You are missing out on some of the most common tax deductions for teachers and educators.

It’s understandable that the last thing you want to worry about is a tax deduction.

This daunting thought can also be the reason why so many workers in the education field file too quickly in an effort to complete this task.

The job of a schoolteacher can be a grueling, with lots of stress, deadlines, and long hours.

Plus, you’re probably using your own money for some work-related expenses.

To add to your already long list, you will want to make sure all your documents are in line for taxes in order to stay ahead of the game.

In this article I will show you how to get the most deductions and lower your tax bill this year.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission.

Key Takeaways

- Unreimbursed Expenses: Teachers can claim up to $300 in unreimbursed expenses for classroom materials.

- Professional Development Courses: Expenses for professional development courses are deductible under the Educator Expense Deduction.

- Viral protective items: protective items like masks and sanitizers are now deductible for educators.

Keep reading to get the full list of items you can deduct this year!

But first, grab your Tax Preparation Checklist below!

When preparing for the tax season, please keep in mind that you can write-off expenses that are common for your profession and ones that are necessary to help you complete your job as a teacher.

Teacher and Education Tax Deduction Checklist

If you need to claim expenses as an employee, then be sure to fill out the itemized deduction Schedule A Form.

File Your Taxes with Ease from Home Today with TurboTax!

What is the $300 Educator Deduction or Education Expense Deduction?

The Educator Deduction allows you to deduct up to $300 in school-related expenses from your income. If you and your spouse are educators and you file jointly, both of you can claim up to $300 each (a $600 total for both of you).

If you have more than $300 in educator related expenses or if you don’t qualify for the deduction, then you may be able to deduct a portion of your unreimbursed expenses for school supplies.

Just be sure to speak with your tax advisor if this is your scenario.

More Tax Savings: File at Ease at Home with Turbo Tax

Who can claim the $300 Educator Expense Deduction?

- A teacher, instructor, counselor, principal, or aide

- Someone who works in an elementary or secondary school (grades K-12)

- An instructor who has completed 900 hours of work during the school year

Who does not qualify for the $300 Educator Expense Deduction:

- Homeschoolers

- College and graduate-level instructors

- Pre-school teachers and aides

Qualified Expenses for Deduction

According to the IRS, qualified expenses for the Educator Expense Deduction include books, classroom supplies, computer equipment, software, and professional development courses.

Additionally, expenses for viral protective items such as face masks, disinfectant, and hand sanitizer are also deductible.

These items are essential for maintaining a safe and effective learning environment.

Get your FREE Tax Refund Estimator TODAY!

What is a Tax Deduction?

A tax deduction is money that you subtract from your earned income, that will lower the amount of money you are taxed and the amount of tax you may possibly owe.

4 Common Tax Deductions for Teachers and other Educators

Before we get into our longer list of tax advantages you’re missing out on, let’s go through a few of the most common tax deductions for teachers.

1. Clothing/Uniforms

Your work outfit has to be specific to the work you do as an Educator or Teacher. For example, uniforms, school required shirts, or shoes are items you can write off when doing your taxes.

If you’re thinking about something more on the fashion sense, you’d have to be able to prove its necessity for accomplishing your job.

This is one of top teacher tax deductions you should be taking advantage of this year.

2. Supplies

Any amount you spend on materials you purchase as an Educator or Teacher for your job.

These items include:

- Books

- Computer equipment and software if working from home

- Athletic equipment for physical education teachers

- School supplies

- Training

- Travel

Power Tip: Keep a good record of each item you buy, just in case you need it in the future for the IRS.

3. Licenses and Education

Being licensed is a common requirement for professionals in the education industry. Good thing for you is that you can write-off the fee associated with getting your license and maintaining your license.

When it comes to your education, which is highly important to stay competitive, these fees can also be written off.

Along with any travel associated with obtaining your continued education, such as teacher-related conferences, meetings, and seminars. Once licensed, you can deduct the cost of any continuing education classes needed to improve your skills.

If you completed your college degree last year or any other schooling, you may be eligible for a tax deduction or credit.

Tuition for school has to be done separately with the 1098-T form that you will receive from your school.

Subscriptions to magazines or books related to your job also count as deductions since you need them to stay up-to-date with the latest trends.

4. Any Services

Services such as dry cleaning or places online to get classroom worksheets are examples of services needed to maintain the integrity of your job.

Are You a Travel Teacher?

If so, you may qualify for quite a few travel tax deductions. This may include mileage, transportation, parking costs, and tolls just to name a few.

What Other Teacher Expenses Are Tax Deductible?

