As tax season approaches, many beginners (like yourself) may find themselves feeling overwhelmed by the complexities of filing taxes.

The good news is that there are several last-minute strategies that can help simplify the process and ensure that you maximize your returns.

In this blog post, I’ll share 13 essential tax tips for beginners that can be implemented quickly, providing valuable insights and practical advice to help you navigate your tax obligations with confidence.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission at no additional cost to you.

1. Know Your Status

First, you’ll want to know the status you are filing under.

It is very important to select the correct filing status when filing your individual tax return.

Many tax credits, deductions, and the amount of taxes paid are dependent upon the filing status selected. At times, more than one filing status may apply to you.

The 5 Filing Statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er) with dependent child

However, if you find you’ve incorrectly stated something on your filing there are ways to fix and update your information.

Get your FREE Tax Refund Estimator TODAY!

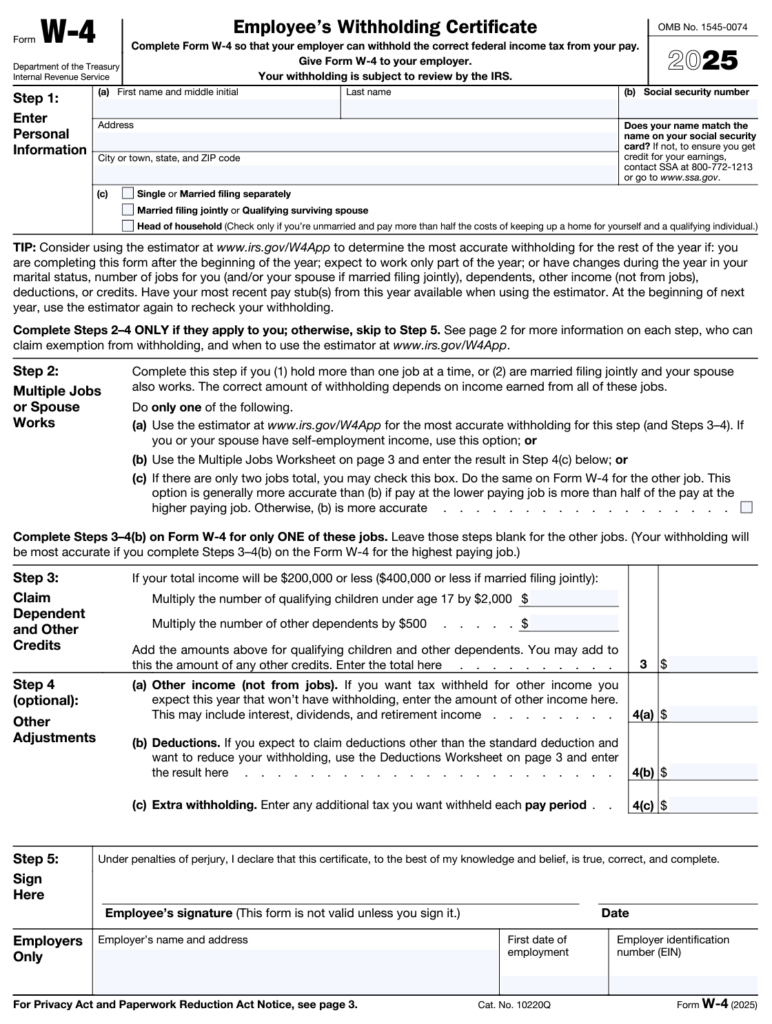

2. Always Select the Correct Withholding

If you are working for an employer, then you have completed the tax withholding form W-4. This form tells you how much taxes are being withheld from your paycheck.

The goal here is to find the delicate balance between putting aside enough taxes, but not giving too much of your hard-earned money to the government.

By withholding too much, it’s like you are giving an “interest free loan” to the government. However, if you do not withhold enough, you will have a tax bill at the end of the year.

There are various forms needed, but don’t worry, you can go through the full Tax Planning Guide here!

If you need to adjust your withholding, it can be done at any time, so no need to get it exactly right on the first go.

PRO TIP: Don’t forget to use the IRS2Go Mobile App which allows you to track your refund or make a payment if you have a tax bill.

