As you navigate this tax season, you maybe asking, “Where’s my refund?”

This blog post aims to clarify the implications of recent tax law changes and guide you through the process of tracking your refund.

We’ll explore the key elements of the new tax regulations, common questions surrounding refunds, and practical steps you can take to ensure you receive what you are owed.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What You Need to Know About Your Tax Refund:

- Refunds likely won’t arrive in bank accounts or debit cards until around the second week of February

- Use the Where’s My Refund? link to check out your daily status

- Possible deposit dates for early Earned Income Tax Credit/Additional Child Tax Credit (EITC/ACTC) refund filers may not be available until around February 28th as these additions can take longer to review

- Your funds may take longer to appear in your account depending on the financial institution (remember that most financial institutions do not process payments on weekends or holidays)

- E-filed return: Most refunds for an e-filed return are issued within 21 days.

- Direct deposit refund: Opting for a direct deposit refund is the fastest way to receive your money.

- Refund approved: Once your refund is approved, the IRS will prepare to send it.

Keep reading to get everything you need to know about this tax refund process.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

Where’s My Refund Tool

With this IRS tool, you can check your refund status and where it’s at in the process. Below are a few things to consider. Your refund status will appear around:

- 4 weeks after you file a paper return

- 24 hours after you e-file a current-year return

- 3 or 4 days after you e-file a prior-year return

- For more information visit the Refund Timing page on the IRS website. Don’t forget to check out The Handy Tax Guy FAQ page for any additional online tax questions.

Get your FREE Tax Refund Estimator TODAY!

2025 IRS Refund Chart

Based on historical IRS processing timelines and assuming the IRS begins accepting tax returns on January 27, 2025, here is an estimated refund cycle chart:

| Date Accepted | Direct Deposit Sent | Paper Check Mailed |

|---|---|---|

| Jan 27 – Feb 1, 2025 | Feb 17, 2025 | Feb 21, 2025 |

| Feb 2 – Feb 8, 2025 | Feb 24, 2025 | Feb 28, 2025 |

| Feb 9 – Feb 15, 2025 | Mar 3, 2025 | Mar 7, 2025 |

| Feb 16 – Feb 22, 2025 | Mar 10, 2025 | Mar 14, 2025 |

| Feb 23 – Mar 1, 2025 | Mar 17, 2025 | Mar 21, 2025 |

| Mar 2 – Mar 8, 2025 | Mar 24, 2025 | Mar 28, 2025 |

| Mar 9 – Mar 15, 2025 | Mar 31, 2025 | Apr 4, 2025 |

| Mar 16 – Mar 22, 2025 | Apr 7, 2025 | Apr 11, 2025 |

| Mar 23 – Mar 29, 2025 | Apr 14, 2025 | Apr 18, 2025 |

| Mar 30 – Apr 5, 2025 | Apr 21, 2025 | Apr 25, 2025 |

| Apr 6 – Apr 12, 2025 | Apr 28, 2025 | May 2, 2025 |

| Apr 13 – Apr 19, 2025 | May 5, 2025 | May 9, 2025 |

| Apr 20 – Apr 26, 2025 | May 12, 2025 | May 16, 2025 |

| Apr 27 – May 3, 2025 | May 19, 2025 | May 23, 2025 |

Note: These dates are estimates and can vary based on IRS processing times and individual circumstances.