Now that you know what the most common tax deductions are, let’s go through a few more that you may not be aware of.

Professional Fees & Dues

- Alumni Dues

- Association Dues

- Credentials

- Parent Teacher Groups

- School and Union Dues

Travel – Out of Town

- Airfare

- Car Rental

- Parking

- Taxi and Train

- Bus & Subway

- Meals (do not combine with lodging)

- Porter, Bell Captain

- Telephone Calls (including home)

Continuing Education

- Correspondence Course Fees

- Materials & Supplies

- Reference Material

- Research Expenses

- Textbooks

- Tuition

Telephone Expenses

- FAX Transmissions

- Cellular Charges

Auto Travel (In miles)

- Continuing Education

- Field Trips

- Library Trips

- Professional Society Meetings

- School Functions

- Seminars

- Parking Fees and Tolls ($)

Classroom Supplies

- Arts & Crafts Materials

- Audio Visual Supplies

- Classroom Decorations

- Film & Processing

- Grading Expenses

- Newspapers and Magazines

- Party Supplies

- Student Prizes & Awards

- Trophies

- Visual Aids

Miscellaneous Expenses

- Liability Insurance – Business

- Periodicals

- Professional Subscriptions

Grab your copy of the Teacher Tax Preparation Checklist Below!

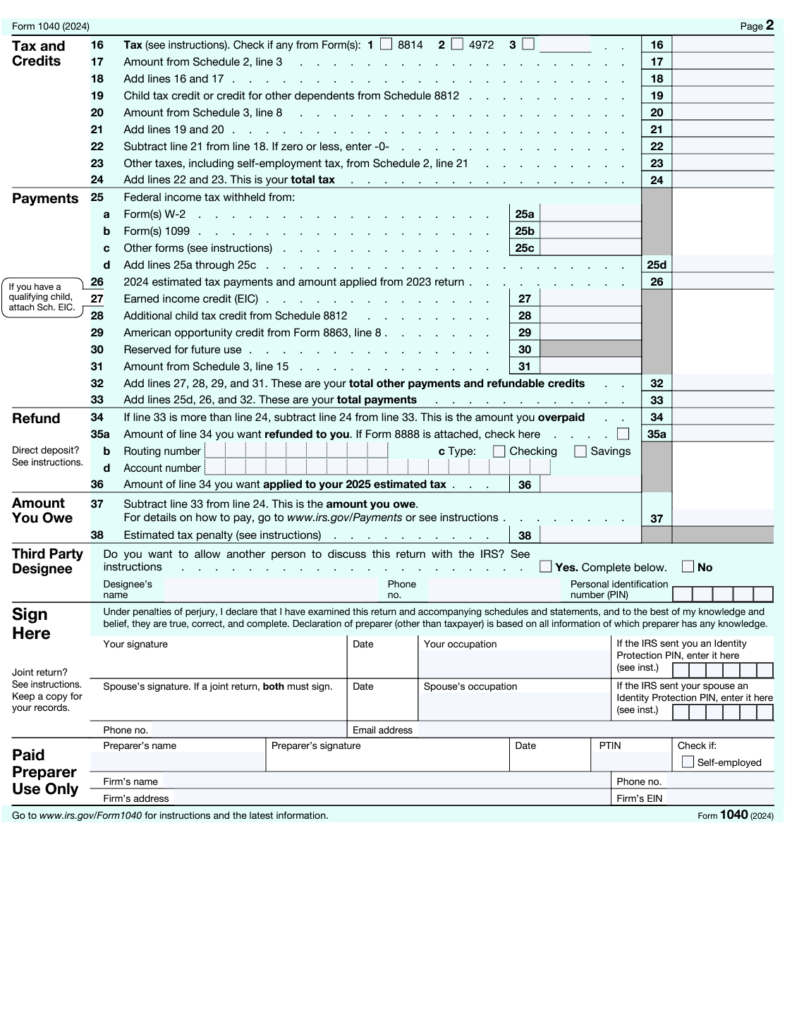

Forms Needed to Claim Deductions as a Teacher or Educator

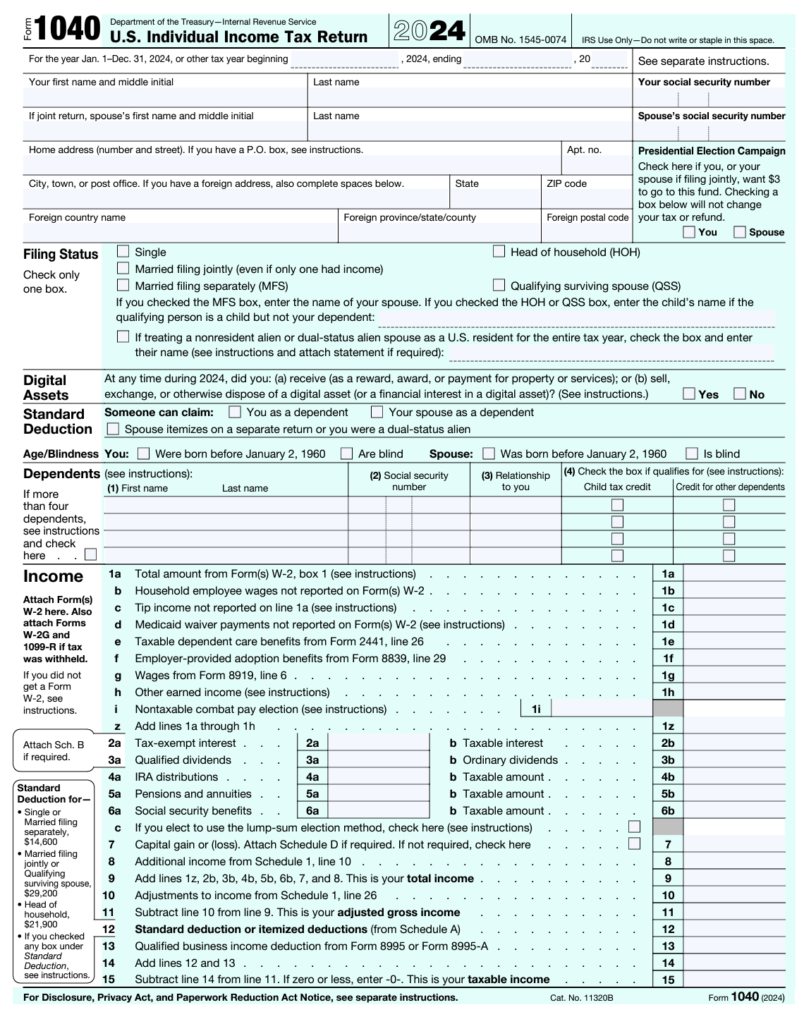

Travel Teachers are generally independent contractors, meaning self-employed. Whatever way you are paid, you’ll want to keep track of every amount of money you receive. IRS Form 1040 is needed to write off your expenses as a Teacher.

The expenses of your business will be placed inside the deductions area of Form 1040.

As an independent contractor, you’re accountable for all of your tax payments plus your travel expenses. Deductions reduce your tax payments as mentioned before.

There are also traveling Teachers who work as full-time W-2 employees for education staffing agencies.

Power Tip: Use the standard deduction only if your total expenses do not exceed the dollar amount set by the IRS.

