Are you trying to figure out if the IRS Form 8965 applies to you?

The Affordable Care Act requires every American to have qualified healthcare coverage. If you didn’t have coverage, you may owe a penalty for the months you went without insurance. Fortunately, there are exemptions many Americans can take advantage of to avoid the penalty.

Please note, this applies only to taxpayers completing tax returns for previous years (2018 and prior), as the Tax Cuts and Jobs Act eliminated the requirement.

If you qualify for an exemption, you must include IRS Form 8965 with your tax returns. Here’s how it works.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is IRS Form 8965?

IRS Form 8965 is the Health Coverage Exemptions form. If you didn’t have insurance and qualify for an exemption, you must complete the form. This only applies to Americans who don’t have any coverage.

If you lost your job, but bought coverage through the Marketplace or you purchased a private policy, you don’t have to complete the form. Keep proof of your insurance handy in case its’ needed.

Keep in mind, only taxpayers completing taxes for tax year 2018 or earlier must complete IRS Form 8965. Starting with tax year 2019, the Tax Cuts and Jobs Act removed the Shared Responsibility Payment requirement, which eliminates the mandate for health insurance for everyone.

Example Scenario for Form 8965

Let’s look at a real-life example and see how it works.

John worked for a big company and carried his family’s insurance. In May of 2018, John lost his job due to downsizing. He went on unemployment and couldn’t afford the Marketplace premiums charged for his family of 5.

The premiums were more than 10 percent of his household income because he was the breadwinner (his wife only works part-time). John completed IRS Form 8965 and checked Box 7, which states ‘if you claim a health coverage exemption due to low household income, check here’.

He didn’t owe any penalties for not having healthcare coverage in 2018.

Here’s another example:

Jan also worked for a big company. She carried the insurance for her and her husband. Jan lost her job due to no fault of her own in January of 2018, and had a little trouble finding a job. It took her two months, but her new job offered insurance day one.

Jan and her husband were only without insurance for 2 months. Since they didn’t exceed the 3-month ‘short gap’ requirement, they claimed an exemption on their tax returns and didn’t pay a penalty.

File Your Taxes with Ease from Home Today with TurboTax!

FAQs – Understanding Form 8965

Now that we understand the basics, let’s go through a few of the most common questions.

What is the purpose IRS Form 8965?

All taxpayers completing taxes from 2018 or earlier, must complete IRS Form 8965 if they have a healthcare coverage exemption granted from the marketplace or if they meet other IRS exemption guidelines.

Read the exemptions carefully and follow the instructions. Know whether you need an exemption from the Marketplace or if you need other proof to show your exemption.

What are health coverage exemptions?

The IRS offers healthcare coverage exemptions for certain circumstances including:

- Financial hardship

- Religious affiliations

- Short gaps (less than 3 months) with no insurance

- You don’t need to file taxes

- Your state didn’t extend the Medicaid program

- You’re part of a tribe

- You’re in jail

- You lived abroad

What is exemption type G on Form 8965?

Exemption Code G covers a few situations:

- The total insurance cost exceeds 8.05 percent of your household income

- Your state didn’t expand its Medicaid coverage beyond families with household income below 138 percent of the poverty level

- You or a family member had a hardship that made it impossible to secure coverage

How do you complete IRS Form 8965?

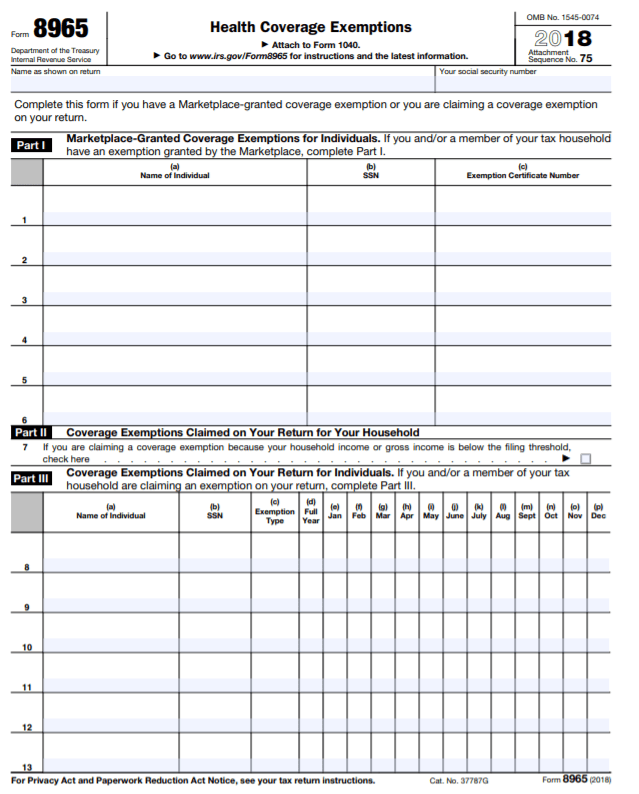

- IRS Form 8965 isn’t complicated. Fill in your name and social security number and then complete Part I, II, or III.

