

What You Should Know about the IRS Form 8949

Now that we have the basics done, let’s go through some of the most common questions asked.

What is the purpose of IRS Form 8949?

IRS Form 8949 helps you and the IRS reconcile your capital gains and losses. It’s a place to record all stock sales. The IRS compares the information you provide with the information provided to them on Form 1099-B from brokers.

Who must file IRS Form 8949?

Any taxpayer who sells assests (for a gain or loss) must complete IRS Form 8949 each year.

Do you still have to file Schedule D if you file Form 8949?

Yes, you must file Schedule D along with Form 8949 each year. Form 8949 breaks down the stock sales, while Schedule D summarizes your total capital gains or losses.

What type of transactions do you report on Form 8949?

You must report most sales of stocks, bonds, mutual funds, real estate, and all other assets on Form 8949. This includes:

- Capital gains or losses from stock sales

- Short sales

- Capital gains from the sale of real estate

- Gains earned from inherited assets

- Capital gains or losses from selling a partnership

Are there separate forms for long-term and short-term transactions?

Yes, Form 8949 has two parts. The first section is for short-term transactions, and the second is for long-term transactions.

Short-term transactions are assets you held for less than one year, and long-term assets are those you held for longer than one year.

File Your Taxes with Ease from Home Today with TurboTax!

6 Tips to Make Your Filing of IRS Form 8949 Easy

- You may need to file separate Form 8949: forms for each transaction depending on the type of transactions. The three types are transactions reported to the IRS, transactions not reported to the IRS, and transactions the IRS wouldn’t know about, like selling a private painting.

- Make sure you have an adequate description of each asset for Form 8949.

- Be sure you have accurate dates for the day you bought and sold the asset.

- Know your cost basis (how much you paid for the asset) and the amount of proceeds received (the amount you sold the asset for).

- Watch out for a wash sale. While the details get complicated, the premise is if you sell a stock for a loss, but buy it again in any form in the 30 days following the loss, you lose your ability to write off the loss. Instead, it offsets the purchase price of the stock but doesn’t benefit your tax liability.

- Remember that completing Form 8949 is complicated. If you don’t understand the complexities, get professional advice.

Bottom Line

Every taxpayer that buys or sells stocks or any other asset, must complete Form 8949. It’s like a checks and balances system with the IRS as they use it to reconcile the information they receive from brokerage firms when you buy and sell assets.

For more money-saving tips and guides, subscribe to the weekly newsletter!

I hope this helps your situation.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**