An itemized deduction is only needed if your expenses are more than the set standard deduction dollar amount. You can use the IRS Form 1040 Schedule C if you need to itemize your deductions.

For tax year 2025, the standard deduction amounts are as follows:

| 2025 Standard Deduction and Personal Exemption (Estimate) | |

| Filing Status | Deduction Amount |

| Single | $15,000.00 |

| Married Filing Jointly | $30,000.00 |

| Head of Household | $22,500.00 |

| Married Filing Separately | $15,000.00 |

| Personal Exemption | Eliminated |

You may itemize expenses if your expenses exceed 2 percent of your adjusted gross income.

How can you tell if you’re self-employed/independent contractor or employee?

It depends on the tax form the employer gives you: W-2 = employee and 1099-MISC = self-employed/independent contractor.

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

How to Keep Your Files Tax Information Organized as a Teacher

- Hold on to your W-2 forms and 1099 forms

- Save receipts of items you bought for your business if you’re a contractor

- Keep track of expenses in an excel spreadsheet or through a bookkeeping software such as Freshbooks

- Have a tax preparation checklist completed

- Keep a detailed Teacher or Educator tax deduction checklist handy

Final Thoughts on Teacher Tax Deductions

I hope this tax deduction checklist helps you navigate through the tumultuous waters of the income tax season.

Let me know which deduction surprised you the most in the comment section below!

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- IRS Form 8917: Full Guide to Understanding Tuition and Fees Deduction

- Understanding IRS Form 8863: Do I Qualify for American Opportunity Credit?

- What Is A 1098-T Form Used For? (Full Guide for College Students)

For more money-saving tips and guides, subscribe to the weekly newsletter!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: December 4, 2018/Updated On January 21, 2025)