Once the tax season comes to an end, many individuals may have received their returns and are set . Then there are those who had something come up where their taxes couldn’t be complete in time and the question, “where’s my amended return,” may come up.

There are also many instances where you have completed your tax return but need to make a correction or amendment.

Don’t panic!

Now with this being the government, you may think it is a long and complicated process, when really, it’s not as bad as it sounds.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Filing an Amended Tax Return at a Glance

- The IRS now allows electronic filing of Form 1040X for the current and two prior tax periods with tax filing software

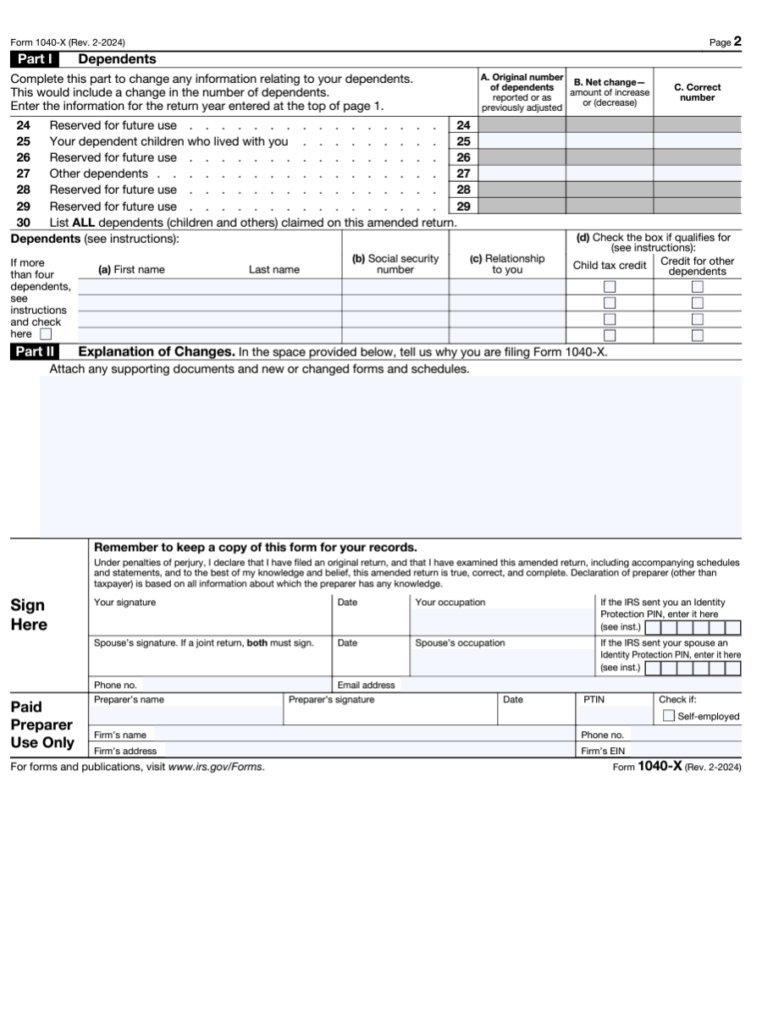

- You can download the blank IRS form 1040X PDF online to see what information is needed

- If you’re asking yourself, where’s my amended return, then you can check it here on the IRS website

- Generally, you must file Form 1040X within three years of the original filing deadline or within two years of paying the tax for that year, whichever is later.

- According to the IRS, it could take up to 8 to 12 weeks for the from to be processed

Keep reading to get everything you need to know about this IRS policy.

What is IRS form 1040X?