- If you or a household member received an exemption from the Marketplace, complete Part I and provide the exemption certificate number.

- If you’re claiming financial hardship and the inability to afford coverage, complete Part II and for any other exemptions, complete Part III (you’ll need the exemption code (A – H).

Do health coverage exemptions cover the entire time without insurance?

Each circumstance differs. If you didn’t have insurance for an entire year, make sure your situation qualifies for the entire year or if you’ll owe a penalty for a portion of the time without insurance.

Is it still mandatory to have health insurance?

The Tax Cuts and Jobs Act removed the requirement for healthcare coverage on a federal level. Some states implemented mandates though, so check at your state level to determine if you’ll owe a penalty if you don’t have insurance.

What is the penalty if you didn’t have health insurance in 2018?

If you didn’t have adequate healthcare coverage, the IRS charges a $695 penalty per adult and $347.50 penalty per child with a maximum $2,085 penalty per family.

4 Simple Tips for Completing IRS Form 8965

- If your income was below the tax filing threshold, you automatically qualify for the exemption and don’t need an exemption code.

- Or your income is above the tax filing threshold, then make sure you have the proper code (consult a tax professional if you are unsure).

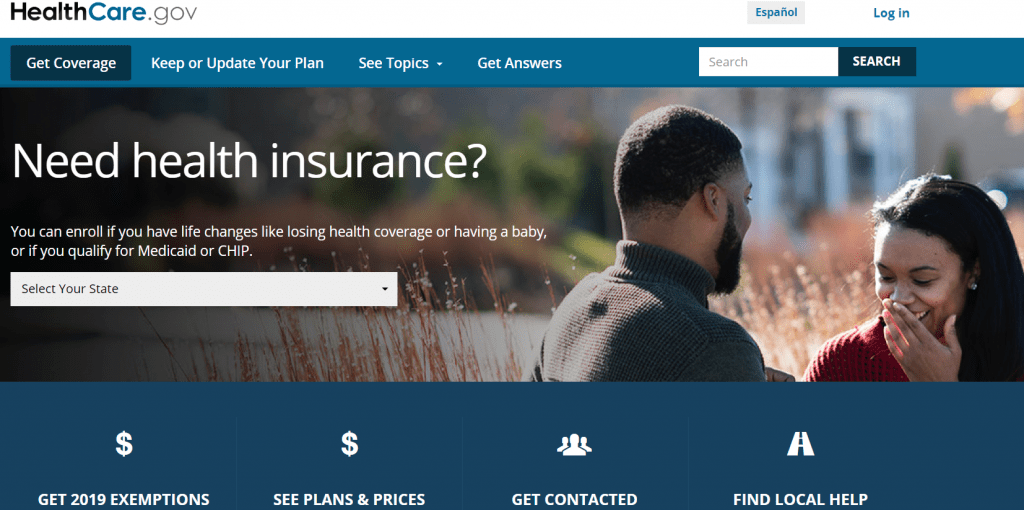

- If you’re claiming financial hardship, you must get an exemption from the Marketplace by completing a form on Healthcare.gov.

- You only need to complete one Form 8965 per household even if all household members don’t have insurance.

File Your Taxes with Ease from Home Today with TurboTax!

Do you Need IRS Form 8965?

Health insurance protects your family from high medical bills, but not everyone can afford it. If you lost coverage and didn’t file your 2018 taxes yet, find out if you qualify for a health coverage exemption.

There are many exemptions available, but you must provide proof of the exemption to avoid the penalty.

Even though the federal government doesn’t require health insurance any longer, your state might. Find out the laws in your state and if there are any exemptions if you can’t afford coverage, especially with the economic downturn due to the global pandemic of 2020.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Tax Software vs. Accountant or Tax Pro (Which Should You Use?)

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Last Minute Tax Tips for Beginners

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**