Are you confused about how YouTube and taxes work and what tax deductions you can take advantage of?

Vlogging (or video blogging) has taken off more than the written blog today.

Millions of vloggers or Youtubers make a living or at least supplement their income making videos.

Thinking outside the box is one of the best, and for some, the only way to make money during these trying times.

If this sounds like you – congratulations! You’ve found a way to make money and help others along the way.

But before you go spending that cold, hard cash, understand YouTube taxes, how to pay them and the best tax deductions for your business.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Key Takeaways:

- Self-employment tax: YouTubers must account for self-employment tax, which includes Social Security and Medicare contributions.

- Estimated tax payments: To avoid penalties, YouTubers should make estimated tax payments if they owe more than $1,000.

- As a self-employed Content Creator, in some cases you will not have taxes automatically deducted from your income. If your tax liability exceeds $1,000, you are required to make estimated tax payments to the IRS on a quarterly basis.

- Hobby vs. business: The IRS may classify your YouTube Channel as a hobby if it doesn’t show a profit, affecting your ability to claim deductions.

- EIN number: YouTubers may need an EIN if they hire employees or operate as an LLC.

Keep reading to get the full list of items you can deduct this year!

YouTube Taxes – Do you Have to Pay Them?

The short answer is ‘yes,’ YouTubers pay taxes. But it’s more complicated than that.

You won’t receive a W-2, complete a 1040 and be done like most people. Instead, YouTubers are self-employed, so they pay self-employment taxes.

First, you pay income taxes like everyone else. Next, you pay self-employment tax which covers the Medicare and Social Security taxes normally covered by an employer. As a YouTuber, you are the employer.

The good news is, you’re likely eligible for tax write-offs for YouTubers. More on that below, for now, let’s focus on how YouTube taxes work.

I’ve put together an easy tax deductions checklist for YouTubers to download below.

Self-Employed Tax Deduction Checklist

Power Tip: If you need to claim expenses, then be sure to fill out the itemized deduction Schedule A Form.

How Does YouTube Taxes Work?

According to YouTube, Google has a responsibility under Chapter 3 of the U.S. Internal Revenue Code to collect tax info, withhold taxes, and report to the Internal Revenue Service (the U.S. tax authority, also known as the IRS) when a YPP creator on YouTube earns royalty revenue from viewers in the U.S.

How to setup your tax information with YouTube

- Sign in to your AdSense for YouTube account.

- Click Payments, then Payments info.

- Click Manage settings.

- Scroll to “Payments profile” and click edit next to “United States tax info”.

- Click Manage tax info.

- On this page you’ll find a guide that will help you to select the appropriate form for your tax situation.

Read NEXT: How Do Disney Bloggers and Vloggers Make Money

How much money does YouTube withhold for your taxes?

- Business Account Type: the default withholding rate will be 30% of U.S. earnings if the payee is outside of the U.S. Businesses in the U.S. will be subject to 24% withholding on total earnings worldwide.

- Individual Account Type: backup withholding will apply and 24% of total earnings worldwide will be withheld.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

How to File Your YouTube Taxes

Below are a few simple steps to getting your taxes filed. Remember that each person’s situation is different and more step may be needed.

Step 1: Choose your business type

Most YouTubers operate as a sole proprietor, but you may operate as an LLC or partnership. Consult your tax advisor to choose what’s best for you.

Step 2: Track your income and expenses throughout the year

Skip the shoebox method, you want everything together at tax time. Keep all receipts and proof of income. Use an app or software, like FreshBooks to keep you organized.

Step 3: Make your estimated quarterly tax payments

Don’t wait until tax time to pay your taxes. Not only will you get hit with a large tax bill, you may pay penalties for not ‘paying as you go.’

Every April 15, June 15, September 15, and December 15 pay your estimated taxes. If you aren’t sure what you owe, use IRS Form 1040-ES.

