As tax season approaches, understanding the taxability of your refund is crucial for managing your finances effectively.

While most tax refunds are not taxable, there are certain situations where a refund may be subject to federal or state income tax.

To avoid any potential tax issues, it’s important to accurately report your refund and stay informed about the tax laws that apply to your specific situation.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission at no additional cost to you.

What is a Tax Refund?

Before understanding the taxability of your tax refund, it’s important to know what a tax refund is. Simply put, a tax refund is the amount of money that the government returns to you when you paid more in taxes than you owed.

It is essentially a reimbursement of the excess taxes you have already paid. This process happens after you file your annual tax return and the government verifies the calculations.

It’s important to note that a tax refund is not considered income in most cases. Instead, it is seen as a return of money that you overpaid to the government.

However, in some cases, a tax refund may be subject to income tax, depending on your specific situation. Let’s explore this topic further.

Tax Refund Basics: Non-Taxable Refunds

When it comes to the taxability of your tax refund, it’s essential to understand the basics. Generally, tax refunds are not considered taxable income.

If you receive a refund because you overpaid your taxes, it is not subject to federal income tax. This is because the refund is seen as a return of your own money, rather than new income.

However, it’s worth noting that state tax refunds can have different taxability rules. If you itemized deductions in the previous year and deducted your state income taxes, any refund you receive may be taxable at the state level. It’s important to check your state’s specific tax laws to determine the taxability of your state tax refund.

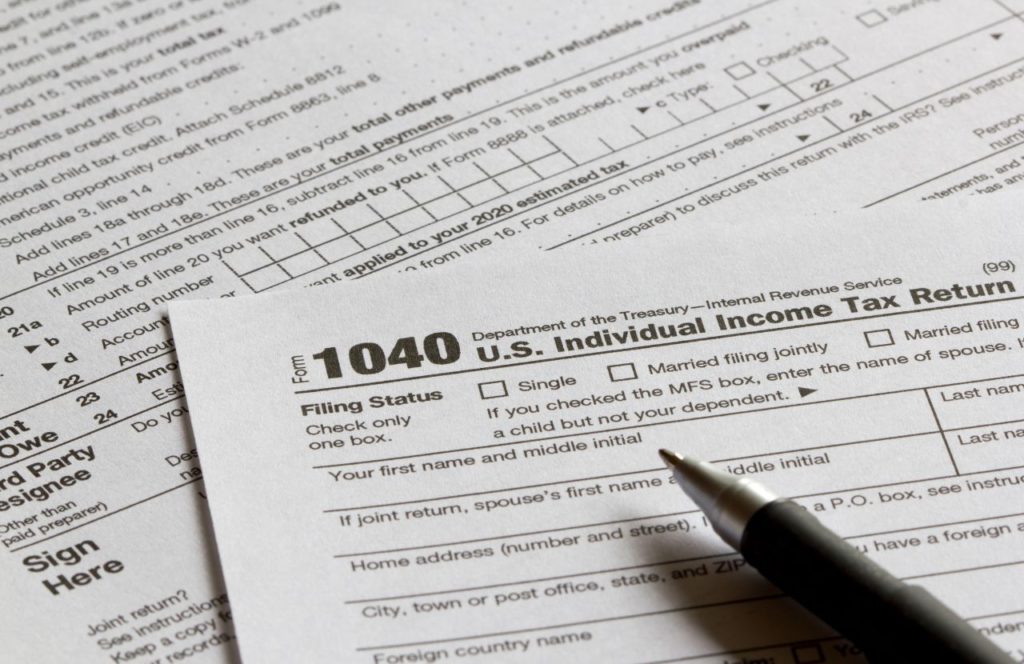

To properly report your tax refund, you will receive a Form 1099-G from the government or your state. This form will show the amount of the refund you received, and if it is taxable. Make sure to include this information when you file your taxes to ensure accuracy and avoid any potential issues with the IRS.

Overall, understanding the taxability of your refund is crucial for effective financial management. By staying informed about the tax laws that apply to your specific situation, you can make informed decisions about your finances and avoid any potential tax issues. Remember, it’s always advisable to seek help from a qualified tax professional if you have any doubts or concerns.

Tax Refund Basics: Taxable Refunds

While most tax refunds are not considered taxable income, there are some situations where you may owe taxes on your refund. If you deducted your state and local income taxes in the previous year and received a refund of those taxes, it may be subject to federal income tax.

This is because the deduction reduced your taxable income in the year you claimed it. So, if you later receive a refund for those taxes, the IRS considers it as if you never made the deduction, and your taxable income increases accordingly.

For example, let’s say you deducted $2,000 in state income taxes in 2020. When you file your 2020 tax return, you calculate that you owe $5,000 in federal taxes. However, your employer withheld $7,000 from your paychecks for federal taxes, resulting in a $2,000 refund.

In this scenario, your $2,000 refund would be considered taxable income for the following year.

It’s important to note that if you did not itemize your deductions in the previous year and instead took the standard deduction, you won’t owe taxes on your state tax refund. This is because you didn’t benefit from deducting the state taxes in the first place.

