Are you looking for the best tax deductions as a Blogger or Content Creator?

Did you know that as an Online Influencer, you can write-off some of the common items you use to make your web empire awesome?

You have sacrificed sleep and your social life to get that time sensitive post out for your followers.

I understand this burden and I am here to help you steer through the world of taxes, especially the tax issues that affect you as a Blogger, Vlogger, or Content Creator because I am one as well.

In this article I will show you how to get the most business deductions and lower your tax bill.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Key Takeaways:

- Self-employment tax: Bloggers and Content Creators must account for self-employment tax, which includes Social Security and Medicare contributions.

- Estimated tax payments: To avoid penalties, bloggers should make estimated tax payments if they owe more than $1,000.

- As a self-employed Content Creator, you will not have taxes automatically deducted from your income. If your tax liability exceeds $1,000, you are required to make estimated tax payments to the IRS on a quarterly basis.

- Hobby vs. business: The IRS may classify your blog as a hobby if it doesn’t show a profit, affecting your ability to claim deductions.

- EIN number: Bloggers may need an EIN if they hire employees or operate as an LLC.

Keep reading to get the full list of items you can deduct this year!

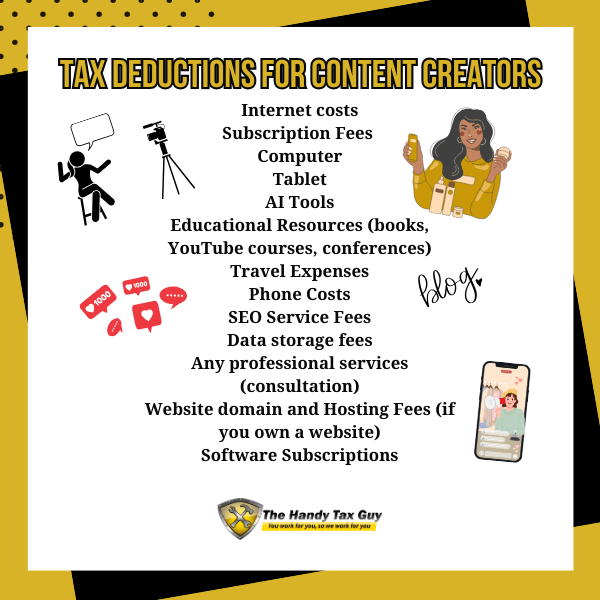

Commonly Missed Tax Write-offs for Bloggers and Online Influencers

For some, like myself, blogging gives you a taxable income. You may be able to deduct some of your blogging or freelancing adventures, but first you will want to make sure all your documents are in line.

When preparing for the tax season, please keep in mind that you can write-off expenses that are common for your profession and ones that are necessary to help you run a business.

I’ve put together an easy tax deductions checklist for Bloggers and Content Creators to download below.

Self-Employed Tax Deduction Checklist

Power Tip: If you need to claim expenses, then be sure to fill out the itemized deduction Schedule A Form.

7 Common Deductions for Bloggers and Content Creators

Now that we have some of the basic information out of the way, let’s go through the commonly missed items that you can deduct on your taxes.

1. Clothing

Your work outfit has to be specific to the work you do as a Blogger or Social Media Influencer.

For example, special shirts, pants, or shoes that are highly impactful for your blog or social media message are items you can write-off when doing your taxes.

You just have to be able to prove its necessity for accomplishing your job as an Online Influencer.

Tax Deductions for Fashion Bloggers and Content Creators

Clothing can be a write-off for you if you’re a fashion blogger since you’ll need to invest in outfits for photo shoots or promotional events while working with brands.

Recommended: How Our Co-founder, Nikida, Grew Her Blog From 0 to $10K+ a Month

2. Supplies and Subscriptions

Any amount you spend on materials you purchase as a Blogger or Content Creator for your business.

Listed below are some deductions you may be missing each tax year and not even know that you’re eligible to claim.

These items include:

- Internet (partial amount)

- Domain fees

- Hosting fees (use BlueHost if you run a blog)

- Public internet access fees

- Stock photo purchases

- SEO services and fees

- Paid site submissions

- Website design fees

- Data storage fees

- Business related software and licensing fees

- Tax and accounting software

- Monthly subscriptions needed to run your business

Power Tip: Keep a good record of each item you buy with Freshbooks, just in case you need it in the future for the IRS.

3. Education

When it comes to your education, which is highly important to stay competitive, these fees can also be written off.