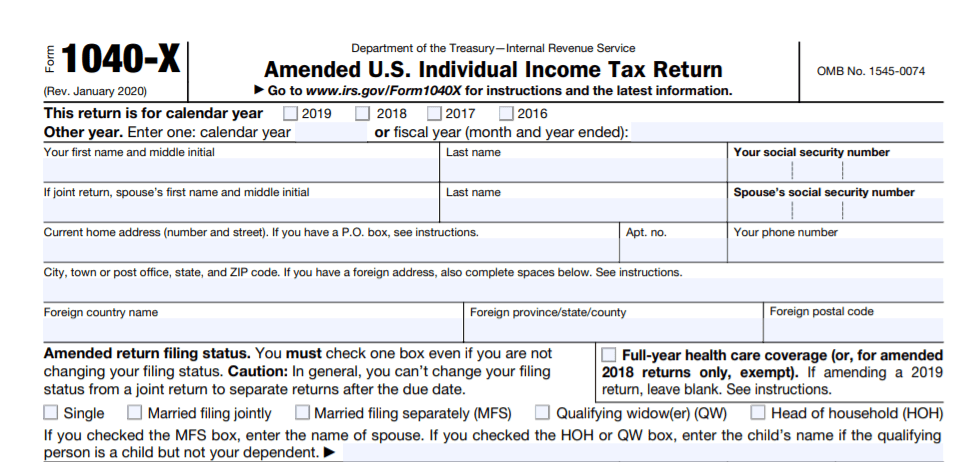

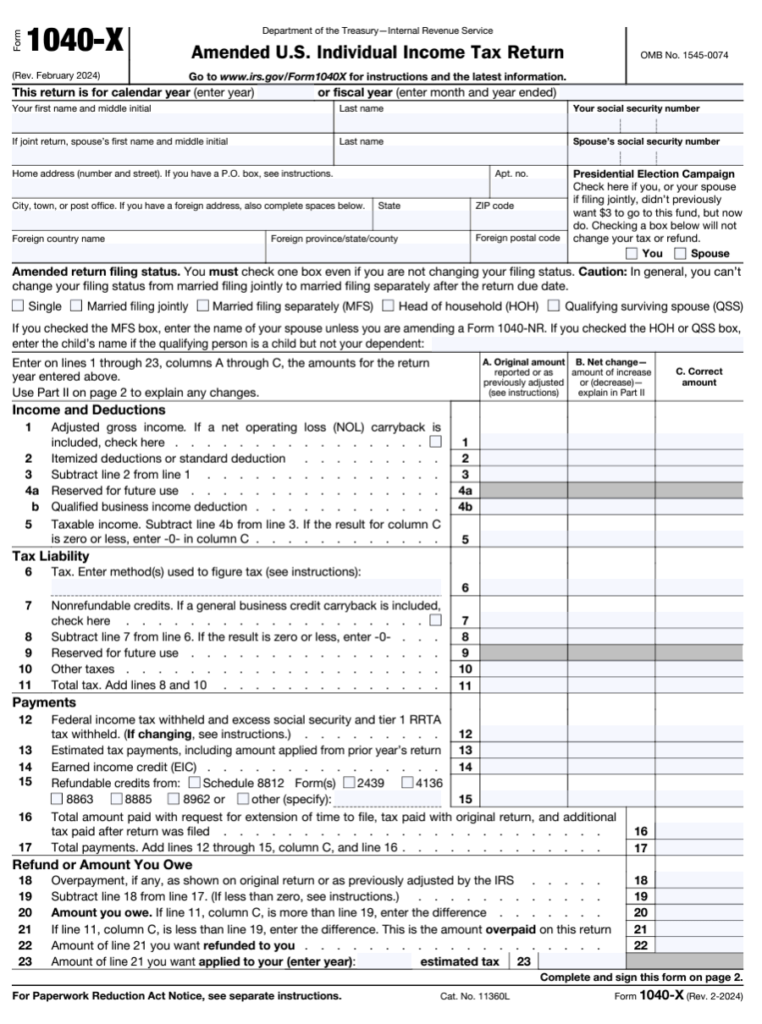

IRS Form 1040X is the Amended U.S. Individual Income Tax Return. Once you download the form, you will notice that it’s two-pages and is used to amend, correct, or update a previously filed individual tax return.

The 1040X is the tax form you’ll complete if you need to amend your tax form for any reason.

You can download the blank IRS form 1040X PDF online and complete it in the comfort of your home.

The IRS now allows electronic filing of Form 1040X for the current and two prior tax periods with tax filing software to amend your Form 1040, 1040-SR, or 1040-NR .

As with any IRS tax form, there are bound to be questions, especially if it’s a form you rarely file.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

When Should You File IRS Form 1040X?