Step 4: Don’t forget your YouTube tax deductions

Fortunately, YouTubers are business owners and can deduct certain expenses. Keep every receipt – you never know what may be eligible for a write-off.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

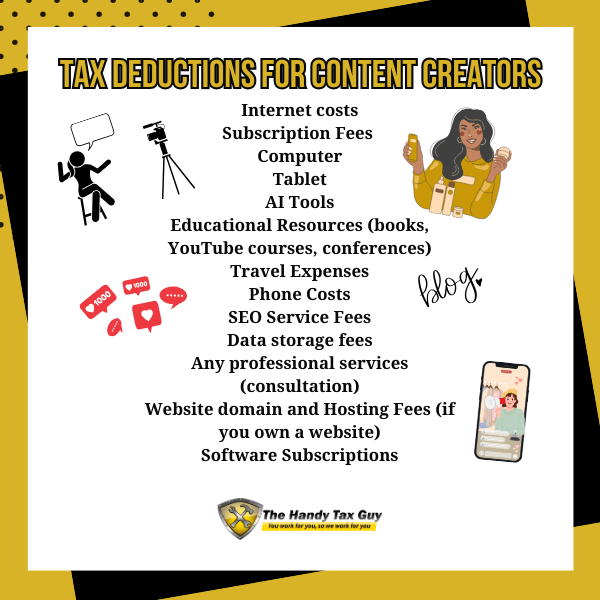

9 Most Common Tax Deductions for YouTubers – Don’t Miss Them

This is the most important (and fun) part of your taxes. There are many YouTube tax deductions that you don’t want to miss.

- Equipment: You’ll need to depreciate your equipment (take a prorated deduction for a specified period), but a write-off is a write-off. Take it.

- Marketing costs: If you pay someone to market your business or you pay for advertising spots, it’s a valid expense.

- Home office: Do you use part of your home EXCLUSIVELY for your YouTube business? You may write off the appropriate portion of your mortgage interest, real estate taxes, and utility costs.

- Mileage: If you drive for your videos, record the mileage. You can take the standard mileage deduction or record actual expenses. The standard mileage deduction is much easier.

- Software and programs: Any software or programs you buy to make your videos, publish, or edit them is a tax write-off.

- Clothing: Your work outfit has to be specific to the work you do as a YouTuber.

- Travel Expenses: As a Content Creator you can deduct your travel expenses, especially if it’s a destination that will be featured on your YouTube Channel to help you make income for your business.

- Health Insurance: As a Self-employed Content Creator, you can deduct your health insurance premiums, including medical, dental, and vision insurance, from your taxable income.

- Additional Services: Services such as advertising or business coaching are examples of services needed to maintain the integrity of your business.

Get your FREE Tax Refund Estimator TODAY!

Additional YouTube Tax Deductions

Here are a few more commonly missed YouTube tax deductions that are often overlooked:

Online Tools

- Internet (partial amount)

- Domain fees

- Hosting fees (using BlueHost if you have a website)

- Public internet access fees

- Stock photo purchases

- SEO services and fees

- Paid site submissions

- Website design fees

- Data storage fees

- Business related software and licensing fees

- AI Technology

- Additional Subscription Fees (TubeBuddy, VIDIQ, Morning Fame, Canva, Adobe, Dropbox, etc.)

Home Office

- Portion of landline/cell phone dedicated to your business

- PC equipment used to blog or create content online

- Home Office (room exclusive use only, contact us for more details)

- Business Cards

- Office Supplies

- Cameras

- Digital memory cards

- Recordable CDs and DVDs

- Cloud Services

- Business furniture

- Zip drives

- Photo printouts and processing

- Printer ink and copier toner

- Long distance charges related to business

- Business equipment rental

- Computer upgrades and depreciation costs of computer equipment

Travel

- Blog conference fees and registration

- Lodging (do not combine with meals)

- Meals during conference (50% of cost- do not combine with lodging)

- Entertainment (50% of cost)

- Vehicle Expenses

- Transportation (flight, shuttles, taxi, car rental, ride share, tolls, etc.)