Along with any travel associated with obtaining your continued education, such as blog conferences.

Seminars and online courses (like The Blog Ranking Academy) can also be written off if they’re used to enhance your skill for your blog business.

Subscriptions to online media related to your blog business also counts as deductions since you need them to stay up-to-date with the latest trends in the industry.

Create Your Blog Post in Half the Time Today!

4. Start-up and Operating Expenses

Start-up expenses are everything you spent to get your blog business running such as, equipment, online services, rental space (if needed), marketing, etc.

The IRS treats these differently, in the fact that you can write off up to $5,000 on your taxes, with the rest being depreciated over 15 years.

Your CPA (Certified Public Accountant) or trusted Tax Advisor can go into more detail on depreciation with you.

Depreciation means you can claim some of the equipment costs for a smaller tax break over a few years (read more about the process called depreciation here).

Operating costs are the expenses needed to maintain your business such as, monthly subscriptions and website hosting fees.

Get your FREE Tax Refund Estimator TODAY!

5. Travel Expenses + Deductions for Travel Bloggers/Influencers

As a Content Creator you can deduct your travel expenses, especially if it’s a destination that will be featured on your blog or on your social media to help you make income for your business.

Additionally, travel expenses incurred while attending conferences or meeting brands can also be deducted, provided they are directly related to your blogging activities.

6. Additional Services

Services such as advertising or business coaching are examples of services needed to maintain the integrity of your business.

Don’t forget about the costs of hiring freelancers, such as graphic designers or photographers; these services can contribute significantly to your content quality and are tax-deductible.

By meticulously tracking these expenses throughout the year, you not only save money but it also empowers you to reinvest in your craft more effectively!

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

7. Health Insurance Deductions

As a Self-employed Blogger, you can deduct your health insurance premiums, including medical, dental, and vision insurance, from your taxable income.

This deduction is available as long as the insurance is not provided through a spouse’s employer. It’s a significant tax break that can help reduce your overall tax liability.

Other Tax Deductions for Bloggers

Now that you have the most important deductions to consider, I want to go a bit more in-depth with other expenses you need to keep track of throughout the year.

Online Tools

- Internet (partial amount)

- Domain fees

- Hosting fees (using BlueHost)

- Public internet access fees

- Stock photo purchases

- SEO services and fees

- Paid site submissions

- Website design fees

- Data storage fees

- Business related software and licensing fees

- AI Technology

Home Office

- Portion of landline/cell phone dedicated to your business

- PC equipment used to blog or create content online

- Home Office (room exclusive use only, contact us for more details)

- Business Cards

- Office Supplies

- Cameras

- Digital memory cards

- Recordable CDs and DVDs

- Cloud Services

- Business furniture

- Zip drives

- Photo printouts and processing

- Printer ink and copier toner

- Long distance charges related to business

- Business equipment rental

- Computer upgrades and depreciation costs of computer equipment

Travel

- Blog conference fees and registration

- Lodging (do not combine with meals)

- Meals during conference (50% of cost- do not combine with lodging)

- Entertainment (50% of cost)

- Vehicle Expenses

- Transportation (flight, shuttles, taxi, car rental, ride share, tolls, etc.)

Education and Professional Tools

- Industry books & periodicals, including audio books

- Magazine subscriptions

- Research sites that require a subscription

- Educational webinars

- Business podcasts

- Professional memberships

- Online courses

Miscellaneous

- Charitable donations

- Marketing fees

- Movie or theater tickets related to blog

- Business incorporation costs

- Costs for Trademarks or Copyrights

- Business logos and graphic design fees

- Advertising costs

- Photocopying/faxing fees

- Legal fees

- PayPal, CashApp and Western Union fees

- Bank Fees

- Tax Advisor Fee

- Post Office Box and Safe Deposit Box fees

- Coaching advice that pertains to your business

- Prizes and giveaways

- Gatherings you organize for your business and more!

Tax Related Items

- Real estate taxes paid (% for your home office)

- Qualified mortgage insurance premiums (% for your home office)

- Deductible mortgage interest (% for your home office)

Create Your Blog Post in Half the Time Today!