You should file form 1040X if you notice an omission or error in your previous tax return that may lead to an affect in refund amount or IRS payment status.

The IRS recommends that you wait until you receive your tax refund before you complete an amended tax return.

Power Tip: You have three years from your original tax return filing date to file form 1040X for claiming a refund.

You can search many of the questions you’ll likely have, but this article aims to answer your most common “where’s my amended tax return” questions in one place. But first, let’s go through how to fill out a 1040X line by line.

File Your Taxes with Ease from Home Today with TurboTax!

How to File an Amended Tax Return (Step-by-Step)

- Locate a blank Form 1040X from the IRS website

- You can use tax filing software to complete and submit your amended returns electronically, making the process more efficient and less prone to errors.

- Check the box indicating tax year you’re amending

- Enter your name, Social Security Number, and your spouse data if you’re filing jointly Put your current address and daytime phone number

- Enter your filing status

- Review the left-most column sections (Income and Deductions, Tax Liability, Payments, Refund or Amount You Owe, Dependents, and Explanation of Changes)

- Start putting in the correct numbers/amount in the right three columns (Column A: Original Amount, Column B: Net Change, Column C: Correct Amount)

- Put negative numbers in parentheses. For example, -1983 would be put in as (1983)

- Sign the document

Power Tip: A separate IRS form 1040X is needed for each tax year.

You may find it easier to complete the form on your computer/with a software like TurboTax or eFile because you can then save an electronic copy on your desktop and print it out to mail to the IRS.