3. Keep Track of Your Side-Hustle Income

If you’re earning income from freelance work or a side gig, it’s important to understand self-employment taxes.

Unlike traditional employment, taxes aren’t automatically withheld from your earnings, which means you’ll need to plan for quarterly tax payments.

You can also deduct business-related expenses to lower your taxable income.

Keeping detailed records of your income and expenses is crucial to avoid penalties and maximize deductions.

Keep track of your nursing expenses through a bookkeeping software such as FreshBooks!

4. Take Advantage of Tax Deductions

Lastly, you’ll want to ensure you are taking advantages of the various deductions out there that are applicable.

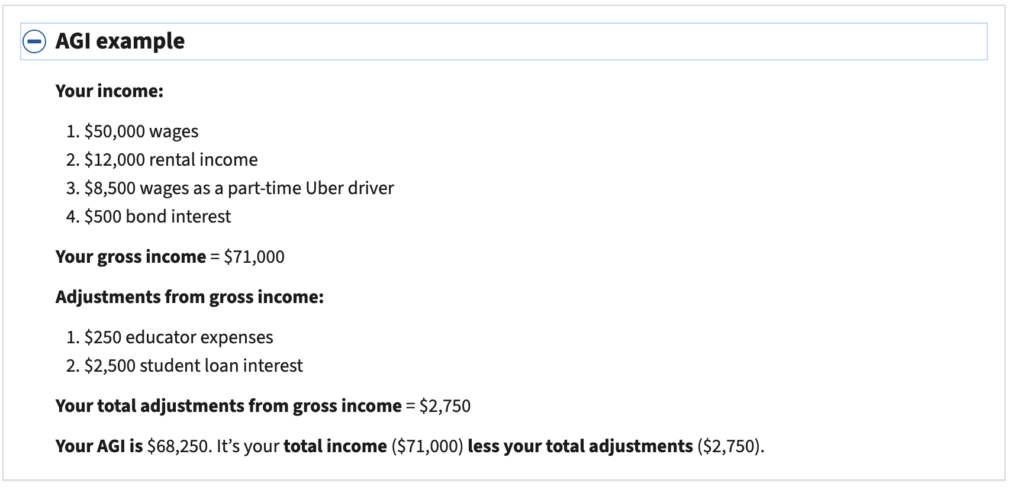

A tax deduction works by totaling your deductions and subtracting them from your adjusted gross income or AGI; therefore, reducing your tax bill for the year.

Tax deduction is commonly a result of expenses, particularly those incurred to produce additional income.

PRO TIP: The IRS lets you decide whether you want to claim the standard deduction or itemize your deductions.

What is a Standard Deduction?

The standard deduction is a fixed amount set by the IRS that reduces your adjusted gross income. However, it is based on your filing status, which is determined by your marital status as of the end of the year.

For tax year 2025, the standard deduction amounts are as follows:

| 2025 Standard Deduction and Personal Exemption (Estimate) | |

| Filing Status | Deduction Amount |

| Single | $15,000.00 |

| Married Filing Jointly | $30,000.00 |

| Head of Household | $22,500.00 |

| Married Filing Separately | $15,000.00 |

| Personal Exemption | Eliminated |

What is an Itemized Deduction?

An itemized deduction is an eligible expense that you can claim on your federal income tax return that may decrease your taxable income. This happens when your total itemized deductions exceed the amount of your standard.

Common Types of Itemized Deductions:

- Mortgage Interest

- Property Taxes

- Charitable Donations (donating to Goodwill, tithing at church, giving money to non-profit organization, etc.)

- Medical Expenses

Get Your Full List of Tax Deductions Here!

5. Maximize Your Tax Credits

Tax credits can significantly reduce your tax liability, sometimes even resulting in a refund.

The Earned Income Tax Credit (EITC) is available to low-to-moderate-income workers and can provide substantial financial relief.

Additionally, the Child Tax Credit (CTC) offers up to $2,000 per qualifying child, with a portion being refundable.