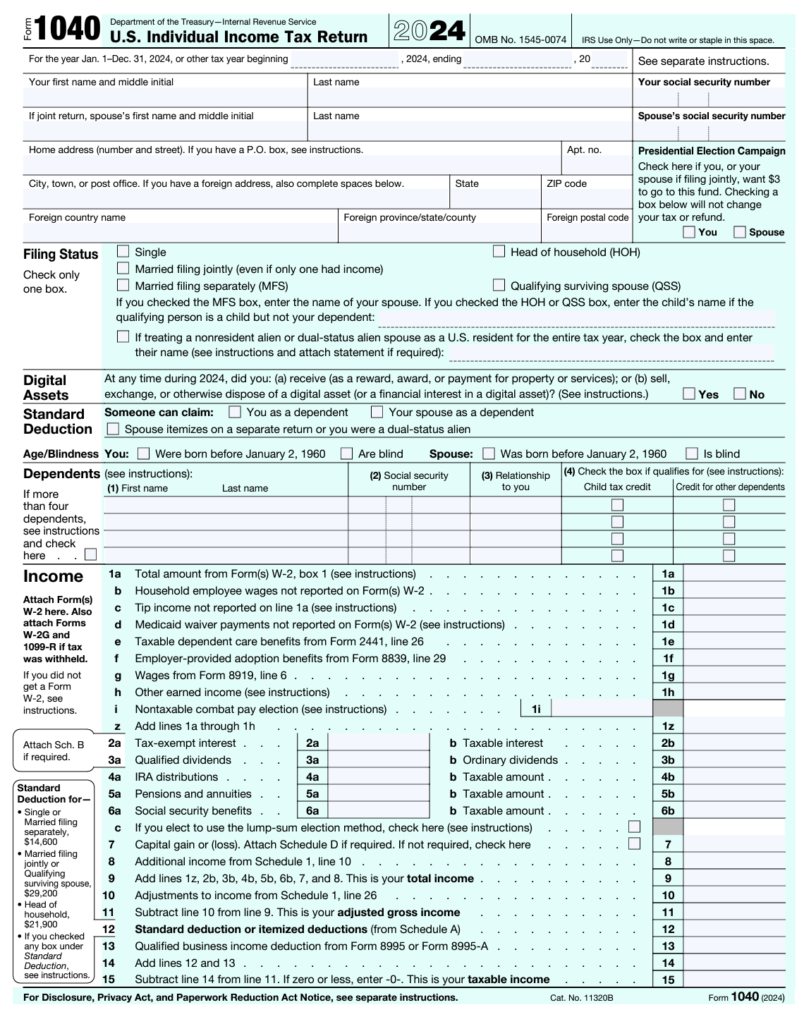

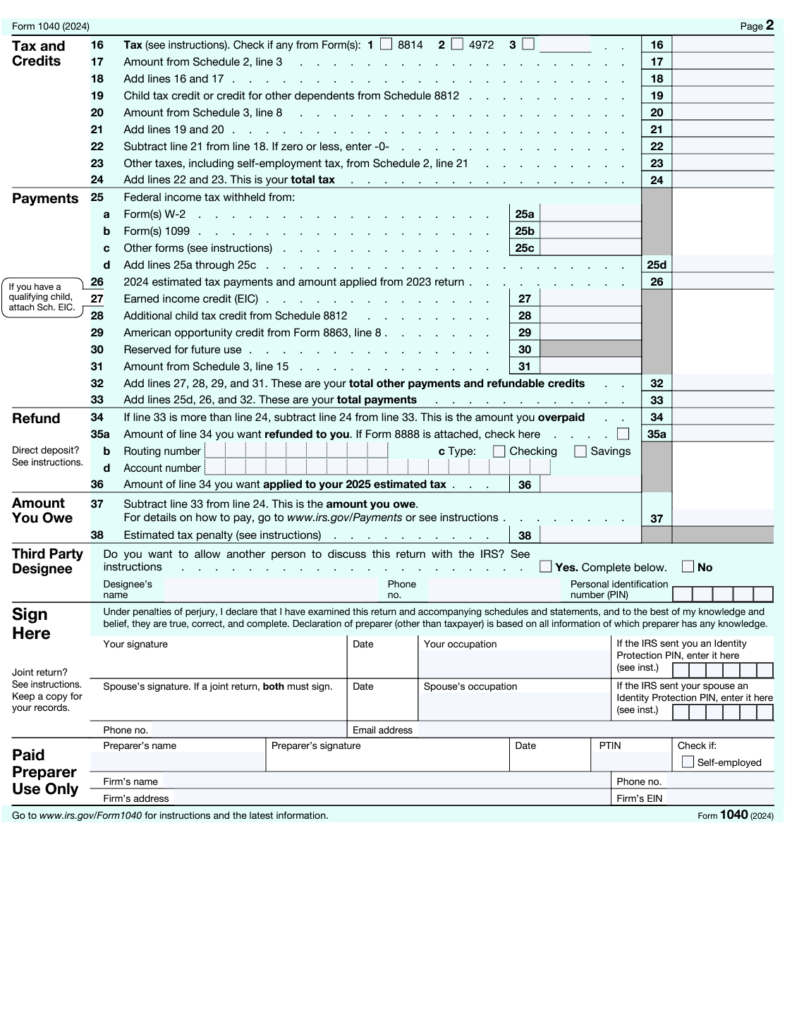

Forms Needed to Claim Tax Deductions as a Blogger or Online Influencer

Bloggers and Online Influencers are generally independent contractors, meaning self-employed.

Whatever way you are paid, you’ll want to keep track of every amount of money you receive. IRS Form 1040 is needed to write off your expenses as a Blogger, Vlogger, or Social Media Influencer.

The expenses of your business will be placed inside the deductions area of Form 1040.

Power Tip: Use the standard deduction only if your total expenses do not exceed the dollar amount set by the IRS.

For tax year 2025, the standard deduction amounts are as follows:

| 2025 Standard Deduction and Personal Exemption (Estimate) | |

| Filing Status | Deduction Amount |

| Single | $15,000.00 |

| Married Filing Jointly | $30,000.00 |

| Head of Household | $22,500.00 |

| Married Filing Separately | $15,000.00 |

| Personal Exemption | Eliminated |

An itemized deduction is only needed if your expenses are more than the set standard deduction dollar amount. You can use the IRS Form 1040 Schedule C if you need to itemize your deductions.

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

How do You Know if Your Blog is a Business for Tax Purpose?

The IRS will categorize your blog as either a business or hobby. If your blog is a hobby, then you cannot claim any tax deductions.

In order to be seen as a business you must have a profit in at least three of the most recent five tax years.

How to Keep Your Tax Information Organized

- Hold on to your W-2 forms and 1099 forms

- Save receipts of items you bought for your business.

- Keep track of expenses in an excel spreadsheet or through a bookkeeping software such as FreshBooks

- Have a tax preparation checklist completed

- Keep a detailed Blogger tax deduction checklist handy

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

Legal and Regulatory Requirements for Content Creators

While not all Bloggers or Content Creators need an EIN, those who hire employees or operate as an LLC may require one.

An LLC can offer liability protection but comes with additional costs. Consider your business structure carefully to optimize your tax situation.