Make sure to accurately report any taxable refunds on your tax return to avoid potential issues with the IRS.

State Tax Refunds and Taxability

State tax refunds can also impact your tax liability and may be subject to tax at both the federal and state levels. If you itemized deductions in the previous year and deducted your state income taxes, any refund you receive may be considered taxable income at the state level.

The specific rules regarding the taxability of state refunds vary by state, so it’s important to consult your state’s tax laws or seek professional advice if you have any doubts or concerns.

When reporting your state tax refund, you will receive a Form 1099-G from your state government. This form will show the amount of the refund you received, and if it is taxable. Make sure to include this information when you file your taxes to ensure accuracy and avoid any potential issues with the IRS.

If you receive a taxable state tax refund, it may impact your future taxes. You might need to adjust your withholding or estimated tax payments to avoid owing taxes in the following year. It’s important to consult with a tax professional to determine the best course of action based on your individual circumstances.

Tax Refund Basics: Reporting Your Refund

It’s important to properly report your tax refund to the government to ensure accuracy and avoid any potential issues with the IRS. To do this, you will receive a Form 1099-G from the government or your state which shows the amount of the refund you received, and if it is taxable. Make sure to include this information when you file your taxes.

If you received a non-taxable refund, you will not owe any federal income tax on that amount. However, if you received a taxable refund, you will need to report it as income and include it in your taxable income for that year. This may increase your tax liability and result in owing additional taxes.

Properly reporting your tax refund can be complicated, especially if you have multiple sources of income or deductions. Consider seeking assistance from a qualified tax professional if you need help navigating the taxability of your refund. By accurately reporting your refund, you can avoid any potential tax issues and stay on top of your finances.

Impact on Future Taxes

If you received a taxable tax refund in the previous year, you may need to adjust your tax payments to avoid owing taxes in the future. Your tax liability may increase due to the taxable refund, which reduces the amount of federal income taxes you paid. This means you may have underpaid taxes during the previous year.

Consulting with a tax professional can help you determine the best course of action based on your individual situation. They can help you calculate the amount of withholding you need to adjust to avoid owing taxes in the future.

Additionally, you may need to adjust your estimated tax payments if you are self-employed or have other sources of taxable income. Underpaying estimated taxes can result in penalties and interest, so it’s important to stay up-to-date on your tax liabilities.

Overall, it’s important to be aware of the potential impact that a taxable tax refund can have on your future taxes. Taking proactive steps to address this issue can help you avoid any surprises and stay on top of your tax obligations.

Avoiding Tax Refund Taxability

To minimize the taxability of your refund, consider adjusting your withholding throughout the year. By making sure you are withholding the correct amount of taxes from your paycheck, you can reduce the chances of receiving a large refund or owing additional taxes. This can be accomplished by filling out a new W-4 form with your employer.

If you have multiple sources of income or deductions, it may be helpful to consult with a qualified tax professional. They can assist you in ensuring that you are withholding the correct amount of taxes and avoiding any potential tax issues.

Remember, the key is to avoid receiving a large refund or owing additional taxes. If you are unsure about how to adjust your withholding or need assistance with your overall tax situation, seeking help from a qualified tax professional can be beneficial.

By taking control of your tax situation, you can minimize the taxability of your refund and ensure that your finances are in order.

Seeking Professional Assistance

Understanding the taxability of your refund can be confusing, especially if you have a variety of income sources or deductions. If you are unsure of the tax implications of your refund or need assistance with your overall tax situation, seeking help from a qualified tax professional is highly recommended.

A tax professional can provide you with personalized guidance and help you navigate complicated tax laws. They can also assist you in accurately reporting your tax refund and ensuring that you are in compliance with all applicable tax regulations.

By working with a tax professional, you can gain peace of mind and avoid potential issues with the IRS. They can help you avoid unnecessary tax liability and ensure that you receive the maximum refund possible.

If you are unsure about how to proceed with your taxes or have concerns about your refund taxability, do not hesitate to reach out to a qualified tax professional.

Remember, proper tax planning and reporting are essential for managing your finances and avoiding any unwanted surprises. Contact a professional today to ensure that you are on the right track.

Final Thoughts

Now that you have explored the topic of tax refunds and taxability, you can make informed decisions about managing your finances. Remember, most tax refunds are not taxable, but it’s essential to understand the specific circumstances where taxability may apply.

When it comes to reporting your refund, make sure to accurately report the amount and taxability information on your tax return. If you received a taxable refund last year, consider adjusting your withholding to avoid owing taxes in the future.

If you’re unsure about the tax implications of your refund or need help with your overall tax situation, don’t hesitate to seek assistance from a qualified tax professional. They can provide guidance tailored to your specific circumstances.

By staying informed and making smart financial decisions, you can navigate the tax system with confidence and make the most of your tax refund. Remember, understanding the taxability of your refund is crucial for effective money management.

So, is a tax refund taxable?

The answer is, in most cases, no. But, it’s important to know when the answer is yes. By staying informed and seeking professional assistance when needed, you can make the most of your tax refund without any unexpected tax liability.

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**