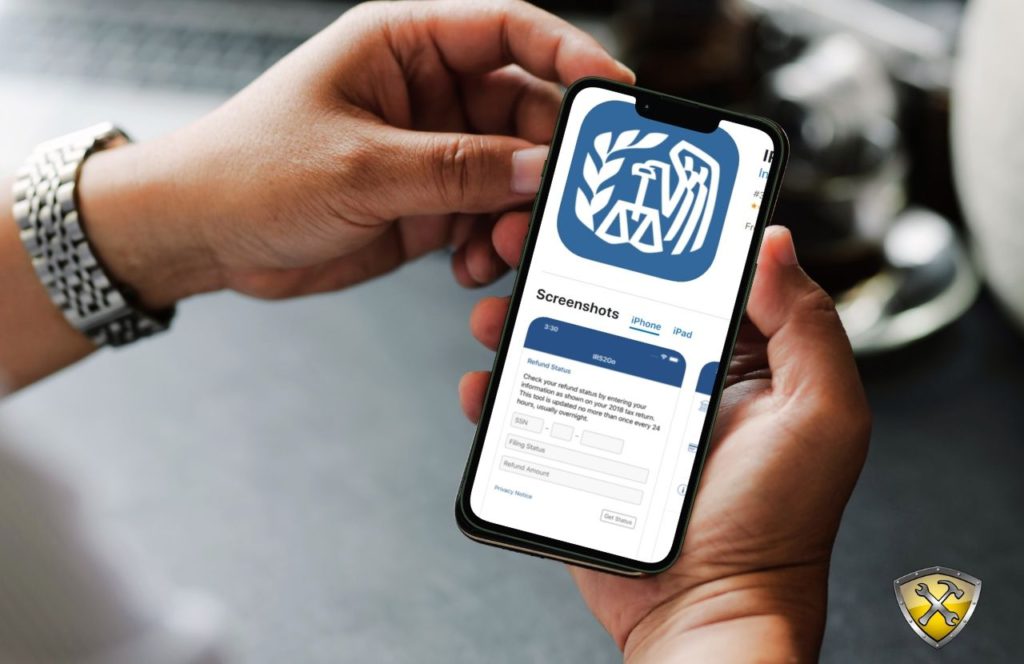

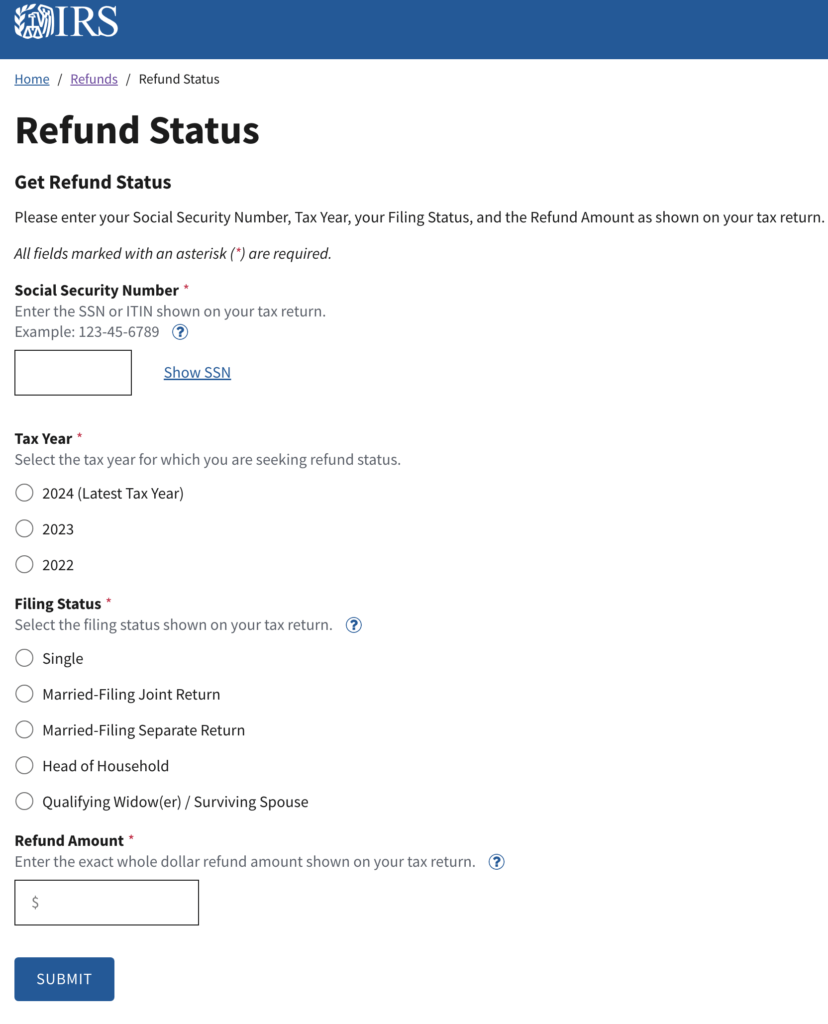

What Do You Need to Check Your Tax Refund Status?

You will need the following:

- Your Social Security or individual taxpayer ID number (ITIN)

- Your filing status

- The exact refund amount on your return

To make this happen, all you need to do is to log into the IRS “Where’s My Refund” page or on the IRS2Go Mobile App.

What Does Your Refund Status Mean?

When you log into your account you will see the following options which will show you where you are in the process:

- Return Received – The IRS has received your return and are processing it.

- Refund Approved – The IRS has approved your refund and are preparing to issue it by the date shown.

- Refund Sent – The IRS has sent the refund to your bank or to you in the mail (just know that it can take about 5 days for it to show in your bank account or several weeks for your check to arrive in the mail).

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

Why You Haven’t Received Your Refund Yet

The IRS issues most refunds in less than 21 days. However, your tax refund can be delayed for several reasons, such as:

- The tax return has errors, requires additional review or is incomplete.

- The return needs a correction to the Earned Income Tax Credit or Additional Child Tax Credit.

- The taxpayer filed their tax return on paper.

- The taxpayer filed an injured spouse claim.

Just know that if the IRS needs more information to process a return, they will contact you by mail. It’s important to ensure all information is accurate and complete to avoid delays.

My Final Thoughts

As you can see, navigating the complexities of tax refunds amid new federal regulations can be challenging.

By staying informed and using available resources, you can better understand where your refund stands and ensure you receive it in a timely manner.

Remember to check back frequently for updates and seek professional advice if you encounter any issues.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

For more money-saving tips and guides, subscribe to the weekly newsletter!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: January 31, 2017/Updated On: January 14, 2025)