2024 Tax Benefit Rule: See How It Can Save You Thousands!

Have you ever stumbled upon a phrase in the tax world and wondered, “What is the tax benefit rule?” Well, ...

Decoding the Mystery: Are Pell Grants Taxable Income?

As a student receiving financial aid, you may be wondering whether the Pell Grants you receive are taxable. With tax ...

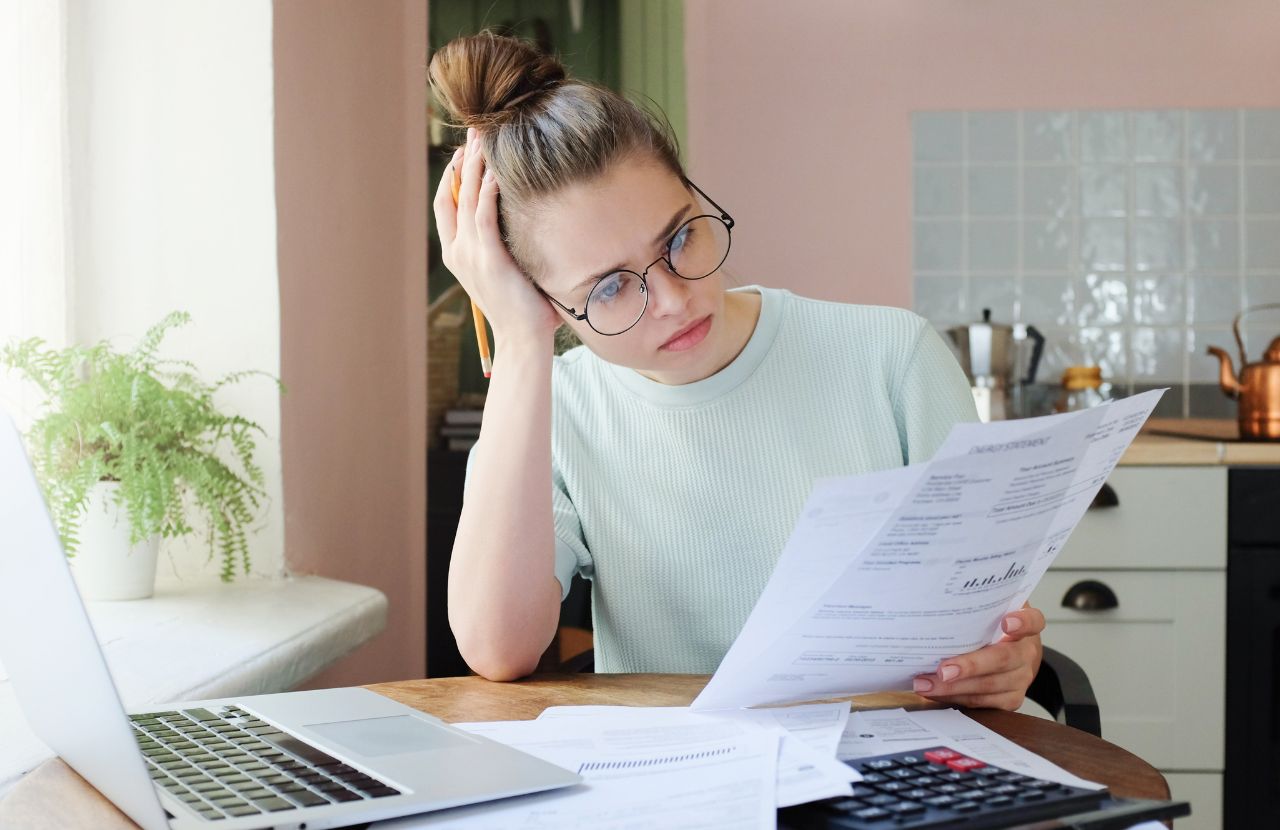

Understanding Your Finances: Is a Tax Refund Taxable?

As tax season approaches, understanding the taxability of your refund is crucial for managing your finances effectively. While most tax ...

Is Homeschooling Tax Deductible? Exploring the Facts and Eligibility

Is homeschooling tax deductible? As you consider the financial aspects of homeschooling, questions about tax deductions may arise. Homeschooling can ...

Is Uncle Sam Coming for Your Workers’ Comp? Find Out if It’s Taxable!

Workers’ compensation is a crucial form of financial assistance for employees who suffer from workplace-related injuries or illnesses. It covers ...