More Tax Savings: File at Ease at Home with Turbo Tax

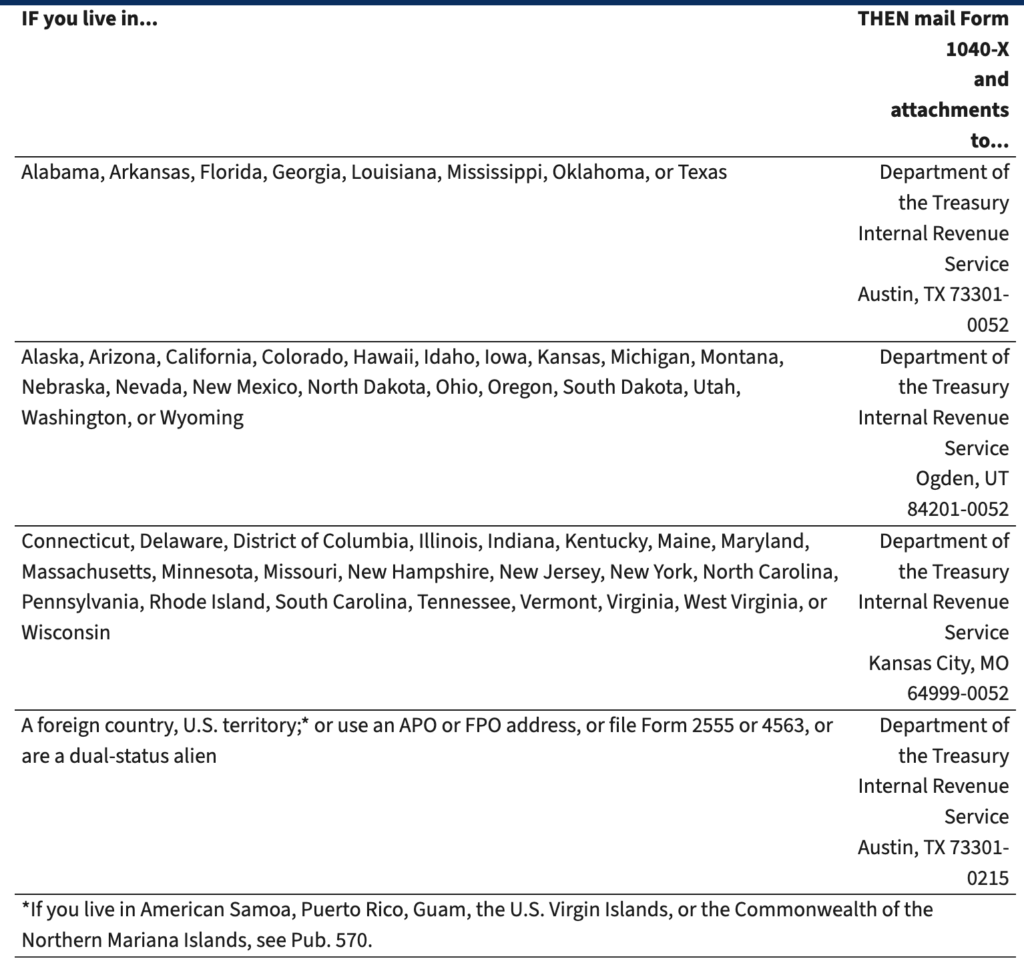

Where to mail 1040x?

If needed, you will mail your 1040x Form to the Department of the Treasury Internal Revenue Service Austin, TX 73301-0255 (address may vary by location) if you file your amended return due to the following issues:

- You’re responding to a notification received from the IRS

- If you received reimbursement for a hurricane-related loss

- You need to file with Form 1040NR or 1040NR-EZ

If the above scenarios do not apply to you, then visit the IRS website to see which location to mail yours in for your state here.

Recommended: The 2025 IRS Refund Cycle Chart

How long does the filing take to process?

The likely most asked question when it comes it comes to any tax form is how long will it take. According to the IRS, it could take up to 8 to 12 weeks for the from to be processed.

However, you do have the ability to track your request through the Where’s My Amended Return website.

Similar to if you’ve checked your Federal refund, you’ll need a few identifying information such as your social security number.

Keep in mind, that if you search after a week of mailing it still may not show up, as it can take up to 3 weeks to populate on the system for tracking.

What occurs once the 1040X Amended Tax Return form has been processed?

You will receive a notice that your tax refund has changed, remained the same or that you now owe taxes. From there you would take the normal steps if you owed and were due a refund from normal tax filings.

Again, this process can take up to 8 to 12 weeks so have some patience with the system.

Why the process is taking longer than 12 weeks?

The process can take in excess of 12 to 16 weeks weeks if your Form 1040X contains errors or mistakes.

When sending your form, please make sure that all the information is correct and up to date, allowing for the process to be completed smoothly.

These are just a few of the questions you may have but these few questions are likely to be the ones you have. Depending on when you catch the errors or are notified, the times for processing can vary.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

Easy Tips to Remember About Your Amended Return

To ensure that you don’t have to useForm 1040X, here are a few tips to consider when preparing your taxes.

1. Make Sure that your W2 and income taxes are filed correctly.

When filing your taxes, take the time to review all of your details to ensure you have the right information.

Keep a list of money you’ve transacted out of a retirement account, a side business and even your personal income. This will ensure you receive the appropriate forms in a timely manner and don’t miss anything.

2 . File as soon as possible.

File your taxes as soon as possible. This will help in expediting the process. If you find that you incorrectly completed your taxes and need a Form 1040X, you will have ample time to complete and submit the form.

3. Use the IRS website for submitting information.

The governments website will tell you everything you need to know about any tax form, including Form 1040X.

Before you submit the form, take your time and ensure everything is correct, because you won’t want to complete a third tax form.

File Your Taxes with Ease from Home Today with TurboTax!

Still have questions regarding the IRS Where’s My Amended Return Situation?

If you find that you still have questions are need assistance, there are two paths you can take. The first is to talk with you current tax professional (or you can book an appointment with me), as they have likely seen your issue before.

Allow them to review you questions or concerns, and they will likely give you the next steps necessary.

The alternative is to visit the IRS website and research your question there, in the FAQ section. Here is where you can access portals such as Where’s My Amended Return.

You will also find a phone number you can contact, however, be prepared to wait on hold depending on what time of the year you reach out.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

Final Thoughts

Filing taxes can be difficult and errors do occur. When you find an error, simply look up the Form 1040X and begin the process of amending your return.

This will save you time and potentially money in the future, eliminating the possibility of fines or unclaimed money.

For more money-saving tips and guides, subscribe to the weekly newsletter!

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Tax Software vs. Accountant or Tax Pro (Which Should You Use?)

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Last Minute Tax Tips for Beginners

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: July 16, 2020/Updated on December 17, 2024)