Knowing if your Lasik surgery is tax deductible is just the first question to ask yourself.

There’s quite a bit of complexity when it comes to elective medical procedures, especially with insurance.

These operations can often cost a lot out of pocket, so taking advantage of potential savings and recuperation is important.

Lasik surgery is an extremely useful procedure that can eliminate the need for glasses or contacts.

This in itself can save quite a bit of money over time, but it may be able to reduce your tax burden as well.

So is Lasik tax deductible?

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Key Takeaways:

- Elective procedure: LASIK is often considered an elective procedure, which means it is not typically covered by insurance.

- Medical expense deduction: To claim LASIK as a medical expense deduction, you must itemize your deductions.

- Tax professional: Consulting a tax professional can help you navigate the complexities of tax deductions related to LASIK surgery.

- Adjusted gross income (AGI): Medical expenses must exceed 7.5% of your adjusted gross income (AGI) to be deductible.

Can I Write-Off My Lasik Surgery on My Taxes?

The short answer is yes, Lasik Surgery can be used as a write-off on your taxes. The annually published 502 IRS article states:

“You can include in medical expenses the amount you pay for eye surgery to treat defective vision, such as laser eye surgery or radial keratotomy.”

But medical expenses have a built-in threshold that has to be met before it can actually apply.

You can only deduct medical expenses that exceed 7.5% of your annual gross income (AGI).

Fortunately, this is cumulative over the year, so once the threshold is reached, anything beyond it can be tax-deductible.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

What Other Medical Expenses Can I Deduct on My Taxes?

But it isn’t just the procedure cost you can deduct either. The IRS states that any costs associated with the surgery can be included.

This could be prescriptions, insurance premiums, and even transportation costs.

So be sure to track any costs you incur if you plan to write off your Lasik surgery.

Itemizing vs Using a Standard Deduction on My Taxes

The standard deduction for 2025 is $15,000 or double that for married couples. That’s a considerable amount of money that needs to be reached before itemizing can offer benefits.

For tax year 2025, the standard deduction amounts are as follows:

| 2025 Standard Deduction and Personal Exemption (Estimate) | |

| Filing Status | Deduction Amount |

| Single | $15,000.00 |

| Married Filing Jointly | $30,000.00 |

| Head of Household | $22,500.00 |

| Married Filing Separately | $15,000.00 |

| Personal Exemption | Eliminated |

If your overall deductions fall beneath the standard deduction, then it’s better off just taking it.

However, if you surpass the $15,000 (or $30,000 if you are head of household) then it can certainly be worth itemizing your deductions.

But remember, medical expenses can only be written off after they surpass 7.5% of your AGI.

That means if you make $50,000, medical expenses need to exceed $3,750 before they can be used as a deduction.

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

5 Easy Tips to Save Money on Lasik Surgery

Whether it’s tax-deductible or not, Lasik surgery is expensive. Here are a few tips on how to reduce the costs as much as possible.

1. Check your insurance

It can be hit or miss when it comes to elective procedures and your health insurance. But it doesn’t hurt to check and see if Lasik is fully or partially covered.

In some cases, insurers will offer partial coverage up to a certain dollar amount and may reimburse certain expenses.

Get your FREE Tax Refund Estimator TODAY!

2. Track your expenses

Track any expenses associated with the surgery itself as this can be added on to the tax-deductible medical expenses. These expenses can include:

- Transportation

- Prescriptions

- Premiums

- Care costs

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

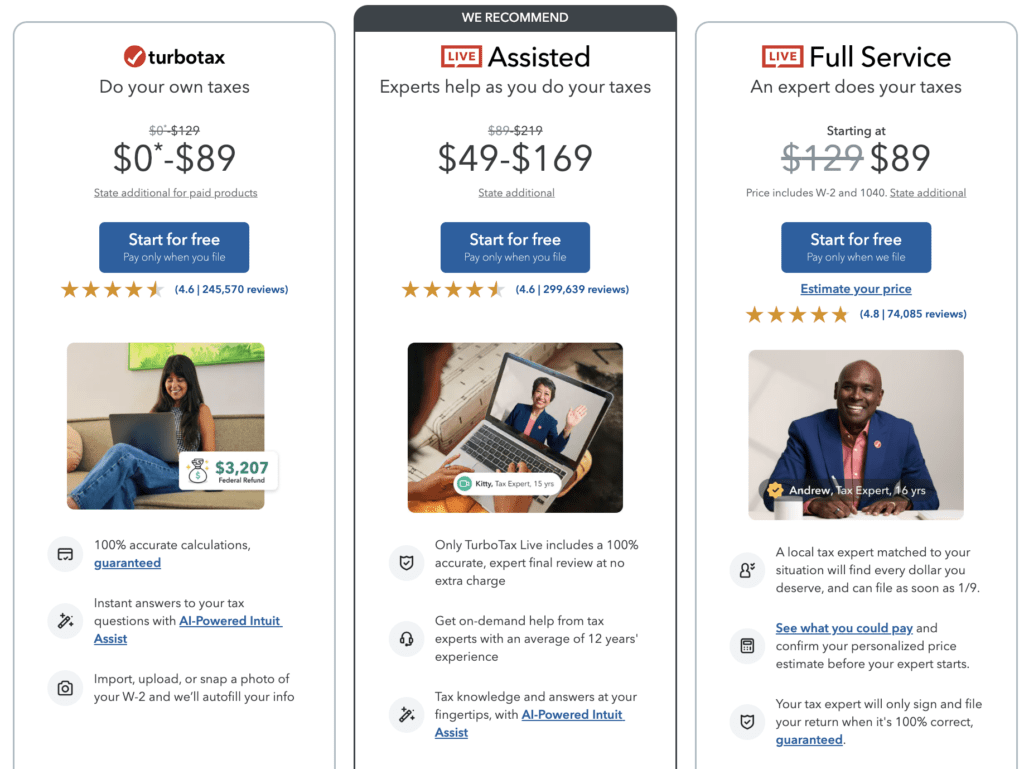

3. Get your taxes done by a trusted source

Be sure to choose the best tax preparer or tax software to do your taxes! They will make sure that you take advantage of each tax deductible that is available to you.

Which online tax services are the best?

4. Use Your FSAs or HSAs for LASIK

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are excellent tools for managing the cost of LASIK surgery.

FSAs allow you to set aside pre-tax dollars for eligible medical expenses, including LASIK.

The contribution limit for FSAs is set annually, and funds must typically be used within the plan year.

HSAs, on the other hand, are available to individuals with high-deductible health plans and offer the benefit of rolling over unused funds year to year.

These accounts can significantly reduce the out-of-pocket cost of LASIK by using pre-tax dollars, making the procedure more affordable.

5. Know Your State Rules

When considering LASIK surgery as a tax-deductible expense, it’s crucial to be aware of state-specific tax regulations.

While the IRS provides federal guidelines for medical expense deductions, individual states may have different rules.

Some states might not allow the same deductions, or they might have different thresholds for medical expenses.

It’s advisable to consult with a tax professional familiar with your state’s tax laws to ensure you’re maximizing your potential deductions.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

Wrapping Up…

So yes, Lasik surgery is tax-deductible as long as your medical expenses exceed the 7.5% AGI threshold. Be sure to keep track of any medical costs throughout the year and add them up.

If your deductions look like they will surpass the standard $15,000 deduction, then be prepared to itemize to get your maximum return.

I hope this article helped you gain some control of your tax plan this year. Remember not to stress out. Don’t forget to check out Tax Forms page for any additional online tax checklists and forms you may need this year.

If you enjoyed this article, then you’ll love these:

- How to Save Money for Vacation in 3 Months (23+ Money Saving Tips)

- Do I Need to File a Tax Return?

- Pay Off Debt Quickly with These 4 Simple Tips

- How to Save $3,000 in 6 Months (Save Money Fast)

Until the next money adventure, take care from The Handy Tax Guy Team!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: September 20, 2021/Updated on February 13, 2025)