12 Tax Tips for Bloggers and Online Influencers

- Remember tax deductions for bloggers have to be items related to your business

- Keep track of receipts

- Create a separate bank account for business only

- Use excel spreadsheet for bookkeeping or a software which will make your life easier once tax season comes

- Take a percentage out of each sale/payment to save for taxes

- Remember that if you make money from your blog, then you have to report it (Profit vs Loss)

- Talk to a professional tax advisor or you can chat with me if you have a question

- Print your tax checklist: the list will help keep you organized and help you not miss any possible deductions

- Save finalized tax report from (e.g. Form 1040) previous years in a file area easy to locate

- Start early and prepare throughout the previous year (trust us it will save you a lot of pain)

- Stay current on new tax laws and breaks especially if they affect you directly

- Remember that overlooked deductions mean you put less money into your wallet, and you may end up paying too much in taxes

File Your Taxes with Ease from Home Today with TurboTax!

My Last Thought on Tax Deductions for Bloggers and Content Creators

Don’t worry, you got this!

Plus, I’m here to help answer any questions you may have along the way. Now go out there and conquer the world with your awesome blog business and influence.

Hope this tax deduction checklist helps you navigate through the sometimes-muddy waters of the income tax season.

Remember to keep track of your receipts and if there’s a question about any possible deduction be sure to contact me.

I definitely do not want you to miss out on any deductions. Overlooked deductions mean you put less money into your own pocket and you may end up paying too much in taxes.

For more money-saving tips and guides, subscribe to the weekly newsletter!

What are some of your best tax tips for your business? Let me know in the comment section below.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Do I Need to File a Tax Return?

- Do I Need to File IRS Form 8832 for My Business?

- 11 Last Minute Tax Tips for Beginners

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Written in 2016/Updated on January 23, 2025)