Education and Professional Tools

- Industry books & periodicals, including audio books

- Magazine subscriptions

- Research sites that require a subscription

- Educational webinars

- Business podcasts

- Professional memberships

- Online courses

Miscellaneous

- Charitable donations

- Marketing fees

- Movie or theater tickets related to blog

- Business incorporation costs

- Costs for Trademarks or Copyrights

- Business logos and graphic design fees

- Advertising costs

- Photocopying/faxing fees

- Legal fees

- PayPal, CashApp and Western Union fees

- Bank Fees

- Tax Advisor Fee

- Post Office Box and Safe Deposit Box fees

- Coaching advice that pertains to your business

- Prizes and giveaways

- Gatherings you organize for your business and more!

Tax Related Items

- Real estate taxes paid (% for your home office)

- Qualified mortgage insurance premiums (% for your home office)

- Deductible mortgage interest (% for your home office)

How to Tell if You Need to Pay Taxes as a YouTuber

So how do you know if you need to pay taxes if you have a YouTube channel? Here’s an example.

John runs a YouTube channel for his RC habit. He loves showing off his new cars and tricks. He doesn’t monetize his channel – he just does it for fun. John doesn’t make any money on it, or advertise it anywhere. John doesn’t have to pay taxes on his channel.

Here’s another example:

Jason runs a YouTube channel as an influencer for RC brands. He advertises the latest models, and provides a link where viewers can buy what he’s promoting. If they do, Jason makes a small commission on it. Jason also earns money from other advertising efforts on his YouTube channel. Jason must claim all income earned on YouTube on his tax returns.

Recommended: How Our Co-founder, Nikida, Grew Her Blog From 0 to $10K+ a Month

What to Know Before You File Your Taxes

Now that you understand the basics, let’s go through a few of the most common questions asked.

How to file taxes on YouTube income?

You should receive Form 1099-NEC from any company that pays you more than $600 for the year. Claim this income on Schedule C of your tax return.

How to pay taxes on YouTube income?

If you pay taxes on your YouTube income quarterly, complete Form 1040-ES and send your estimated payments in. At tax time, you’ll record those payments, and figure out if you overpaid or underpaid for the year, much like you would if you had a W-2 position.

PRO TIP: Although YouTube collects taxes on your behalf, it’s still good practice to do your quarterly taxes to make sure that you’re in good standing throughout the year and to account for additional income you may receive from affiliate income, brand deals or any other extra income.

How does quarterly income taxes work for a YouTuber?

Paying quarterly taxes avoids the tax penalty for not paying your taxes on time. The United States is on a ‘pay as you go’ system, so if you don’t pay each quarter, you’ll pay a penalty.

You can file your estimated payment online or mail them into the IRS.

Does YouTube send me a 1099?

Yes, YouTube/Google as well as any other companies you create content for who paid you more than $600 will send you and the IRS a 1099-NEC.

File Your Taxes with Ease from Home Today with TurboTax!

7 Easy YouTuber Tax Tips to Remember

- All deductions must be related (and ordinary) for a YouTube business

- You must claim all income, even if you didn’t receive a 1099

- Keep careful track of your expenses or you can’t claim them

- Have separate bank accounts for business income, business expenses, and business taxes

- Set aside 20% – 30% of each payment for taxes

- Make your quarterly tax payments

- Work with a professional to make sure you get all YouTube tax deductions

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

Pay your YouTube Taxes on Time

Don’t be caught by surprise at the amount of YouTube taxes you owe.

Do the work all year round, saving for taxes, keeping track of your income, and expenses so you get the most YouTube tax deductions possible.

I hope this article helped you gain some control of your tax plan this year. Remember not to stress out. Don’t forget to check out Tax Forms page for any additional online tax checklists and forms you may need this year.

If you enjoyed this article, then you’ll love these:

- How to Save Money for Vacation in 3 Months (23+ Money Saving Tips)

- Do I Need to File a Tax Return?

- Pay Off Debt Quickly with These 4 Simple Tips

- How to Save $3,000 in 6 Months (Save Money Fast)

Get started on your taxes early TODAY!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: April 12, 2021/Updated on January 24, 2025)