2025 Earned Income Tax Credit Table

| Filing Status | No Children | One Child | Two Children | Three or More Children |

|---|---|---|---|---|

| Income at Max Credit | $19,104 | $50,434 | $57,310 | $61,555 |

| Maximum Credit | $649 | $4,328 | $7,152 | $8,046 |

| Phaseout Begins | $10,620 | $23,350 | $23,350 | $23,350 |

| Phaseout Ends (Credit Equals Zero) | $26,214 | $57,554 | $64,430 | $68,675 |

Understanding and claiming these credits can make a big difference in your tax outcome.

6. Put Money Aside

You should save a few bucks at the end of the year just in case you do owe taxes.

Sometimes we may not adjust our tax-withholdings correctly on our paycheck, so it’s always good to put a little money to the side.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

7. Hire a Tax Preparer

Online tax software can be simplistic and doesn’t always apply to your individual needs that may change from year to year.

Don’t get me wrong, online tax software can be an excellent choice for a SIMPLE tax return, but not necessarily the best choice for a more detailed tax return.

A tax advisor or CPA (Certified Public Accountant) are experts in their field and will know how to deal with your specific situation, ensuring that you come out on the best end for your financial situation related to taxes.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

8. Know What Role Your Spouse Plays

A spouse is never considered the dependent of the other spouse. This is one of the tax tips that many people are confused on.

9. Know What Happens When You Divorce

Taxpayers who are divorced or legally separated at the end of the tax year cannot claim their (former) spouse

If you decide to file separately, you and your spouse must report income and deductions on separate returns even if one spouse had no income.

Read NEXT: Divorce and Taxes: Everything You Need to Know for Filing Taxes

10. Know if Your Dependent has to File Taxes

Your dependent may have to file if they are earning an income or if they are having taxes withheld for some reason.

You’ll want them to file separately, but if they’re too young, you’ll be responsible for filing one for them.

11. Know When to Choose Standard Deduction vs. Itemized Deduction

If your total itemized deductions exceed the amount of your standard deduction, then go with the itemized deduction option.

Remember that the standard deduction is a fixed amount based on your filing status

12. Know the Income Tax Bracket for 2025

Due to inflation, there are higher tax brackets. Here is a look at the tax brackets for the 2025 filing year.

2025 Estimated Income Tax Brackets and Rates

| Tax Rate | Single Filers | Married Joint Filers | Heads of Household Filers |

|---|---|---|---|

| 10% | $0 – $11,925 | $0 – $23,850 | $0 – $17,000 |

| 12% | $11,926 – $48,475 | $23,851 – $96,950 | $17,001 – $64,850 |

| 22% | $48,476 – $103,350 | $96,951 – $206,700 | $64,851 – $103,350 |

| 24% | $103,351 – $197,300 | $206,701 – $394,600 | $103,351 – $197,300 |

| 32% | $197,301 – $250,525 | $394,601 – $501,050 | $197,301 – $250,500 |

| 35% | $250,526 – $626,350 | $501,051 – $751,600 | $250,501 – $626,350 |

| 37% | Over $626,351 | Over $751,601 | Over $626,351 |

13. Donate to Charity

Donating to charity is not only a good way to give back, but it also allows you to get some great tax deduction benefits on your return. Especially, if you plan on using the itemized deduction method.

To be considered a charitable deductible, you will have to make your contributions to qualified organizations and not individuals. This is one of the best tax tips for lowering your bill.

My Final Thoughts

I know that taxes can seem intimidating but they certainly don’t have to be.

Once you have a basic working knowledge of the common tax terms and information, you’ll be able to make a plan.

First, you’ll want to understand how you are filing. From there, make sure you are withholding just enough of your hard-earned money.

Money Saving Challenge Workbook

Get Out of Debt Workbook

2025 Ultimate Tax Planning Guide: Tips to Get the Largest Tax Refund

Complete Tax Planning & Savings Bundle

Lastly, ensure you are taking advantage of the deductions available to you because if not, you are leaving ‘free’ money on the table.

If you ever have questions, you can reach out to your Accountant or Tax Advisor and they’ll be able to direct you in the right direction. For more money-saving tax tips and guides, subscribe to the weekly newsletter!

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Why a Tax Checklist Will Make Your Life Easier

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclosure Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation to the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site.

(Original Article Date: February 4, 2019/Updated On January 13, 2025)